Key performance indicators for portfolio management

Abstract

The measurement and transparent reporting of key performance indicators (KPIs) are extremely beneficial for portfolio managers in making informed and improved decisions regarding resource allocation and risk management. By tracking specific metrics, portfolio managers can determine which programs and projects are delivering on time and which are underperforming. The metrics required by portfolio managers vary depending on the industry in which they operate. In this article, the focus will be on appropriate primary and secondary KPIs for managing a portfolio in the consultancy industry. In this industry, time is the commodity sold, with the product being derived from the knowledge, expertise, and advice provided to the client.

The main aim of this article is to focus on KPIs used in portfolio management. The primary KPIs that will be discussed are Turnover, EBIT margin, Accounts Receivable, and Backlog, while the secondary KPIs discussed are Work-in-Progress (WIP), Own Production (OP), and Contingency. It is often assumed that the same KPIs are used in a project, program, and portfolio management, but that is not the case. KPIs used in project management tend to focus on the operational aspects of managing a project, while portfolio management considers the strategic implications of projects and programs. Furthermore, a guideline on how to define good KPIs will be demonstrated in which the application of KPIs in engineering consultancy will be demonstrated. Portfolios, unlike programs and projects, often have longer life cycles and thus require ongoing management attention. At last, the limitations of KPIs will be discussed, specifically the accuracy of data, contextual issues, and limited information. .[1] [2]

Contents |

What is Key Performance Indicators (KPIs)?

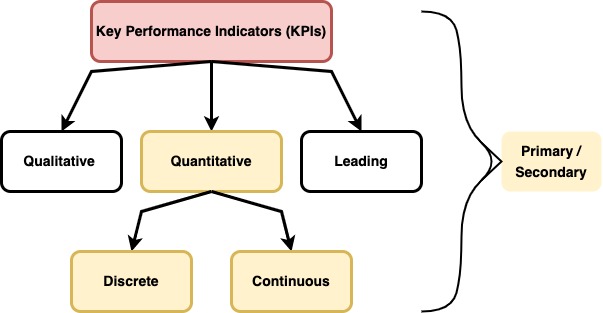

Peter Drucker, an Austrian American consultant, contributed to the philosophical and practical foundations of modern business corporations and management. He notably said, "What gets measured gets done… Even if it harms the purpose of the organization to do so." [3] [4] Measures and targets are essential management tools that help organizations, companies, and portfolio managers identify their strengths, weaknesses, and areas for improvement while also setting benchmarks with historical data. There are three overall types of Key Performance Indicators (KPIs):

- Quantitative indicators measuring a target often set based on historical data

- Qualitative indicators measuring a target that cannot be expressed by numbers

- Leading indicators that predict the outcome of a given process.

Qualitative and leading indicators KPIs are essential and should not be overlooked when managing a portfolio. However, they are not the focus of this paper. [5] Examples of such indicators include employee satisfaction for qualitative indicators and average hours worked for leading indicators. Indicators of the quantitative type can be classified as either discrete variables or continuous variables. An overview below shows the different types of KPIs and the type of variables, Figure 1. For instance, a KPI for a portfolio could be getting ten new projects in a specific month, which is classified as a discrete variable. Reaching a perfect Net Promoter Score (NPS) is a continuous variable as this value can range from -100 to 100. For context, the Net Promoter score is the gold standard in the corporate industry and especially in Consultancy which measures customer loyalty and satisfaction. Note: NPS is a customer-centric KPI and is used to indicate the level of how a business is perceived by their customer. High NPS scores indicate highly satisfied customers who are more likely to come back and do business again. [6]

Primary Vs. Secondary KPIs in portfolio management

In addition to the three types of KPIs and the types of variables that exist within each category, Key Performance Indicators can also be categorized as primary and secondary KPIs. A primary KPI is a direct quantifiable measure of a process, while a secondary metric provides added information that aids in understanding the target of a portfolio, since it is not tied to the actual result. Categorization of KPIs is not only used in monthly or weekly reporting of organizational performance but is also done on a portfolio management level. This enables portfolio managers to understand the performance and health of their specific portfolio, giving them governance over it.

