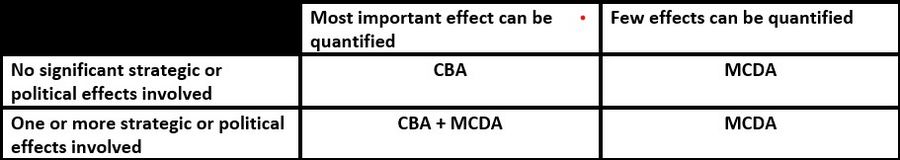

Risk Assessment: framework for combining CBA and MCDA

Risk management in portfolios, programs, and projects has the objective of setting goals and business objectives with the core vision and values of the organizations[1]. Meanwhile, the formation of the Sustainable Development Goals (SDGs) and the required commitment from the organizations, has led to a formation of new core values and visions to be pursued. Consequently, the portfolio and project management process has developed significantly in the last years, portfolio managers must ensure that organizations competing in a dynamic and uncertain environment are aligned with their strategies [1], while program and project managers are responsible for implementing and successfully managing the different criteria generated by the external opportunities and threats. Yet, most of the project and program risk assessments are limited on the application of the Cost-Benefit Analysis (CBA), mainly focusing on the profitability of projects. While the CBA provides a lot of insightful economic data (e.g., NPV, BCR, IRR), project assessments should consider also social and environmental criteria (e.g., economic development, public image, environmental sustainability) to strive for success. Therefore, the scope of the article is to set a framework for the risk assessment process of programs and projects, through the combination of the traditional Cost-Benefit Analysis and the more recent Multi-Criteria Decision Analysis (MCDA), by providing a mix of tools which considers monetary goals, as also non-monetary strategic goals. This framework assumes that the first step of the appraisal, the CBA part, has already been completed, since the method is widely spread and used by most of the companies. The article will consider the limitations of this framework, providing suggestions to mitigate the typical difficulties related to the tools, facilitating the decision-making process during risk assessments. In order to provide an effective and appliable tool for the reader, this article will focus on the application of the REMBRANDT technique during the MCDA phase, and then on the COSIMA approach, used to combine the results from CBA and MCDA.

Contents |

Introduction

The purpose of quantitative risk analysis is to get a clear overview from a managerial perspective of which might be the uncertainties involved in a project, in order to estimate numerical, often monetary, values associated to each risk[1], which are usually considered costs. At the same time opportunities can be identified, and usually, once they are associated a value, they can be defined benefits. While in some cases quantitate risk assessments can not be conducted, and thus only a qualitative risk assessment can be executed, it is still mandatory to update the process of program/project risk assessment whenever it is the case, in order to meet the requests of the many different stakeholders involved in the organizations. With this purpose in mind, the article will be structured with an introduction on the CBA and MCDA methods, highlighting the values they provide, along with their limitations. Thereafter the application of REMBRANDT and COSIMA approaches will be explained in detail through Excel examples and theory background. Finally the limitations of this mix of tools/framework will be presented, followed by suggestions to avoid or mitigate the shortcomings exposed.

CBA

Characteristics of the CBA analysis

Limitations

MCDA

Characteristics of the MCDA analysis and the different tools.

Limitations

Application

REMBRANDT technique

Description of the tool and its main features

Steps

Criteria selection

Alternatives and Criteria comparisons

Eliciting Weights

Consistency analysis

Sensitivity analysis

COSIMA approach

Overall application method, shadow prices and alpha percentage

Steps

Inputs from CBA

Inputs from REMBRANDT and value function scoring

MCDA% and calculation of shadow prices

Determination of the TRR

Comparison of the different projects/alternatives basing on the MCDA%

Limitations

Suggestions

Annotated bibliography

Barfod, M. B., & Leleur, S. (Eds.) (2014). Multi-criteria decision analysis for use in transport decision making. (2 ed.) DTU Transport. https://backend.orbit.dtu.dk/ws/portalfiles/portal/104276012/DTU_Transport_Compendium_Part_2_MCDA_.pdf

This compendium illustrates in detail the main theories used to create this framework, including extra tools that can be used as substitutes in order to combine CBA and MCDA. It has been used as the main source of data for the article.

References

- ↑ 1.0 1.1 1.2 Standard for Risk Management in Portfolios, Programs, and Projects. Project Management Institute, Inc. (PMI) Publication Date 2019 https://app-knovel-com.proxy.findit.cvt.dk/kn/resources/kpSRMPPP01/toc?kpromoter=federation

- ↑ Barfod, M. B., & Leleur, S. (Eds.) (2014). Multi-criteria decision analysis for use in transport decision making. (2 ed.) DTU Transport.https://backend.orbit.dtu.dk/ws/portalfiles/portal/104276012/DTU_Transport_Compendium_Part_2_MCDA_.pdf