Return on Investment (ROI)

Abstract

The Return on Investment, widely referred to as simply ROI, is a crucial financial tool in Project Management. It provides valuable insight into the effectiveness and efficiency of investment decisions made . Project managers use ROI to evaluate the overall impact that investments have had on the organization [1]. It may also be employed to compare the performance of various projects and identify which should be given priority in the future [1].

ROI is obtained through the quotient of profit and funds invested [1]. This metric is favoured for its ease of calculation and ability to facilitate comparisons between investment options. Despite its popularity, it is crucial to acknowledge that ROI does not factor in the time value of money, unlike other metrics such as Net Present Value (NPV) and Internal Rate of Return (IRR) [2] [3]. This limitation should be taken into consideration when using ROI to evaluate the performance of a project.

This article will explore the concept and practical applications of the ROI method. It will start by outlining the principles behind the use of ROI and then delve into its calculation. To ensure objectivity, the limitations of the method will be discussed. Finally, a section will be dedicated to presenting an annotated bibliography of key references utilized in the preparation of the article.

Contents |

Big Idea

Measurement is an important component of project management since it allows Project Managers (PMs) to track progress, detect possible problems, and make educated decisions[4]. By defining clear key performance indicators (KPIs), PMs may evaluate projects' performance and verify whether it matches the objectives set close with the stakeholders [4]. Effective measurement also provides actionable data that can facilitate decision-making and help keep the project on track [4].

Return on Investment and Formula

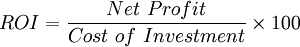

Return on Investment (ROI) is a financial metric used to assess the profitability and efficiency of an investment and it may also serve as a comparison tool between multiple investments. The ROI calculation is considered rather easy and fast and its formula is often presented as [5]:

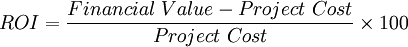

In project management, however, to make it easy for Project Managers to understand, the variable “Net Profit” is deconstructed as can be seen below[5]:

Be aware of the different variables:

- Financial Value – refers to the total revenue generated by a project [5].

- Project Cost/Cost of Investment – represents all the costs incurred for the implementation of the project. It includes both direct and indirect costs [6].

- Net Profit – it is the difference between the financial value and the project cost.

Classification of ROI

Once the ROI has been calculated, it is important to assess it, in order to understand how a project has performed. This KPI can take different values and the classification of the results is done as followed[7]:

| Condition | Idea |

|---|---|

| Negative ROI | Unprofitable. The project has generated a loss, as the value of the return is lower than the cost of the investment. |

| Zero ROI | Breakeven. The project has generated a return that is equal to the cost of investment. |

| Positive ROI | Profitable. The project has generated a profit as the value of the return is higher than the cost of investment. |

(Table 1: Classification of the value of ROI. Source: Created by the author based on information found in [7])

Furthermore, it should be noted that the higher the ROI, the higher the profit a project generates. Thus, when choosing between projects, decision-makers should always choose the one with the highest ROI. It is important to only take this into account when this is all the data given. When other variables are available, such as level of risk, another approach should be used.

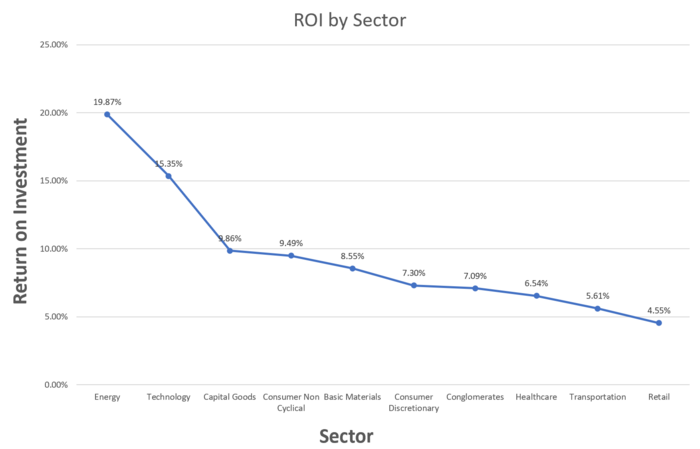

Despite this classification, the assessment of what is considered a “good” or “bad” ROI is a bit more complex, as different industries and companies tend to set different benchmarks. Benchmarking is indispensable because by comparing one’s return on investment with others, it allows the maximization of profits as one does not settle purely for a positive value [4]. CSIMarket does a ROI ranking by sector where companies can go and check what is the average return from other competitors [8] (check graph 1 to see the average ROI for different sectors in the US).

Moreover, when setting the criteria for a “good” ROI, project managers must also bear in mind the results of similar projects conducted by the company they are in, the organizational goals, and last but not least, the stakeholders’ expectations [4].

Types of ROI

ROI can be calculated during several phases of a project and depending on when it is done, it can take two different forms: expected (or anticipated) and actual ROI [5].