Depending on the size, type of portfolio, and industry, some KPIs might be more useful than others to provide a more holistic overview. As previously mentioned in the introduction, the industry being discussed is the consultancy, specifically the type of consultancy where time is the commodity sold. Some primary KPIs that are used to measure such a portfolio in the consultancy industry are: (Peterson Drake & Fabozzi, 2010, Chapter 4). [7]

- Turnover: The measure of revenue generated by projects or programs in a portfolio within a specific period, including taxes. The following metric provides valuable insights into the financial performance and can help gauge its growth trajectory. [8]

- EBIT Margin: Measuring the overall portfolio performance and portfolio’s operating profitability. This KPI is calculated in simple terms by dividing the EBIT by turnover and provides a measure of the portfolio’s ability to generate profits from its operations. The EBIT margin may vary from the industry due to the competitive environment, the cost structure of the firm, and market demand. For instance, airlines and manufacturing industries tend to have a lower EBIT margin while consulting and software have much higher margins. Part of the reason is due to their highly skilled and specialized workforce and expertise that comes at a high-cost price; thus consultancy is considered a high-value service [9]. his was especially evident during COVID, of which major tech firms presented strong financial results [10].

- Accounts receivable (AR): AR refers to the amount of money owed to the portfolio for the work done on a project/program that has been delivered but not yet paid. A high AR can be an indication of potential cash flow issues, and managing it effectively is essential for the financial health of a consultancy. Specifically, in consultancy (and depending on the payment structure), portfolios with high AR tend to have projects that are still active, since projects are paid off after project handover.

- Backlog: The amount of work contracted (Won and signed), but either not started or not completed. This KPI provides insights into the demand for a consultancy's services and can help them plan their resources and capacity more effectively. By tracking backlog, a consultancy can ensure that it has a healthy pipeline of work and can manage its resources more efficiently [11].

The above-mentioned KPIs are excellent for tracking a portfolio as they provide great governance over the health and progress of the portfolio. For instance, accounts receivable (AR) provides information on the balance of money due For instance, a firm that have delivered a service but not yet been paid by the customer [12]. Meanwhile, backlog provides the portfolio manager with knowledge of the number of projects/ programs won, but not yet started. This is extremely important as it provides insight to the portfolio manager on how much-expected revenue is yet to be realized. This information is also greatly beneficial to the portfolio manager as they can prioritize projects and schedule them in a manner that doesn’t overload their employees with stress or work overload. Furthermore, secondary KPIs used to track progress and health of a portfolio in the consultancy industry could be as follows:

- Work-in-Progress (WIP): The measure of partially completed work on projects/ programs. The following secondary KPI provides insight into the progress of the work and how much is yet to be completed. Tracking Work-in-progress ensures the status of the work and thus the Portfolio manager can identify potential delays or issues that may impact the timeline or the budget.[13]

- Own Production (OP): This KPI measures the work done on projects or programs by a company using its resources. It is calculated by multiplying the hours spent by the base rate of each employee on the project. This KPI helps to measure the effectiveness of a portfolio's resource allocation and utilization of its internal operations. PMs monitor this specific KPI to identify the area of improvement and reduce cost.

- Contingency: The measure of the provision set aside to cover unforeseen risks that may impact a project's timeline, scope, or in the worst case the budget. Contingency serves as a safety net as it helps the PM to manage the risk and uncertainty associated with the portfolio. By having a contingency plan in place, a PM can better manage unexpected events, and reduce the impact on the overall budget of the portfolio [14].

These secondary KPIs provide an indirect overview of the portfolio as they are not directly tied to primary KPIs such as turnover or EBIT. Work-in-Progress (WIP) provides portfolio managers with great insight into ongoing projects and helps manage the work done. This KPI is often used in parallel with Backlog to gain a holistic understanding of the production process and the demand for the portfolio. This information is used by the portfolio manager to forecast future revenue and cash flow while also identifying potential bottlenecks or capacity constraints, which can then be used to make informed decisions about resource allocation and planning. For example, if the portfolio manager notices that the backlog is low and the WIP is high, then a portfolio is running efficiently and there is an excess capacity of employees that could be reallocated to other ongoing projects in the portfolio. (Peterson Drake & Fabozzi, 2010, Chapter 13). [15]

Application

Guideline on how to define good KPIs [16] [17] [18]

