Decision making under risk

Developed by Regitza Hansen

Decision making is one of the most important tasks in the management process and it is often a very difficult one. When having knowledge regarding the states of nature, subjective probability estimates for the occurrence of each state can be assigned. In such cases, the problem is classified as decision making under risk.

In the decision making process, all relevant information is evaluated through decision analysis (DA). The decision analysis process consist of the use of a decison tool and a decsion theory. The decision tree is the most commonly applied decision tool in the decision analysis. The decision theory of interest in the decision analysis, regarding the decision making under risk, is the expected value of criterion also reffered to as the Bayesian principle. This is the only one of the four decision methods that incorporates the probabilities of the states of nature.

Contents |

Methologdy

Risk analysis and risk management is an important tool in the construction management process. Risk implies a degree of uncertainty and an inability to fully control the outcomes or consequences of such an action. The objective of a decision analysis is to discover the most advantageous alternative under the circumstances.

Decision analysis is a management technique for analyzing management decisions under conditions of uncertainty. The decision problems can be represented using different statistical tools applied to the mathematical models of real-world problems. An important and relevant decision tool to represent a decision problem is a decision trees. A decision tree is a graphical representation of the alternatives and possible solutions, also challenges and uncertainties. In decision analysis, formulating the decision problem in terms of a decison tree is a favorable visual and analytical support tool, where the expected values of competing alternatives are calculated.

Theory and principles

The following provides the theory and principles behind the decision making under risk, using bayesian decision analysis. An overview of the principles and construction regarding the decision tree is provided as well as a the decision theory regarding the decision tree analysis.

Decision tree

A Decision Tree is a chronological representation of the decision process. It is particularly useful where there are a series of decisions to be made and/or several outcomes arising at each stage of the decision-making process, it is therefore useful in analyzing multi-stage decision processes. The number of alternative actions can be extremely large and a framework for the systematic analysis of the corresponding consequences is therefore expedient.

Decision trees is an effective decision tool in the decision-making, because it:

- Clearly lay out the problem so that all options can be challenged

- allow to fully analyse the possible consequences of a decision

- provides a framework in which to quantify the values of outcomes and the probabilities of achieving them

- helps make the best decisions on the basis of existing information and best guesses.

The following section provides the construction of the decision tree, providing a simple example.

Construction of decision tree

A decision tree is a schematic, tree-shaped diagram representation of a problem and all possible courses of action in a particular situation and all possible outcomes for each possible course of action. The diagram is constructed of branches and each branch of the decision tree represents a possible decision, occurrence or reaction. The tree is structured to show how and why one choice may lead to the next, with the use of the branches indicating each option is mutually exclusive.

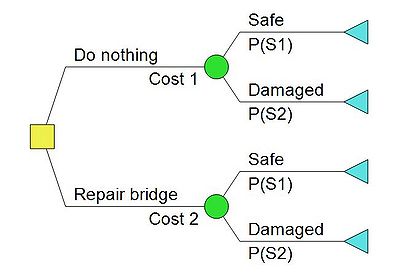

A decision tree consists of three type of nodes, there is no universal set of symbols used when drawing a decision tree but the most common ones is:

- Decision (choice) Node – square

- Chance (event) Node - circles

- Terminal (consequence) Node – triangles

For the purpose of illustration, the decision tree in figure 1 considers the following very simple decision problem. An old bridge has been subject to deterioration, control data reveal that the bridge structure may be damaged. However, this cannot be indicated with certainty. If the bridge is damaged, it is unfit for service and a new one needs to be constructed. Your company is hired to find the best solution of two alternatives:

- Alternative a2: Do nothing

- Alternative a2: Repair the bridge

The decision analysis is therefore to evaluate weither is most beneficial to do nothing or repair the bridge, so which alternative is associated with the lowest risk, in this case the lowest risk is the alternative with the lowest expected cost.

In figure 1, the first node drawn is the decision node, a branch emanating from a decision node corresponds to a decision alternative, which in this case are either to repair the bridge or do nothing. It includes a cost or benefit value, which in this example is refered to as cost 1 and cost 2.

The next node is a chance node, since both alternatives does not lead to a new the decision. A branch emanating from a state of nature (chance) node corresponds to a particular state of nature, and includes the probability of this state of nature. For both alternatives the branches has the same outcome, either the bridge is safe and fit for service or the bridge is damaged. The probability associtaed with the bridge being safe or damaged, are denoted P(S1) and P(S2), respectively. The final node is the terminal node, this represent the cost consequens related to the choice of decision branch.

