Risk Assessment: framework for combining CBA and MCDA

| Line 24: | Line 24: | ||

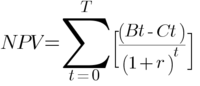

The Net Present Value is an investment criteria utilized for determining wether or not a project will be profitable. It considers the difference between benefits (e.g, user impacts/benefits) and costs (investments cost, maintenance), discounted during all the period of the project. The requirement to fulfill the profitability condition for a project is NPV>0. When comparing projects, the ones with higher NPVs should be selected. '''A NPV-based selection is recommended whenever the program consists of projects that are dependent between each other''', i.e., if the exectution of a project excludes or limits the possible execution of a different project. | The Net Present Value is an investment criteria utilized for determining wether or not a project will be profitable. It considers the difference between benefits (e.g, user impacts/benefits) and costs (investments cost, maintenance), discounted during all the period of the project. The requirement to fulfill the profitability condition for a project is NPV>0. When comparing projects, the ones with higher NPVs should be selected. '''A NPV-based selection is recommended whenever the program consists of projects that are dependent between each other''', i.e., if the exectution of a project excludes or limits the possible execution of a different project. | ||

| + | [[File:NPV!.png|200px|thumb|centre|Figure 2: NPV formula ]] | ||

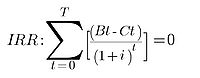

| − | 2. '''IRR''': | + | 2. '''IRR''': |

The Interal Rate of Return determines the discount rate which balances costs and benefits of the project. The higher the discount rate determined, the higher the value of the project when compared between other projects in the same program. | The Interal Rate of Return determines the discount rate which balances costs and benefits of the project. The higher the discount rate determined, the higher the value of the project when compared between other projects in the same program. | ||

| + | [[File:IRR.jpg|200px|thumb|centre|Figure 3: IRR formula ]] | ||

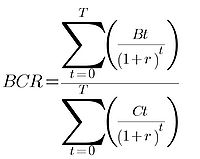

3. '''BCR''': | 3. '''BCR''': | ||

The Benefit-Cost Rate takes in account the rate between discounted benefits and discounted costs during the whole project duration. The requirement for a profitable project is to hav a BCR>1. '''A BCR-based selection is recommended whenever the program consists of budget-constrained projects, which are also indipendent between each other'''. | The Benefit-Cost Rate takes in account the rate between discounted benefits and discounted costs during the whole project duration. The requirement for a profitable project is to hav a BCR>1. '''A BCR-based selection is recommended whenever the program consists of budget-constrained projects, which are also indipendent between each other'''. | ||

| + | [[File:BCR!.jpg|200px|thumb|centre|Figure 4: BCR formula ]] | ||

| + | |||

'''In the suggested framework, the BCR, as well as the sum of the benefits and the costs, will be used as inputs during the COSIMA approach.''' | '''In the suggested framework, the BCR, as well as the sum of the benefits and the costs, will be used as inputs during the COSIMA approach.''' | ||

Revision as of 22:23, 19 February 2022

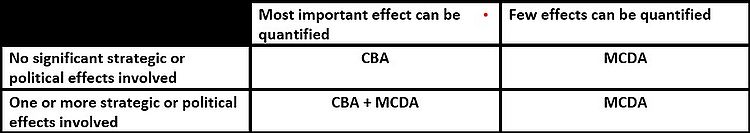

Risk management in portfolios, programs, and projects has the objective of setting goals and business objectives with the core vision and values of the organizations[1]. Meanwhile, the formation of the Sustainable Development Goals (SDGs) and the required commitment from the organizations, has led to a formation of new core values and visions to be pursued. Consequently, the portfolio and project management process has developed significantly in the last years, portfolio managers must ensure that organizations competing in a dynamic and uncertain environment are aligned with their strategies [1], while program and project managers are responsible for implementing and successfully managing the different criteria generated by the external opportunities and threats. Yet, most of the project and program risk assessments are limited on the application of the Cost-Benefit Analysis (CBA), mainly focusing on the profitability of projects. While the CBA provides a lot of insightful economic data (e.g., NPV, BCR, IRR), project assessments should consider also social and environmental criteria (e.g., economic development, public image, environmental sustainability) to strive for success. Therefore, the scope of the article is to set a framework for the risk assessment process of programs and projects, through the combination of the traditional Cost-Benefit Analysis and the more recent Multi-Criteria Decision Analysis (MCDA), by providing a mix of tools which considers monetary goals, as also non-monetary strategic goals. This framework assumes that the first step of the appraisal, the CBA part, has already been completed, since the method is widely spread and used by most of the companies. The article will consider the limitations of this framework, providing suggestions to mitigate the typical difficulties related to the tools, facilitating the decision-making process during risk assessments. In order to provide an effective and appliable tool for the reader, this article will focus on the application of the REMBRANDT technique during the MCDA phase, and then on the COSIMA approach, used to combine the results from CBA and MCDA.

Contents |

Introduction

The purpose of quantitative risk analysis is to get a clear overview from a managerial perspective of which might be the uncertainties involved in a project, in order to estimate numerical, often monetary, values associated to each risk[1], which are usually considered costs. At the same time opportunities can be identified, and usually, once they are associated a value, they can be defined benefits. While in some cases quantitate risk assessments can not be conducted, and thus only a qualitative risk assessment can be executed, it is still essential to update the process of program/project risk assessment whenever it is necessary, in order to meet the requests of the many different stakeholders involved in the organizations. With this purpose in mind, the article will be structured with an introduction on the CBA and MCDA methods, highlighting the values they provide, along with their limitations. Thereafter the application of REMBRANDT and COSIMA approaches will be explained in detail through Excel examples, after a theoretic background is provided. Finally the limitations of this mix of tools/framework will be presented, followed by suggestions to avoid or mitigate the shortcomings exposed.