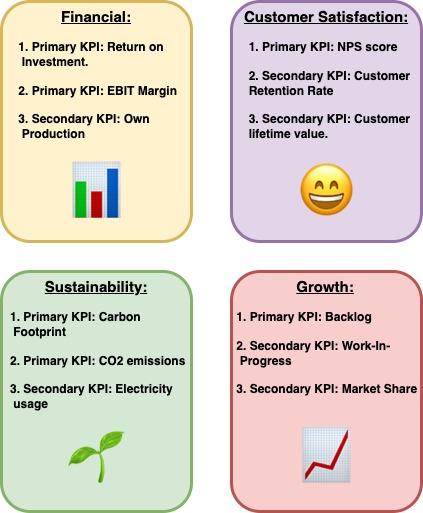

After establishing the definition of KPIs in general and specifically in portfolio management, the next step is to define KPIs. But how can this be done effectively? Defining good KPIs is critical to ensure that the portfolio is measuring the right metrics and progress is made towards the set targets. The four buckets of KPIs that must be evaluated are the following: Financial Performance, Customer Satisfaction, Sustainability, and Growth. By following this guideline: clear KPIs can be set and tracked, portfolio managers and others in the hierarchy can be held accountable, and finally data-driven decisions can be made.

- Define Portfolio Objectives: The selected KPIs must align with the overall business objectives. Thus, it is important to stay within the mission of the organization. Identify what needs to be achieved in terms of financial performance, customer satisfaction, sustainability, and growth.

- Pick Out Key Metrics: Which KPIs will help measure the progress towards the set objectives? Start by identifying KPIs. These KPIs could be a combination of primary and secondary KPIs, as well as discrete or continuous measures. In the figure 2 on the right, a few KPIs from each theme can be identified and selected as an example.

- Set Realistic Targets: By selecting specific and measurable KPIs, the progress of the portfolio can be measured and areas for improvement can be identified. Historical data and industry benchmarks can be used to set realistic targets.

- Assign Responsibilities: By assigning responsibilities for each KPI to a project manager or intermediate manager below the Portfolio manager, the specific individual is held accountable to meet the targets set in step 3. This will drive results and set accountability as a top priority.

- Regulate and Monitor: KPIs are not a set-and-leave thing. They must be continuously monitored and adjusted as needed, both internally within the organization and externally. Review progress towards the objectives to meet the strategy set by the organization.

The guideline above serves as a step-by-step guide on how to define KPIs for a portfolio. Following this guideline ensures that KPIs are selected and evaluated based on the four major themes: Financial Performance, Customer Satisfaction, Sustainability, and Growth.

Application of KPIs in Engineering Consultancy

Many challenges can be identified when it comes to portfolio management in engineering consultancy. Firms take on multiple projects across departments that specialize in different subjects. Some of these projects start next year and some are tender projects that are of high priority. A tender is defined as the invitation from a stakeholder to carry out and solve a problem for a project. It’s important to mention that tender projects are not projects won, but in the phase of bidding. Portfolio managers, evaluate and manage the performance of many departments (programs) and their projects as a whole [19] [20]. Thus, it becomes important to track the progress of each department and see if more resource allocation is needed. Within engineering consultancy and consultancy in general, projects vary in size but also in priority. The field is a fast-paced environment and many initiatives come and go. Therefore, it is important to balance the distribution of resources on ongoing projects but also within resources and FTEs (Full-time employees) available for mega projects. This is where KPIs come in. Primary KPIs are used to track the overall performance of the portfolio, whereas secondary KPIs are used to track individual project performance. Primary KPIs may include revenue, profit, and deviation between target and budget for each department, while secondary KPIs may include a measure of project completion time, resource utilization, and project cost.

The benefit of using primary and secondary KPIs in engineering consultancy for portfolio management is the ability to track progress. The measure of KPIs at a regular frequency is crucial in ensuring everything runs smoothly and according to the time-plan. By measuring the right KPIs at regular intervals, portfolio managers can identify trends and make strategic decisions to improve overall performance [21]. Through regular meetings with financial controllers and project managers, KPIs can be used to identify potential risks but also opportunities allowing firms to address the issues and capitalize on the strengths. Another important aspect of using KPIs in engineering consultancy is the ability to communicate progress and success to key stakeholders in the organization. Higher officials in the organization are often interested in measurable results and KPIs provide exactly a clear but also an objective way of demonstrating the value of the firm’s services. A balanced set of primary and secondary KPIs must cover financial, customer satisfaction, sustainability, and growth KPIs [21] [22]. An example of primary KPIs is Turnover, EBIT margin, Accounts receivable (AR), Backlog, and EBIT. For secondary KPIs that could be WIP, Own production (OP), Project cost, contingency, and CO2 emissions.