Expected ROI is an estimation of the value a project can bring if decision-makers choose to pursue it. It is calculated before a project starts and serves to predict the profitability of a project [5]. On the other hand, actual ROI is typically calculated by the end of the project and, therefore, accounts for true costs and profits [5].

Note that one does not substitute for the other, they complement each other. When the expected ROI is calculated for an initiative and decision-makers decide to invest in it, it means that they expect a positive return [5]. By the end, once the project is completed, the Project Managers calculates the ROI once again, in order to check whether the expectations were met. There might be three different outcomes:

- Expected ROI = Actual ROI – this means that the project performed as expected.

- Expected ROI > Actual ROI – this means that the project underperformed. And if the actual ROI is lower than zero, it even indicates that it generated losses.

- Expected ROI < Actual ROI – this means that the project exceeds expectations and has generated even more value than what was initially forecasted.

Benefits of ROI

There are numerous benefits to using ROI, including:

- Easy to calculate – the formula is straightforward, and the values needed should be visible in financial statements [9].

- Universally understood and accepted – it is a globally used KPI and, therefore, most people have some sort of knowledge about what it concerns and how it is applied [10].

- Easy comparison – it can be used to compare diverse investment plans [9].

Applications of ROI in Project Management

As has been stated, ROI is a crucial tool for project managers as it provides a useful overview of their projects. Let us look at the examples below of how this metric can be applied for a more in-depth understanding of its application and interpretation.

Project Evaluation

ROI can be used to measure how well a project has performed and determine whether or not it has met its financial goals. To assess if a project was successful or not, project managers should compare its actual ROI to its predicted ROI. This enables them to learn from their poor or good performance and enhance future decision-making processes [11].

Example 1

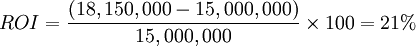

Company X operates in the technology sector, and it has just delivered Project Alpha. Next week, the project manager will have a meeting with key stakeholders, and he must show them how the project performed. He knows that the expected ROI was 16%, the financial gains were 18,150,000DKK, and it had a cost of 15,000,000DKK. Thus, the actual ROI is:

This means that for every Danish krone (DKK) invested, there was a return of 0.21DKK. Since actual ROI > 0 and actual ROI > expected ROI, the project has not only generated profit but has also exceeded expectation. The stakeholders should be very happy when they hear the news, especially because the return is also higher than the average for the technology sector (see Graph 1).

Example 2

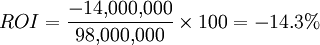

Company X has another project which was recently delivered. The project deadline was postponed by two years due to unforeseen problems. Its net profit was -14,000,000DKK, the cost was 98,000,000DKK and the expected ROI was the same as the average for the technology sector in Q1 of 2023, 15.35%. Therefore, the actual ROI is:

The negative ROI means that the project ended up generating a loss for the company, and it fell far behind the goal initially set. The meeting with the stakeholders will not be easy and the project manager will have to thoroughly explain why the project failed to deliver (it was most likely due to the unplanned events which prolonged the project duration and made it more expensive).

Project selection

ROI helps project managers compare and prioritize project proposals based on their forecasted return [12]. This way, they are also able to effectively allocate available resources to the most promising tasks and initiatives [11].

Example 3

In order to illustrate this situation, take Company X and the five projects decision-makers have been contemplating inventing.

| Project | ROI |

|---|---|

| Project A | 17% |

| Project B | 5% |

| Project C | 7.2% |

| Project D | 25% |

| Project E | 4.5% |

(Table 2: Forecasted ROI for projects in Company X. Source: Created by author)

They were informed that only four out of the five projects can move to the next phase. Without being provided with any other additional information, which one should they choose? A quick look at Table 2 would allow them to see that Project E should be discarded as its ROI is the lowest of the group.

Budgeting and fundraising

ROI can help project managers justify project expenditures to stakeholders by demonstrating the financial benefits of a project [13]. It is a good tool to gain stakeholders’ support. Besides, its simplicity makes it easy for everyone to understand and project managers do not need to spend much time explaining what it entails.

Common mistakes

There are many mistakes project managers make when calculating ROI and that can lead them to an inaccurate value that does not express the performance of an investment. Some of the most common are:

- Failure to include all costs – all costs associated with the project must be included in the calculation, otherwise the result will not be reliable [14]. It is important to make sure personnel expenses and indirect costs, such as rent and utilities, are not forgotten.

- Confusing financial gains with net profit – when unfamiliar with the different terms presented in the ROI formula, some people tend to think that “Net profit” refers exclusively to all the cash inflow registered for the investment [14]. This is not true as was explained in subsection 2.1. This should be avoided as the ROI would be much better than what it is in reality.

Limitations

Although ROI is a valuable metric for evaluating projects' performances and investment decisions, it has certain limitations of which project managers should be aware.

