Risk-Reward Bubble Diagrams in Project Portfolio Prioritization

| Line 13: | Line 13: | ||

= History = | = History = | ||

| + | [[File:Method popularity_fromPortfolioMangamentForNew.jpg|400px|thumb|right|Figure 1. - Popularity of different portfolio management methods. Source: Cooper: Portfolio Management for New Products.]] | ||

As with many other methods of this kind, tracing the Risk-Reward Bubble Diagram down to one “inventor” on a given day is practically impossible. The Bubble Diagram, however, is widely mentioned in literature from various authors <ref name="CooperPMNP" /> <ref name="Milosevic" /> <ref name="Levine" /> and is included in the PMI Standard for Portfolio Management under the name “Bubble Chart”. In the Portfolio Management Standard, the Bubble Diagram (Bubble Chart) is denoted as a graphical representation “''often used by organizations to balance and monitor their portfolios''” <ref name="PMI_PMS_standard" />. The content parameters used in a generic Bubble Diagram, however, may be any measure of any property of the project. | As with many other methods of this kind, tracing the Risk-Reward Bubble Diagram down to one “inventor” on a given day is practically impossible. The Bubble Diagram, however, is widely mentioned in literature from various authors <ref name="CooperPMNP" /> <ref name="Milosevic" /> <ref name="Levine" /> and is included in the PMI Standard for Portfolio Management under the name “Bubble Chart”. In the Portfolio Management Standard, the Bubble Diagram (Bubble Chart) is denoted as a graphical representation “''often used by organizations to balance and monitor their portfolios''” <ref name="PMI_PMS_standard" />. The content parameters used in a generic Bubble Diagram, however, may be any measure of any property of the project. | ||

| Line 25: | Line 26: | ||

* Probability of Success: Either from a technical, commercial or combined point of view. | * Probability of Success: Either from a technical, commercial or combined point of view. | ||

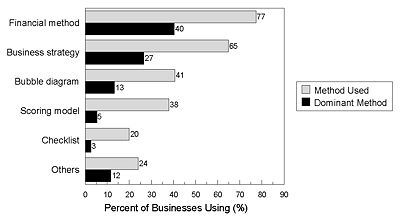

| − | The Bubble Diagrams, therefore, presents a number of project scoring parameters in a single plot with each Bubble Diagrams being able to display up to 6 parameters at once using sizes, shapes, surfaces, colours etc. of the bubbles. [[Citation]] According to Cooper <ref name="CooperWP12" />, Risk-Reward Bubble Diagram is with 44 % the most used Bubble Diagram. The Risk-Reward Bubble Diagram is used in 41 % of businesses but is only the dominant method in 13 % of the businesses, as shown in Figure | + | The Bubble Diagrams, therefore, presents a number of project scoring parameters in a single plot with each Bubble Diagrams being able to display up to 6 parameters at once using sizes, shapes, surfaces, colours etc. of the bubbles. [[Citation]] According to Cooper <ref name="CooperWP12" />, Risk-Reward Bubble Diagram is with 44 % the most used Bubble Diagram. The Risk-Reward Bubble Diagram is used in 41 % of businesses but is only the dominant method in 13 % of the businesses, as shown in Figure 1 presented by Cooper <ref name="CooperWP13" />. |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

= Application and Use = | = Application and Use = | ||

Revision as of 22:09, 16 September 2016

- WIP ***

Risk-Reward Bubble Diagrams are visual tools for achieving an overview of the different parameters of the project such as the added value of the project when selecting which projects to run. Hence, the Risk-Reward Bubble Diagrams are considered useful for portfolio structuring.

In the classical Risk-Reward Bubble Diagram, as suggested by Stage-Gate International among others, a chart is made with a measure of the Project Importance (e.g. Net Present Value, NPV) on one axis and a measure of the Ease of Project Completion on the other. Four squares, or quadrants, are now formed within the graph determining the desirability of each project. Projects in the quadrant yielding high value and high ease of completion are named “Pearls”, and are the most desirable whereas “White Elephants” projects with low value and low ease of completion are the least desirable. In between are the “Bread & Butter” projects with high ease but low value and the oysters that add high value but with little ease of completion.

On this graph, the projects are displayed as surfaces, where the size, shape, colour etc. may indicate the costs of the project, the uncertainty of the estimates, the strategic fit or other relevant parameters.

The Risk-Reward Bubble Diagram has been altered several times to match the different needs of different companies or project organisations with the more famous adjustments being the ones of Procter & Gamble and 3M.

In this article the use of classical Risk-Reward Bubble Diagrams and their altered alternatives in portfolio prioritization will be investigated with focus on their benefits and limits. The Bubble Diagrams will be put in perspective to the BCG Portfolio Prioritization Matrix, as these are typically grouped together, though their differences and commons are still discussed in the literature.

Contents |

History

As with many other methods of this kind, tracing the Risk-Reward Bubble Diagram down to one “inventor” on a given day is practically impossible. The Bubble Diagram, however, is widely mentioned in literature from various authors [1] [2] [3] and is included in the PMI Standard for Portfolio Management under the name “Bubble Chart”. In the Portfolio Management Standard, the Bubble Diagram (Bubble Chart) is denoted as a graphical representation “often used by organizations to balance and monitor their portfolios” [4]. The content parameters used in a generic Bubble Diagram, however, may be any measure of any property of the project.

The Risk-Reward Bubble Diagram, defining the displayed project properties in the Bubble Diagram, is mentioned by several authors, most notably Robert Cooper from Stage-Gate Inc. The Bubble Diagram is here considered “… an adaptation of the four quadrant BCG (star; cash cow; dog; wildcat) diagrams which have seen service since the 1970s as strategy models…” [5].

Background for Project Scoring

The Bubble Diagrams, however, are generally considered a visual representation of the project scoring results. Hence, the parameters shown in the Bubble Diagrams are quantifications of various project parameters found through the project scoring process. Several properties can be quantified, but some of the most notable and used [2] are:

- Risk: Risk numbers on different scales or risk costs (probability of a risk occurring times its expected economic impact) or different measures for assessing the risk.

- Value: Often expressed as Net Present Value (NPV), Expected Commercial Value (ECV) or the more vaguely (or multiply) defined Return On Investment (ROI).

- Time: for instance, Time to Complete or Time to Market

- Strategic Fit: Measure of fit with either business/corporate strategy or the strategy of a business unit

- Probability of Success: Either from a technical, commercial or combined point of view.

The Bubble Diagrams, therefore, presents a number of project scoring parameters in a single plot with each Bubble Diagrams being able to display up to 6 parameters at once using sizes, shapes, surfaces, colours etc. of the bubbles. Citation According to Cooper [5], Risk-Reward Bubble Diagram is with 44 % the most used Bubble Diagram. The Risk-Reward Bubble Diagram is used in 41 % of businesses but is only the dominant method in 13 % of the businesses, as shown in Figure 1 presented by Cooper [6].

Application and Use

Risk-Reward Bubble Diagram Structure

Variants of the classical Risk-Reward Bubble Diagram

Alternatives and Limitations

Risk-Reward and Portfolio Prioritzation

Complexity Perspective

Annotated Bibliography

References

Cite error:

<ref> tags exist, but no <references/> tag was found