Decision theory

Decision theory is an analytical and systematic way to tackle problems. Decision theory is the part of probability theory that is concerned with calculating the consequences of uncertain decisions. This can be applied to state the objectivity of a choice and to optimise decisions. The construction of the decision tree is the tool provided to show the process. The decision theory is the theory used in the decision process.

The decision method used is the expexted value of criterion, it incorporates the probabilities of the states of nature. The expected value criterion, also refered to as expected monetary value (EMV) analysis is the foundational concept on which decision tree analysis is based. EMV is a tool and technique for the “Perform Quantitative Risk Analysis” process (or simply, quantitative analysis), where a numerically analyze is performed regarding the effect of identified risks on overall project objectives.

The formula for EMV of a risk is this:

Expected Monetary Value (EMV) = Probability of the Risk (P) * Impact of the Risk (I)

or simply, EMV = P * I

EMV calculates the average outcome when the future includes uncertain scenarios. The EVM is therefore the sum of the different scenarios related to a chance note. Depending on the state of information regarding the probability at the time of the decision analysis, three different analysis types are distinguished, namely prior analysis, posterior analysis and pre-posterior analysis. Each of these are important in practical applications of decision analysis and are therefore discussed briefly in the following.

Prior ananlysis- decision analysis with given information

The prioir decicison analysis with known information, it quantify the beliefs before any evidince is taking into account.

Baysian decision analysis

The theory and principles of decision making under risk, has been represented. An example with is now presented with the applied theory.

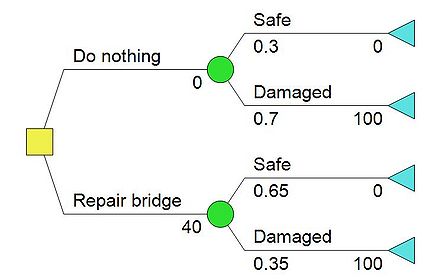

Example 1 - Prior analysis

The prioir analysis is related to the condition of known information. Using the same example as given previous under the construcion of the decision tree, following information is now provided: If the bridge structure is damaged, then a new bridge is reqiured which is asssociated with a cost of $100 mio. If the structure is safe then the cost is $0. It is estimated that there is a 10% probability that the bridge structure is safe. If the bridge is repaired then the probabaility of the bridge stucture having damaged is 20%. Reparing the bridge costs $20 mio. Table 1 provides the probabilities used in the construcion of the decision tree in figure 2.

| a1- Do nothing | a2- Repair bridge | |

|---|---|---|

| P(S1) - Safe | 0.1 | 0.8 |

| P(S2) - Damaged | 0.9 | 0.2 |

Table 1: Probabilities related to the two alternatives

The cost for reparing the bridge is $20mio, which means that cost1=$0mio. and cost2=$20mio.. Providing the given values in figure 1, the decison tree is now represented in figure 2.

The pogram used is having the cost related to each branch, which means that value for the terminal nodes, are the sum of the cost for each branch. This values is also called the Net Path value or NPV. The values are shown in figure 3 and futhermore presented in table 2 below.

| NPV | Cost-

|

|---|---|

| NPV 1 | $0mio. |

| NPV 2 | $100mio. |

| NPV 3 | $20mio. |

| NPV 4 | $120mio. |

Table 1: Net path values (NPV) for example 1.

The decision tree analysis is now preformed, starting with first chance node, associated with alternative a 1 . EVM=P(s1)*0 + P(s2)*$100mio=$90mio Chance node 2 EVM=P(s1)*$120mio + P(s2)*$120mio=$40mio

The most benifical solution, is the one associated with the lowest cost, so:

E[C]=min{EVM a 1 ;EVM a 2 }.

Example 2 - Prosterior analysis

When additional information becomes available, the probability structure in the decision problem may be updated. Having updated the probability structure the decision analysis is unchanged in comparison to the situation with given prior information. The same condition and information provided in example 1 is used. Now acquired more information through a study about the chances of a bridge repairment. The study costs $5mio. Table 4 contains the estimation of the success rate (structure safe) of the bridge repairations in the study. Bridge repairment results 𝑆 (structure safe) 𝑆̅(structure damaged) Indication 𝐼 90% 10%

Table 4: Study indication of bridge repairment success.