- Time value of money - ROI does not consider the time value of money, which is the concept that money is worth more in the present than in the future[10] [15]. This means that, for example, today 200DKK is worth more than it will be tomorrow, in a week, in a few months or in years. Other metrics such as Net Present Value (NPV) and Internal Rate of Return (IRR) can be used to complement ROI and help provide a more precise assessment.

- Limited scope - Since non-financial factors such as social and environmental impacts are quite difficult to measure, most of the time ROI does not consider them [16]. This means that ROI may not provide a complete picture of the value of an investment. Additionally, ROI does not consider the risk associated with an investment. Two investments may have the same ROI, however, one may be much riskier than the other.

Annotated bibliography

Project Management Institute. (2021). A Guide to the Project Management Body of Knowledge (PMBOK® Guide) – Seventh Edition. Project Management Institute.

Chapter 4 focuses on project performance domains as it reflects on the importance of measuring projects' performance

CSIMarket. (n.d.). Return on Investment (ROI) Ranking, Valuation & Fundamental Analysis for US Stocks. Retrieved May 10, 2023, from https://csimarket.com/screening/index.php?s=roi

This website that provides information on return on investment (ROI) rankings, valuations, and fundamental analysis for US stocks.

Harrison, B. (2021, March 18). How to Calculate ROI for a Project. Harvard Business School Online Blog. https://online.hbs.edu/blog/post/how-to-calculate-roi-for-a-project

This page provides an overview of ROI and its application. It is good to understand the basics for the calculation of this KPI and how it can be used to evaluate projects.

References

- ↑ 1.0 1.1 1.2 Stobierski, T. (2020, May 12). How to Calculate ROI to Justify a Project | HBS Online. Business Insights - Blog. https://online.hbs.edu/blog/post/how-to-calculate-roi-for-a-project

- ↑ Dearden, J. (1969, May 1). The Case Against ROI Control. Harvard Business Review. https://hbr.org/1969/05/the-case-against-roi-control

- ↑ Birken, E. G. (2021, March 17). Understanding Return On Investment (ROI) (B. Curry, Ed.). Forbes Advisor; Forbes. https://www.forbes.com/advisor/investing/roi-return-on-investment/

- ↑ 4.0 4.1 4.2 4.3 4.4 Project Management Institute. (2021). A Guide to the Project Management Body of Knowledge (PMBOK® Guide) – Seventh Edition. Project Management Institute.

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 5.6 Harrison, B. (2021, March 18). How to Calculate ROI for a Project. Harvard Business School Online Blog. https://online.hbs.edu/blog/post/how-to-calculate-roi-for-a-project

- ↑ ProjectManagement.com. (2014, April 21). Demystifying return on investment (the ROI). ProjectManagement.com. https://www.projectmanagement.com/blog/blogPostingView.cfm?blogPostingID=24708&thisPageURL=/blog-post/24708/Demystifying-Return-On-Investment--the-ROI--#_=_

- ↑ 7.0 7.1 Project Management Academy. (2021, April 22). Return on Investment: Understanding ROI in Project Management. Project Management Academy. https://projectmanagementacademy.net/resources/blog/return-on-investment/

- ↑ 8.0 8.1 CSIMarket. (n.d.). Return on Investment (ROI) Ranking, Valuation & Fundamental Analysis for US Stocks. Retrieved May 10, 2023, from https://csimarket.com/screening/index.php?s=roi

- ↑ 9.0 9.1 Bharti AXA. (2021). What is Return on Investment (ROI) and Benefits? Bharti AXA. https://www.bhartiaxa.com/be-smart/investments/what-is-return-on-investments-and-benefits

- ↑ 10.0 10.1 Corporate Finance Institute. (n.d.). Return on Investment (ROI) Formula. Corporate Finance Institute. https://corporatefinanceinstitute.com/resources/accounting/return-on-investment-roi-formula/

- ↑ 11.0 11.1 Harvard Business School Online. (2021, January 14). How to Calculate ROI for a Project. Harvard Business School Online Blog. https://online.hbs.edu/blog/post/how-to-calculate-roi-for-a-project

- ↑ Thiry, M. (2010). Program management: A strategic decision management process. CRC Press.

- ↑ Mir, F. A., & Pinnington, A. H. (2014). Exploring the value of project management: Linking Project Management Performance and Project Success. International Journal of Project Management, 32(2), 202-217. https://doi.org/10.1016/j.ijproman.2013.05.012

- ↑ 14.0 14.1 Gough, O. (2017, December 5). The most common mistakes small businesses make in calculating ROI. SmallBusiness.co.uk. Retrieved from https://smallbusiness.co.uk/common-mistakes-calculating-roi-2541803/

- ↑ Investopedia. (n.d.). Time Value of Money (TVM). Retrieved May 9, 2023, from https://www.investopedia.com/terms/t/timevalueofmoney.asp

- ↑ Harvard Business Review. (2021). ESG Impact Is Hard to Measure — But It’s Not Impossible. Retrieved from https://hbr.org/2021/01/esg-impact-is-hard-to-measure-but-its-not-impossible