Performance-based contracting

Abstract

In this article a review of performance-based contracting, as utilized in project, program or portfolio management, will be presented. Performance-based contracting (PBC) is one of seven fundamental business models known as The Seven Sourcing Business Models. The general concept of Sourcing Business Models as well as The Seven Sourcing Business Models will be explained in this article and it will be elaborated how PBC fits into this theory. Performance-based contracting is a product support strategy in which the procurement model is based on clearly defined objectives and key performance indicators (KPIs) [1]. The objectives and Key Performance Indicators are the driving forces to encourage behaviours from the supplier that will ultimately achieve the required project objectives and procurement. Specific KPIs such as cost, quality and completion are the basis of project consequences, in the form of risk and reward, for the involved contract participants. The concept of KPIs will also be studied in this article along with a brief description of what a contract is in general. In performance-based contracting the incentivized performance measures serve the purpose of motivating the supplier to improve performance and cost effectiveness through enhanced internal practices. This is different than the more traditionally used transaction-based contracting, also known as waterfall approach, in which payments are made based on completion of agreed milestones and project deliverables. Roughly speaking the key difference between the two methods lies in the fact that performance-based contracting describes the work in terms of the required results rather than "how" the work should be accomplished [2]. The advantage of using this business model is therefore that it leaves the contractor with more room for innovation and creative solutions that actually have the purpose of solving a problem in the best way possible rather than strictly carrying out a piece of work merely because a contract says so. This results in a win-win situation for both partners in the partnership as both parties have interest in achieving the best possible solution. Finally the limitations of the Performance-based contracting will be reviewed. Such limitations may for instance come from the argument that KPIs are not well suited for all businesses as they may lead to internal conflicts and unhealthy work environments among employees.[3] Another limitation to PBC may be that the contracts tend to be more complex which can lead to unnecessary conflicts between the parties due to misunderstandings.[4]

Contents |

Contract

In order to provide some background to the idea of performance-based contracting it can be useful to first get a sense of what a contract is when broken down on a basic level. A contract can be described as a promise made between two or more persons or organisations in which each participating party agrees to do certain things.[5] The contract is a written list which describes the agreed upon items and it is therefore useful because it can be used to:

- State what is expected of the agreeing persons or organisations

- Protect the needs and rights of the agreeing parties

- Ensure accountability of the promises made by the agreeing parties

- State the consequences if the promises made are not fulfilled

Sourcing Business Models

Next it would be useful to have a brief description of what a Sourcing Business Model is. Sourcing Business Models are used for procurement management for achieving the best fit between suppliers and buyers. In portfolio management supply and demand management is of great importance and it is crucial to be able to balance supply against the portfolio demands.[6] In the following the focus will be on the supply side and on which Sourcing Business Model a company should select based on the situation it is in.

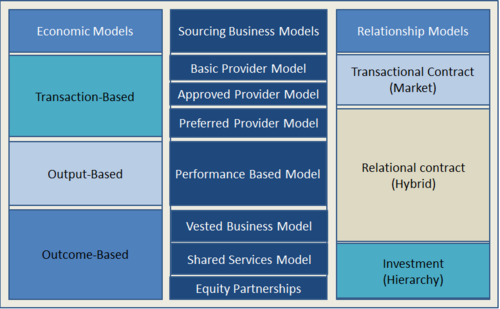

A Sourcing Business Model is based on the company's Relationship Model and it's Economic Model. The Relationship Model describes how the company wishes to influence or formally control the supply source. As seen in Figure 1 the Relationship Model can be described as being either transactional, relational or investment.[7]

The Economic Model describes how the economics of the relationship should be managed. As seen from Figure 1 the Economic Models can either be:

- Transaction-based

- Activities are basis of payment(payment per hour, unit, activity)

- Output-based

- Payment is made for supplier output

- Outcome-based

- Business outcomes in which the reward (and risk) is shared

A business should ask itself what would be the right Relationship Model for them as well as what the right Economic Model would be. Based on these decisions this should result in the optimal choice of Sourcing Business Model as seen in Figure 1.

With an understanding of what a Sourcing Business Model is, it is now possible to study seven fundamental business models known as The Seven Sourcing Business Models.

The Seven Sourcing Business Models

Performance-based contracting is a part of the so-called Seven Sourcing Business Models which are fundamental supply business models that are established with the supplier to support the purchase requirements. The models are useful within procurement management and can be used to create value and manage risk in various different ways.[7]

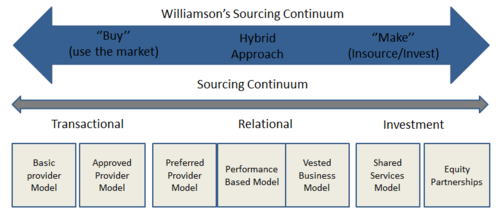

A fundamental question a company or organisation needs to ask itself is how to obtain the goods and services required to run the business. On the one hand they can be "bought" on the marked externally or on the other hand they can be "made" via insourcing internally in the company. A hybrid approach also exists in between the two extremes. This is illustrated in Figure 2.