It's crucial to remember that KPIs should be carefully chosen and customized to the unique requirements of the company and its initiatives. Not all KPIs will be applicable or meaningful in every circumstance, and utilizing the incorrect KPIs may have unfavorable effects. KPIs should also be routinely checked to make sure they are still offering insightful data and are in line with the aims and objectives of the company [21] [23]. While there is no one-size-fits-all approach to selecting KPIs for portfolio management, similarly there isn't a standardized way of reporting and ensuring consistency within the organization. As a result, the use of KPIs may evolve over time, and different KPIs may be explored. The status quo on KPIs, they are an essential tool for measuring and tracking portfolio performance [23] [19].

Limitations and conclusion

The measure of KPIs in portfolio management depends on many factors and one cannot disregard the financial and business part of this. The KPIs selected may include primary financial and secondary KPIs, as well as non-financial KPIs that focus more on customer satisfaction, such as NPS or sustainability metrics like CO2 emissions. It is not a surprise that the metrics discussed in this article are also used in finance and not only in portfolio management, yet it goes to show how essential finance is to portfolio management. Often in large consultancy organizations, finance, and business doesn’t go together, as organizational policies and laws must be obeyed by finance. Thus, transparency and openness in financial reporting are key to achieving accuracy and quality in data [19]. For effective drive and measure of KPIs, it is crucial to have a proper data structure in place and ensure good validation of data. Portfolio management heavily relies on real-time data that must be assessed promptly to avoid negative impacts on the portfolio's overall performance. This is where the portfolio manager plays a central role, as they have a holistic overview of the portfolio, including information on delays, trends, and sensitive financial data [19]."

Although structural reporting, controlling, and transparency of data to drive good portfolio management is essential, it must not be all about numbers and data. Contextual issues about the data can lead to conflicts or unnecessary waste of time. In the example of the Work-in-progress (WIP) being too high on a specific project, the PM may see this and react, without any additional context of what has caused this or what impact this may have on the portfolio [23]. The issues of accuracy of data and contextual issues all boil down to limited information on the portfolio. KPIs might not give the whole picture of what is really going on in the portfolio. For example, a portfolio manager may see that a project is on budget, but without additional information, it may not be clear whether the project is progressing according to plan or if other aspects of the project are causing problems. The selection and implementation of KPIs may be a challenge to an organization as they must be aligned with organizational objectives and that they must provide meaningful information [21]. Primary and secondary KPIs must be specific and clearly defined to contribute to the overall goal and evaluating them is often also best practice. It’s important to highlight that a set of primary and secondary KPIs for an organization or portfolio cannot be copied to another portfolio. The use of the KPIs must be done in a sensible manner and must reflect the organizational strategies, goals, and objectives.

Annotated bibliography

[6].

Fisher, N. I., & Kordupleski, R. E. (2018). “Good and bad market research: A critical review of Net Promoter Score” [6]

Fisher and Kordupleski (2018) reviews the commonly used customer centric KPI, the net promoter score (NPS, and how it is used to measure customer satisfaction and loyalty. The authors discus the limitations of this specific KPI and concludes that it cannot be used as the sole measure of customer satisfaction. Furthermore, highlights that it should rather be supplemented with other KPIs to provide a complete picture of customer feedback.

Toor, S.-u.-R., & Ogunlana, S. O. (2009). “Beyond the 'iron triangle': Stakeholder perception of key performance indicators (KPIs) for large-scale public sector development projects” [22]

This article examines different stakeholder perceptions of KPIs for many large-scale public sector development projects. The focus is specifically on “Iron triangle” of cost, time, and quality. Although the authors suggest the Iron triangle approach and argue that typical KPIs are insufficient for measuring success of complex development projects, they suggest that the focus should be on a broader set of KPIs. Specifically, KPIs that include stakeholder satisfaction, customer satisfaction and sustainability.

Eik-Andresen, P., Johansen, A., Landmark, A. D., & Sørensen, A. Ø. (2016). “Controlling a multibillion project portfolio - Milestones as key performance indicator for project portfolio management” [19]

The following research article proposed using milestones as a primary KPI for project portfolio management. Project portfolio management and portfolio management is very similar, yet different. Portfolio management manages the holistic overview and performance of the portfolio. Project portfolio management covers a group of projects, to achieve strategic business objectives. This wiki-article covers project portfolio management. The many authors of the research article take a case study of a Norwegian defense organization and examines how the successful implementation of milestones as a KPI was done and the results it had achieved.

Bhatti, M. I., Awan, H. M., & Razaq, Z. (2014). “The key performance indicators (KPIs) and their impact on overall organizational performance” [21]

The last research article examines the overall relationship between KPIs and organizational performance. This article in particular focuses on financial and non-financial KPIs. It covers the importance for managing and improving organizational performance using both financial and non-financial KPIs and concludes that a scorecard approach including both financial and non-financial KPIs is the most effective method in pushing organizational performance.