CBA

The Cost-Benefit Analysis became a popular tool in the 1960s and is mainly used for the risk assessment and appraisal of relevant projects, yet it can be used also for smaller projects. The aim of the CBA is to compare different projects considering both financial flows and economic impacts on the society, in a common and objective monetary metric [3]. For example, a project involving railways construction, will not only consider the variation of the financial flows inside the organization, but also indirect impacts such as “Reduced time travel” and “Safety Increased”. As the financial flows and the economic flows are assessed, these are then confronted in order to measure the positive/negative impact on society’s welfare. One of the most important factors used in the CBA is the discount rate, which takes in account the assumption that benefits are more valuable in the present, rather than in the future. It is fundamental to not confuse the discount rate with the inflation rate. Thus, the value provide by a benefit decreases over time, and the costs will also decrease as the project goes on. There are many outputs once the CBA has been completed, the most relevant investment criteria for projects assessment are the following[2]:

1. NPV:

The Net Present Value is an investment criteria utilized for determining wether or not a project will be profitable. It considers the difference between benefits (e.g, user impacts/benefits) and costs (investments cost, maintenance), discounted during all the period of the project. The requirement to fulfill the profitability condition for a project is NPV>0. When comparing projects, the ones with higher NPVs should be selected. A NPV-based selection is recommended whenever the program consists of projects that are dependent between each other, i.e., if the exectution of a project excludes or limits the possible execution of a different project.

2. IRR:

The Interal Rate of Return determines the discount rate which balances costs and benefits of the project. The higher the discount rate determined, the higher the value of the project when compared between other projects in the same program.

3. BCR:

The Benefit-Cost Rate takes in account the rate between discounted benefits and discounted costs during the whole project duration. The requirement for a profitable project is to hav a BCR>1. A BCR-based selection is recommended whenever the program consists of budget-constrained projects, which are also indipendent between each other.

In the suggested framework, the BCR, as well as the sum of the benefits and the costs, will be used as inputs during the COSIMA approach.

Limitations

The most important limitations regarding the CBA are the following[2]:

1. Long term and strategic impacts:

Some impacts are impossible or very hard to assess, especially strategic impacts, e.g., decrease of stress among workers.

2. Discount rate:

The discount rate principle relies around the conception that a benefit is more valuable today rather than tomorrow, therefore privileging present generations instead of the future ones. This concept goes againt many definitions of sustainability and it displays the need to update and combine the CBA with other assessment tools[4].

3. Unit prices determination:

The estimation of unit prices for non-marketable impacts, such as pollution reduction and safety improvements, may be quite difficult, leading to assumptions and more subjective-based unit prices. This problem can lead to misunderstandings and conflicts with the stakeholders involded in the project assessment, in fact the goal of the CBA is to provide an objective economic analysis.

4. Hyphotetical results and uncertainty:

Even if the CBA makes estimations based on forecasts and the aggregated willingesses to pay, there is no actual cash-flow, making the project appraisal process results debatable.

MCDA

Characteristics of the MCDA analysis and the different tools.

Limitations

Application

REMBRANDT technique

Description of the tool and its main features

Steps

Criteria selection

Alternatives and Criteria comparisons

Eliciting Weights

Consistency analysis

Sensitivity analysis

COSIMA approach

Overall application method, shadow prices and alpha percentage

Steps

Inputs from CBA

Inputs from REMBRANDT and value function scoring

MCDA% and calculation of shadow prices

Determination of the TRR

Comparison of the different projects/alternatives basing on the MCDA%

Framework's limitations

Suggestions

Annotated bibliography

Barfod, M. B., & Leleur, S. (Eds.) (2014). Multi-criteria decision analysis for use in transport decision making. (2 ed.) DTU Transport. https://backend.orbit.dtu.dk/ws/portalfiles/portal/104276012/DTU_Transport_Compendium_Part_2_MCDA_.pdf

This compendium illustrates in detail the main theories used to create this framework, including extra tools that can be used as substitutes in order to combine CBA and MCDA. It has been used as the main source of data for the article.

References

- ↑ 1.0 1.1 1.2 Standard for Risk Management in Portfolios, Programs, and Projects. Project Management Institute, Inc. (PMI) Publication Date 2019 https://app-knovel-com.proxy.findit.cvt.dk/kn/resources/kpSRMPPP01/toc?kpromoter=federation

- ↑ 2.0 2.1 2.2 Barfod, M. B., & Leleur, S. (Eds.) (2014). Multi-criteria decision analysis for use in transport decision making. (2 ed.) DTU Transport.https://backend.orbit.dtu.dk/ws/portalfiles/portal/104276012/DTU_Transport_Compendium_Part_2_MCDA_.pdf

- ↑ Cost Benefit Analysis, Statistical Tools for Program Evaluation — 2017, pp. 291-324 BY Le Maux, Benoît; Josselin, Jean-Michel https://finAdit.dtu.dk/en/catalog/595cdaa05010df732981119e

- ↑ https://www.un.org/en/academic-impact/sustainability#:~:text=In%201987%2C%20the%20United%20Nations,development%20needs%2C%20but%20with%20the