Risk Quantification

| Line 4: | Line 4: | ||

| − | + | = Introduction = | |

| − | + | ===Definition=== | |

| − | <div style="text-align: center;">Risk quantification is a process of evaluating the risks that have been identified and developing the data that will be needed for making decisions as to what should be done about them [http://pmtips.net/blog-new/defining-risk-management-part-4-risk-quantification]. PMBOK <ref>[Duncan W. R., “A Guide to Project Management Body of Knowledge (PMBOK)”, PMI Standards Committee, | + | <div style="text-align: center;">Risk quantification is a process of evaluating the risks that have been identified and developing the data that will be needed for making decisions as to what should be done about them [http://pmtips.net/blog-new/defining-risk-management-part-4-risk-quantification]. PMBOK <ref name=Duncan2013 >[Duncan W. R., “A Guide to Project Management Body of Knowledge (PMBOK)”, PMI Standards Committee, (2013).] </ref> describes risk quantification as evaluating risks and risk interactions to assess the range of possible outcomes.</div><br /> |

| − | + | ===Inputs and Outputs of Risk Quantification=== | |

In risk quantification process of a project, there are inputs that should be considered with delegate care and as a result of risk quantification process outputs are generated. According to PMBOK, following inputs are considered and outputs are produced in risk quantification process of any project: | In risk quantification process of a project, there are inputs that should be considered with delegate care and as a result of risk quantification process outputs are generated. According to PMBOK, following inputs are considered and outputs are produced in risk quantification process of any project: | ||

{| class="wikitable" | {| class="wikitable" | ||

| Line 43: | Line 43: | ||

<div style="text-align: center;"><math>R = P\times I</math></div><br /> | <div style="text-align: center;"><math>R = P\times I</math></div><br /> | ||

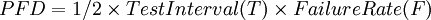

| + | [[File:Risk Matrix of a project.jpg|thumb| |upright=2.5||right||Figure 1: Example of risk matrix of a project (source: http://www.cbisco.com.au/wp-content/uploads/2014/06/aa.jpg)]] | ||

<div style="text-align: justify;">Once risks are quantified then these are evaluated against a defined risk criteria or risk matrix. Red zone in a risk matrix may represents unacceptable risks, yellow zone as acceptable risk, and green zone as neglectable risks. For example, if an event has a likelihood of class “Likely” and it has a severity class “Catastrophic” then it may lie in red zone of risk matrix. This may mean that this risk is not acceptable and appropriate or immediate actions should be applied to lower this risk into acceptable zone. Figure 1 shows an example of risk matrix of a project. First column represents criteria for likelihood, where, first row represents criteria for consequence. Further, nature of any possible risk is defined based on both likelihood and consequence from low, moderate, high, to extreme. </div><br /> | <div style="text-align: justify;">Once risks are quantified then these are evaluated against a defined risk criteria or risk matrix. Red zone in a risk matrix may represents unacceptable risks, yellow zone as acceptable risk, and green zone as neglectable risks. For example, if an event has a likelihood of class “Likely” and it has a severity class “Catastrophic” then it may lie in red zone of risk matrix. This may mean that this risk is not acceptable and appropriate or immediate actions should be applied to lower this risk into acceptable zone. Figure 1 shows an example of risk matrix of a project. First column represents criteria for likelihood, where, first row represents criteria for consequence. Further, nature of any possible risk is defined based on both likelihood and consequence from low, moderate, high, to extreme. </div><br /> | ||

| − | |||

| + | ===Importance=== | ||

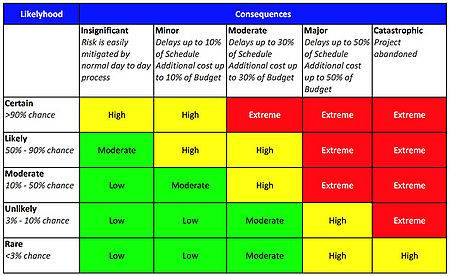

| + | [[File:Why projects fail.png|thumb| |upright=2.5||right||Figure 2: Causes of project failure (source: https://media.licdn.com/mpr/mpr/shrinknp_800_800/AAEAAQAAAAAAAAg4AAAAJDVlMzhiNDM5LWJlMWUtNGU5Zi05ZTY4LTAzYWRhODM5YjhmYQ.png)]] | ||

| + | <div style="text-align: justify;">The term risk or risk assessment may sound like a modern scientific concept, but the idea of risk is as old as recorded human history. The gambling, the very essence of risk, was a popular pastime that inspired Pascal and Fermat’s revolutionary breakthrough into laws of probability <ref>[''Bernstein P.L., “Against the Gods: The remarkable story of risk”, John Wiley & Sons, New York, (1996).''] </ref>. However, Risk as a scientific field is quite young. Around 30-40 years ago scientific journals, papers, and conferences started to cover this idea and principles on how to assess and manage risk <ref>[''Aven T., “Risk assessment and risk management: Review of recent advances on their foundation”, European journal of operational research, (2016), Vol. 253, No. 1, pp. 1-13.'']</ref>. Figure 2 shows that 17% of projects were failed due to inadequate risk management. </div><br /> | ||