Depending on the sourcing situation a given organisation or company is in, the most appropriate Sourcing Business Model should be chosen in order to optimize for the business environment the organisation or company navigates.

As seen in Figure 2 the Sourcing Business Models include:[7]

- Basic Transaction Provider

- Approved Provider

- Preferred Provider

- Performance-Based Agreement

- Vested Business Model

- Shared Services

- Equity Partnerships

These models fall within the so-called sourcing continuum which can be described as being either transactional, relational or investment.

A more detailed description of each model is provided in the following sections:

- Basic Transaction Provider

The primary purpose of this model is to acquire goods or services at the lowest cost posible. The supplier provides a basic transaction and thus operates under a simple buy-sell arrangement. The buyer pays a fixed transaction price for the goods or services provided. The Economic model is transaction-based while the Relationship model is transactional.[7]

- Approved Provider

This model assumes using few proven suppliers. The proven suppliers live up to predefined qualification characteristics or other criteria or have previously performed well. Trusting few suppliers means that larger volumes of goods or services can be used as leverage to gain pricing discounts or reduction of other expences such as administrative costs.[7]

- Preferred Provider

The suppliers are here chosen specifically and exclusive arrangements may exist allowing for more streamlined purchasing processes and easily repeatable business. The main purpose with this model is to achieve best value or volume discounts via longer-term contracts. The Economic Model is transaction-based and the Relationship-model is relational.[7]

- Performance-Based Agreement/Contracting

The primary purpose of the Performance-Based Agreement is to ensure high efficiency and service levels by utilizing expert providers as suppliers. It is intended to achieve these service levels by use of longer-term contracts to make sure that the supplier invests in product improvements and cost savings. The aim is to buy performance rather than transactional goods or services. The method is also known as "painshare/gainshare", "pay for performance" or "managed service agreement with fixed fee" and it essentially shifts the risk to the supplier. The Economic model is transaction-based with output performance incentives and penalties. The implementation of the Performance-Based Contracting is typically carried out in eight steps:[8]

1) Business Case: A business case which assesses the benefits, risks and other impacts of the contract is presented to senior staff as input for decision making.

2) Outcomes: The desired deliverable or result of the contract in presented.

3) Measures: A set of performance measures is defined in order to measure the performance compared to the defined outcomes. The performance measures could be in the form of Key Performance Indicators (KPIs). The measurable performance standards should be chosen such that they are not a too large burden but at the same time not so low that they disincentivise good performance. Too high performance standards also have the disadvantage that they drive up cost.

4) Levels: Performance levels are used to determine how well the contractor needs to perform in terms of the defined performance measures.

5) Payment: It is defined how much the contractor should be paid for a given performance level.

6) Incentives: A group of incentives is defined in order to encourage positive behaviour and punish negative behaviour.

7) Contract: A contract which covers all aspects of the performance, terms and conditions and payment of the relationship is drafted, reviewed and finalised.

8) Review: With the differing definitions of succes in mind of the groups involved with the contract, an analysis of the outcomes of the PBC is carried out.

An example of the difference between the traditional input-based contracts and performance-based contracts could that of a water utility.[4] A water utility will traditionally contract out works to a contracter paying a fixed fee for specific deliverables. In this case the focus is mainly on the inputs such as replacing pipes, delivering a study or building a wastewater plant without consideration of the direct impact of the contract. The impact would here be the output for the utility such as improved operational performance, reduction of leakages or the amount of wastewater treated. The contracter would here be paid based on the finished deliverables regardless of how well the provided service solves the problem such as whether the number of leaks in a pipe has gone down.

With a performance-based contract however completion of the work would also be paid at a fixed price but additional bonusses may be rewarded based on the outcome of the service such as how well the leakages in the pipe has been reduced. The combination of fixed payments and variable payments make most PBCs hybrid schemes and the real difference between traditional contracts and PBCs lies in the percentage of the payments made through variable payments. In order to be considered a "real" PBC a contract should contain 20-30 % of the payments in the form of variable fees.[4]

- Vested Business Model

This model aims to generate and optimize value through a co-managed and co-developed collaboration with an external expert. This developed value would not otherwise have been achieved through individual work. The idea is to create a win-win collaboration where the buyer and supplier are equally committed to ensure succes for each other. Longer-term relationships between 5 to 15 years are typically created and often lead to solutions that expand the boundaries of businesses. The model is good for risk managing and the Economic model is outcome-based while the Relationship model is relational.[7]

- Shared Services

A Shared Services model is an investment-based model which aims to setup an internal functional business unit which is able to provide goods or services to the rest of the broader organization. It is essentially an organisation which outsources to its own internal supplier while other business units and users in the organisation are charged for the services the "outsourced" units provide.[7]

- Equity Partnerships

Potential business partners here bind legally through more formal structures in order to more effectively meet business goals. The Equity Partnerships model is another investment-based model and since formal and comprehensive governance framework are typically needed, setting up an Equity Partnership can be a costly and complicated affair. Equity Partnerships can take various different legal forms such as acquisitions, joint ventures, subsidiaries and purchasing cooperatives.[7]

Key Performance Indicators

KPIs are, as the name indicates, values that can be used to measure and monitor effectiveness. They are often used by managers to assess whether a project is on the right path working towards a strategic goal. In reality there are thousands of KPIs but in order for a KPI to be effective it can be said that it should:[7]

- Be quantifiable and well-defined

- Be known to the whole organization

- Be of great importance to achieving the goal

- Be applicable to the given line of business

Key Performance Indicators can be divided up into several different metrics under which some noteworthy KPIs can be categorized. Some examples include:

- Financial metrics[7]

1) Profit: One of the more straightforward KPIs which may include both gross and net profit margin.