Given the result of the study, the updated probability structure or the posterior probability,now called P'(S) is evaluated by use of the Bayes' rule. P ��[θi] = P[I| θi]P[θi ]�j P[zk| θj ]P�[θj ]

P[I]=

The decision tree is now updated and is presented in figure 3.

The cost for the repairment of the bridge is now changed to $25mio., since is is both the cost of the repairent and the study.

This now give:

Compared to the prioir analysis, the new

The prerior analysis is related to the condition of known information. Using the same example as given previous under the construcion of the decision tree, following information is now provided:

If the bridge structure is damaged, then a new bridge is reqiured which is asssociated with a cost of $100 mio. If the structure is safe then the cost is $0. It is estimated that there is a 10% probability that the bridge structure is safe. If the bridge is repaired then the probabaility of the bridge stucture having damaged is 20%. Reparing the bridge costs $20 mio.

Table 1 provides the probabilities used in the construcion of the decision tree in figure 2.

| a1- Do nothing | a2- Repair bridge | |

|---|---|---|

| P(S1) - Safe | 0.1 | 0.8 |

| P(S2) - Damaged | 0.9 | 0.2 |

Table 1: Probabilities related to the two alternatives

The cost for reparing the bridge is $20mio, which means that cost1=$0mio. and cost2=$20mio.. Providing the given values in figure 1, the decison tree is now represented in figure 2.

The pogram used is having the cost related to each branch, which means that value for the terminal nodes, are the sum of the cost for each branch. This values is also called the Net Path value or NPV. The values are shown in figure 3 and futhermore presented in table 2 below.

| NPV | Cost-

|

|---|---|

| NPV 1 | $0mio. |

| NPV 2 | $100mio. |

| NPV 3 | $20mio. |

| NPV 4 | $120mio. |

Table 1: Net path values (NPV) for example 1.

The decision tree analysis is now preformed, starting with first chance node, associated with alternative a 1 . EVM=P(s1)*0 + P(s2)*$100mio=$90mio Chance node 2 EVM=P(s1)*$120mio + P(s2)*$120mio=$40mio

The most benifical solution, is the one associated with the lowest cost, so:

E[C]=min{EVM a 1 ;EVM a 2 }.

utility function a the mathematical function that ranks alternatives according to their utility to an individual. The EVM From each change node

When the utility function has been defined and the probabilities of the various state of nature corresponding to different consequences have been estimated, the analysis is reduced to the calculation expexcted utilities corresponding to the different action alternatives.

Risk defines decision situations in which the probabilities are objective or given, such as betting on a flip of a fair coin, a roll of a balanced die, or a spin of a roulette wheel. Uncertainty defines situations in which the probabilities are subjective (i.e., the decision maker must estimate

or infer the probabilities).

decision-maker does know the probabilities of the various outcomes

When the utility function has been defined and the probabilities of the various state of nature corresponding to different consequences have been estimated, the analysis is reduced to the calculation of the expected utilities corresponding to the different action alternatives. In the following examples the utility is represented in a simplified manner through the costs whereby the optimal decisions now should be identified as the decisions minimizing expected costs, which then is equivalent to maximizing expected utility.

The bridge modification success is probable with 𝑃(𝑆|𝑀) = 0,8. If the deterioration continues, it will lead with 𝑃(𝑁) = 0,95 to building a new bridge. Thus 𝑃(𝑁̅) = 0,05 for the cases the bridge remains fit for service although the deterioration was not stopped. The associated costs are as follows: Action Cost [DKK] 𝑀: Modify bridge 20’000’000 𝐵: Block bridge for trucks 10’000’000 𝑁: Build new bridge 100’000’000

Table 1: Deterioration associated costs.

In the specifications for the construction of a production facility using large amounts of

The decision tree is about making decisions when facing multiple options, as in the giving example.

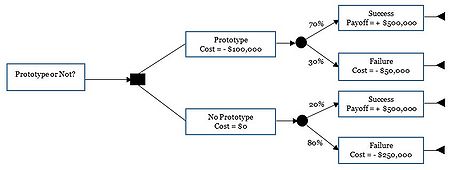

Example

The example consist of a simple situation, that could represent a every-day situation in the constrution mangemant process. A prototype for a project (example a mock-up on the facades) are being constructed. The cost of the prototype is $100,000, and not cost is related if the prototype aren't being prusued. The first step is therefore the decsion, do the prototype or not? Figure 1 represent the construiton of the decision node process.