| + | |||

| + | =Applications= | ||

| + | <div style="text-align: justify;">Several tools and techniques are used in order to apply risk quantification in projects. PMBOK <ref name=Duncan2013 /> provides 6 methods that can be used in risk quantification process. These tools and techniques are described briefly below, along with application, advantages, and disadvantages of each tool. </div><br /> | ||

| + | |||

| + | ===Expert Opinion:=== | ||

| + | Merriam-Wesbster (https://www.merriam-webster.com/dictionary/expert%20opinion) defines expert opinion as, “a belief or judgment about something given by an expert on the subject”. Expert opinion is one of the risk quantification techniques. In expert opinion, risks are quantified based on the opinions of experts or senior executives based on their experiences. One of the best ways to use expert opinion is to conduct risk assessments workshops where experts can discuss and consequently assign values to the to the risks identified. But, this may lead to group bias and can affect the outcome. This bias can be minimized by using Delphi method, but there still be a chance of high variation in opinion. (http://www.theactuary.com/archive/old-articles/part-3/risk-quantification-techniques/) | ||

| + | |||

| + | Although, expert opinion is not as concrete, as other methods may be, and may prone to personal subjectivity, but it is a very useful tool for risk quantification when data is scarce or no sufficient past experience is available or where risks are very company or project specific. (http://www.theactuary.com/archive/old-articles/part-3/risk-quantification-techniques/) | ||

| + | |||

| + | Table below shows an example of risk quantification using expert opinion in a case study on construction project conducted by Yildiz et al. (2014). The ratings are estimated ratings, quantified by SEM (Structural Equation Modeling) software based on the sub risks and attributes ratings assigned by experts using 1-5 Likert Scale. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

==Limitations and Challenges== | ==Limitations and Challenges== | ||

==Annotated Bibliography== | ==Annotated Bibliography== | ||

==References== | ==References== | ||

<references /> | <references /> | ||

Revision as of 16:48, 22 September 2017

Contents |

Introduction

Definition

Inputs and Outputs of Risk Quantification

In risk quantification process of a project, there are inputs that should be considered with delegate care and as a result of risk quantification process outputs are generated. According to PMBOK, following inputs are considered and outputs are produced in risk quantification process of any project:

| Inputs | Outputs |

|---|---|

| Stakeholder Risk Tolerance: Every organization and different individuals may have different tolerance for risk value | Opportunities to Pursue, Threats to Respond to: The list of opportunities that should be pursued and threats that should be taken care of. |

| Sources of Risks: Categories of possible risk events that may negatively affect the outcome of a project. For example, Designs errors, stakeholder actions, or poor estimates etc. | Opportunities to Ignore, Threats to Accept: List of opportunities that can be ignored and threats that can be accepted. |

| Potential Risk Events: Discrete occurrences that can occur during a project that may affect the outcome of the project. Such as natural disaster or departure of key member etc. | |

| Cost Estimates: Assessment of likely cost required to complete the project activities. | |

| Activity Duration Estimate: Quantitative assessment of likely number of work period required to activities of a project |

Purpose and Concept

Importance

Applications

Expert Opinion:

Merriam-Wesbster (https://www.merriam-webster.com/dictionary/expert%20opinion) defines expert opinion as, “a belief or judgment about something given by an expert on the subject”. Expert opinion is one of the risk quantification techniques. In expert opinion, risks are quantified based on the opinions of experts or senior executives based on their experiences. One of the best ways to use expert opinion is to conduct risk assessments workshops where experts can discuss and consequently assign values to the to the risks identified. But, this may lead to group bias and can affect the outcome. This bias can be minimized by using Delphi method, but there still be a chance of high variation in opinion. (http://www.theactuary.com/archive/old-articles/part-3/risk-quantification-techniques/)

Although, expert opinion is not as concrete, as other methods may be, and may prone to personal subjectivity, but it is a very useful tool for risk quantification when data is scarce or no sufficient past experience is available or where risks are very company or project specific. (http://www.theactuary.com/archive/old-articles/part-3/risk-quantification-techniques/)

Table below shows an example of risk quantification using expert opinion in a case study on construction project conducted by Yildiz et al. (2014). The ratings are estimated ratings, quantified by SEM (Structural Equation Modeling) software based on the sub risks and attributes ratings assigned by experts using 1-5 Likert Scale.

Limitations and Challenges

Annotated Bibliography

References

- ↑ 1.0 1.1 [Duncan W. R., “A Guide to Project Management Body of Knowledge (PMBOK)”, PMI Standards Committee, (2013).]

- ↑ [Bernstein P.L., “Against the Gods: The remarkable story of risk”, John Wiley & Sons, New York, (1996).]

- ↑ [Aven T., “Risk assessment and risk management: Review of recent advances on their foundation”, European journal of operational research, (2016), Vol. 253, No. 1, pp. 1-13.]