2) Cost: The cost of running the organization is a good measure for managing and reducing expenses.

3) Revenue vs target: It can be useful to compare the actual revenue the organization makes against the projected revenue.

- Customer metrics[7]

1) Number of customers: Another straightforward performance indicator is the number of customers the company has gained or lost. This indicator can be used to get an understanding of whether or not the company meets the customers needs.

2) Customer satisfaction and retention: Measuring how happy the customers have been with the service the company has provided can be a useful KPI which in turn can be used to figure out how to retain customers as well as how to attract new customers. Multiple indicators can be used such as customer satisfaction scores and measuring percentage of customers repeating purchases.

3) Customer lifetime value: This KPI can be used to look at the value the company gets from a long-term customer relationship. Having this knowledge can help pinpoint the channel that secures the best customers for the best price.

- Process metrics[7]

1)Line-of-business (LOB) efficiency measure: This is an efficiency measure which may be different in various different industries. One example could be how many units a factory can produce of a given product per hour held up against how long the factory runs per day. This provides the opportunity to set up goals to improve production efficiency.

2) Percentage of product defects: The number of defect units produced per time unit divided by the total number of units produced gives the percentage of product defects. Efficiency can be improved be aiming to lower this number.

- People metrics[7]

1) Employee satisfaction: Having happy employees is a good way to improve efficiency within the organization since happy workers are more effective. The employee satisfaction can be measured through surveys and questionaires.

2) Employee turnover rate: This is a measure of the number of people who have departed the organization divided by the average number of employees. Having a high employee turnover rate means that a lot of people leave the company and if that is the case it may be a symptom of workplace culture or environment problems.

Limitations

The performance-based contracting modelling seen as one of the Seven Sourcing Business Models is as explained, largely based on rewarding positive behaviour and punishing negative behaviour. The measure to determine whether a behaviour has been positive or negative can be the KPIs. The attitude towards these KPIs among employees and managers can however often be one of disgust and some are even arguing that KPIs can be counter productive and cause unhealthy internal competition where each employee works only with it's own interests in mind rather than those of the team or company as a whole.[3]

Another limitation of performance-based contracting stems from the fact that it is in fact more flexible. This inherently has the risk that such contracts tend to be more complex than traditional input-based service based contracts which may lead to contract unclarity. If the contract is not clearly understood by both parties conflicts may arrise which may be very counterproductive.[4]

Annotated Bibliography

Seven Sourcing Business Models to Create Value and Manage Risk: This teaching material from The Forefront Group provides an in-depth description of what a sourcing business model is as well as a concise overview of the Seven Sourcing Business Models explaining their usefulness and details about each of the seven fundamental models. It also provides hands-on guidance of how to use the model for a given organization type.

Performance-based contracting for services: A new mechanism for increasing water utility efficiency: This article discusses the concept of makes a performance-based contracts and how they are relevant to the water industry. It provides some good examples of how performance-based contracts are different than traditional input-based contracts as illustrated from a utility company perspective. It praises the idea of performance-based contracts while also providing a critical look at the types of contracts which may not suit all organizations and industries.

Performance-based contracts: KPIs that drive performance and strategic outcomes: This article introduces how Key Perfomance Indicators are the measures used to insentivise and have concrete goals to achieve the desired performance and output of a given project. It gets into how KPIs should be used in a sensible and relevant way as well as how they should be clearly defined in order to work towards a well defined goal.

References

- ↑ Performance-based contracts: KPIs that drive performance and strategic outcomes

- ↑ Public Procurement Practice PERFORMANCE BASED CONTRACTING.

- ↑ 3.0 3.1 At leve i et KPI helvede

- ↑ 4.0 4.1 4.2 4.3 Performance-based contracting for services: A new mechanism for increasing water utility efficiency

- ↑ https://www.artslaw.com.au/legal/raw-law/what-is-a-contract

- ↑ Project Management: A guide to the Project Management Body of Knowledge (PMBOK guide)6th Edition (2017), section 5.5.2 page 55

- ↑ 7.00 7.01 7.02 7.03 7.04 7.05 7.06 7.07 7.08 7.09 7.10 7.11 7.12 7.13 7.14 7.15 Seven Sourcing Business Models to Create Value and Manage Risk

- ↑ https://en.wikipedia.org/wiki/Performance-based_contracting#cite_note-7