The decision tree is drawn chronological from left to right. The construction of a simple decision tree is provided in this article. Figure 1 shows the first step, which consists of the decision node. The example is based on the use of a prototype, the first decision is weather or not to do the prototype. Let’s work through an example to understand DTA’s real world applicability.

To begin your analysis, start from the left and move from the left to the right. First, draw the event in a rectangle for the event — “Prototype or Not.” This obviously will lead to a decision node (in the small, filled-up square node as shown below).

From there, you have two options — “Do Prototype” and “Don’t Prototype.” They are also put in rectangles as shown below.

Since there are two options, the tree is constructed with two branches coming from the decision point.

The people involved in constructing a decision tree (sometimes referred to as framing the problem) have the responsibility of including all possible choices for each choice node.

Key benefits

Limitations and pitfalls

References

Annotated bibliography

Wu, G., Zhang, J. and Gonzalez, R. (2004) Decision Under Risk, in Blackwell Handbook of Judgment and Decision Making: This chapter of the handbook provides and introduction to decision making under risk, it present many phases in the history of risky decision-making research and highlight the differences and similarities between how economists and psychologists have approached this subject.

(eds D. J. Koehler and N. Harvey), Blackwell Publishing Ltd, Malden, MA, USA. doi: 10.1002/9780470752937.ch2

Knight, F. H. (1921) Risk, Uncertainty, and Profit: This book presents the work of Frank Knight, a economist at University of Chicago, who distinguished risk and uncertainty. Knights point of view, was that an ever-changing world provides new opportunities for the industry to create profit, but also brings imperfect knowledge related to future events.

Knight, F. H. (1921) Risk, Uncertainty, and Profit. New York: Houghton Mifflin.

Raf Dua (1999) Implementing Best Practice in Hospital Project Management Utilising EVPM methodology: Dua applies EVA in the context of Earned Value Performance Management (EVPM) within the optimization of risk management and process control in hospital project management. His motivation is that healthcare sector usually does not face the competitive pressure as other industries. He therefore works out and describes extensively the EVM methodology and the implementation requirements in order introduce these to hospital sector, providing a case study and special research in that area.

Howes, R. (2000) Improving the performance of Earned Value Analysis as a construction project management tool: Howes, similar to Lukas stated above, takes a rather critical position towards EVA. In his paper, he attempts to refine and improve the performance of traditional EVA by the introduction of a hybrid methodology based on work packages and logical time analysis entitled Work Package Methodology (WPM). In a nutshell, he in his approach applies EVA calculations to individual work packages in order to take into consideration their unique characteristics.

Michael Raby (2000), Project management via earned value: This article very clearly outlines the main characteristics of EVA and the benefits of its' application in project management. While doing so in a nicely summarized way, he provides a quick introduction and a step-by-step guide for execution of the method.

National Defense Industrial Association, Integrated Program Management Division (2014), EIA-748-EVMS Standard, Revision C Intent Guide: This intent guide describes the main requirements within the EIA standard for EVMS and the 32 key consideration to be included. The very specific instructions are summarized, clustered in 5 dimensions and their overall relevance for businesses is explained.

Howard Hunter, Richard Fitzgerald, Dewey Barlow (2014), Improved cost monitoring and control through the Earned Value Management System: This article introduces EVMS in order to optimize performance measurement in Space Department. In order to provide a consistent, standard framework for assessing project performance, which has already been implemented in a reference project, the key characteristics are summarized nicely before the article very specifically treat the particularities of the case study.

Ferguson, J., Kissler, K.H. (2002), Earned Value Management: A very quick but convenient introduction to the EVM requirements, objectives, followed by a general application in the contracting environment of the european institute for nuclear research (CERN).

Kedi, Zhu and Hongping, Yang (2010), Application of Earned Value Analysis in Project Monitoring and control of CMMI: This article reflects upon EVA as a software project controlling method in the context of the CMMI maturity model. They provide detailed schemes for interpretation of EVA indicators. Furthermore, the methods applicability is linked to the overall capabilities of an organization to provide cost, schedule and budget metrics.

Hayes, Heather (2002) Using Earned-Value Analysis to Better Manage Projects: A short introduction to the benefits of EVA, followed by a description of it's relevance for pharmaceutical sector according to a generic example.