Referenfes

- ↑ [1.1 Purpose of the standard for Portfolio Management] https://content.knovel.com/content/pdf/13786/51975_01.pdf?ekey=f2AgMtPziM6rvTNh5JfrbVinHPOx3NMTm4v3_d5aDHGzHAowSUCkBwnfmZAGnYSOWa

- ↑ [KPIs for effective portfolio management] https://thinkingportfolio.com/en/7-key-kpis-for-effective-project-portfolio-management/

- ↑ [Peter Drucker management theory] https://www.businessnewsdaily.com/10634-peter-drucker-management-theory.html

- ↑ [Peter Drucker famous quote. From Corporate finance review ] https://static.store.tax.thomsonreuters.com/static/relatedresource/CMJ--15-01%20sample-article.pdf

- ↑ [Guide to types of KPIs] https://www.brightgauge.com/blog/quick-guide-to-11-types-of-kpis

- ↑ 6.0 6.1 6.2 [Good and bad market research: A critical review of Net Promoter Score] https://onlinelibrary.wiley.com/doi/full/10.1002/asmb.2417?casa_token=KnYnaDzXVP4AAAAA%3AfDrktMvhgLlfHuNWARfVJ9sh_R9V3gUrfWje590vrk5ri5S0UH4gUGtP4BLmVlX4zCRRFu51_Wv7OSO1

- ↑ [The basics of finance: An introduction to financial markets, business finance and portfolio management] http://dspace.vnbrims.org:13000/jspui/bitstream/123456789/4796/1/The%20Basics%20of%20Finance%20An%20Introduction%20to%20Financial%20Markets%2C%20Business%20Finance%2C%20and%20Portfolio%20Management.pdf

- ↑ [Corporate growth of engineering consulting firms: a European review] https://www.tandfonline.com/doi/epdf/10.1080/01446190210139487?needAccess=true

- ↑ [Industries and EBITDA] https://www.investopedia.com/ask/answers/052015/which-industries-tend-have-greatest-ebitda-margins.asp

- ↑ [Prospering in the pandemic: Winners and losers of the COVID era] https://www.ft.com/content/8075a9c5-3c43-48a5-b507-5b8f5904f443

- ↑ [Backlog] https://www.investopedia.com/terms/b/backlog.asp

- ↑ [Accounts recivable information ] https://www.investopedia.com/terms/a/accountsreceivable.asp

- ↑ [Managing work-in-progress (WIP) by Focusing on finishing] https://www.pmi.org/disciplined-agile/da-value-stream-consultant-resources/manage-work-in-process-wip

- ↑ [Contingency-based approach to firm performance in construction] https://ascelibrary.org/doi/abs/10.1061/(ASCE)CO.1943-7862.0000738

- ↑ [The basics of finance: An introduction to financial markets, business finance and portfolio management] http://dspace.vnbrims.org:13000/jspui/bitstream/123456789/4796/1/The%20Basics%20of%20Finance%20An%20Introduction%20to%20Financial%20Markets%2C%20Business%20Finance%2C%20and%20Portfolio%20Management.pdf

- ↑ [Sustainable KPIs ] https://www.compareyourfootprint.com/measuring-key-kpis-sustainability-business/

- ↑ [Customer centric KPIs ] https://blog.hubspot.com/service/customer-service-kpi

- ↑ [Financial and growth KPIs ] https://www.netsuite.com/portal/resource/articles/accounting/financial-kpis-metrics.shtml

- ↑ 19.0 19.1 19.2 19.3 19.4 [Controlling a Multibillion Project Portfolio - Milestones as Key Performance Indicator for Project Portfolio Management] https://www.sciencedirect.com/science/article/pii/S1877042816308771

- ↑ [Tender in Finance] https://www.investopedia.com/terms/t/tender.asp

- ↑ 21.0 21.1 21.2 21.3 21.4 [The key performance indicators (KPIs) and their impact on overall organizational performance] https://link.springer.com/article/10.1007/s11135-013-9945-y

- ↑ 22.0 22.1 [Beyond the 'iron triangle': Stakeholder perception of key performance indicators (KPIs) for large-scale public sector development projects] https://www.sciencedirect.com/science/article/pii/S0263786309000623

- ↑ 23.0 23.1 23.2 [Important KPIs and Metrics for Portfolio management] https://projectric.com/blog/kpis-and-metrics-for-project-portfolio-management-ppm/