Risk Management in Renewable Energy Projects

Developed by David Moya Perrino

The needed of introduce renewable energy in the grid system is a clear reality. Traditional energy sources like fossil fuels or nuclear energy carry complex risks which has been evaluated and optimized in the last decades. Meanwhile, renewable energy project outlines new risks that have to be taken into consideration. Some of these problems are not well address yet, increasing the uncertainty in some of these technologies. Wind energy is not total stable, for the discontinuity of the wind; solar energy policies are not clear in many countries, changing continuously depending of the government or biomass energy, which discuss shortage and supply chain problem. Risk is a key part of all these technologies and how to manage it is a challenge which is going to be faced for the global society in the following years. Energy Project Managers has the responsibility of this changes in order to reach success and transform both the energy sector and the society [1] [2].

Contents |

Introduction

Energy sector is known for being complex and uncertain [3]. Energy market is changing continuously, appearing new products, tools, processes and policies [4]. Because of this, the risk is inherent and companies must take into consideration many factors and variables to decide which projects they are going to invest. Specially important is risk management in renewable energy projects where the horizon is larger and the amortization of the projects is a key factor [4]. In this article is discussed different attributes which have in common energetic technologies and their specific characteristics in risk management.

Traditionally, fuel and nuclear industry has been the areas with higher risk. Fuel industry outline the exploration problem. Oil wells are not exactly localized and thousands of miles of dollars are spending every year to find new wells. The prospecting stages included desk-top studies, geological mapping, geochemical surveys, geophysical surveys and multi-client seismic surveys [5]; all of them without knowing if it will be found any well at the end. Financial risk is high, being the main reason why oil companies agree ventures to share both risk and benefits. According to Deloitte [6], about a third of global oil and gas companies are at risk of insolvency. Bad decisions about how manage these risks has been fatal for companies like Canadian-listed Pacific Exploration & Production with $5.3 billion of debt in 2016 [7]. Environmental problem is other risk related to this resource, for example, the great disaster happened in Spain in 2002 with Prestige sinking, spilling over 11,000 tonnes of toxic fuel oil [8].

Nuclear technology has also numerous risk factors. Risk management in nuclear energy is different than risk management in fuel energy; in this case it is more important prevent from any fail than budget due to the catastrophic consequences of an accident [9]. The two main risks are human health and policies. Nuclear energy is potentially dangerous, an accident could cause human loses, environmental catastrophes, inter alia. To avoid this, power stations have strong security systems which lot of redundancy systems and specific software packages that optimize the probability of accident. A nuclear accident is almost impossible that happen but the consequences would be terrible if it is not mitigated fast enough. Political risk is linked directly with the previous one. Because of its potential effects, public opinion does not feel comfortable with this type of power stations, tending to make a social amplification of the risk [10] [9]. As result, some governments have decided to close them; an example is Spanish nuclear park, which is being closed after strong public opinion opposition [11].

Although non-renewable energy sources are an inherent risk source and should be managed carefully, this article is going to be focus on the renewable energy projects. Firstly, main considerations are addressed and risk analysis is presented. After that, different type of risks and risk sources are explained, stressing their evaluation. In the following sections this article proposes a risk evaluation of a specific case. Finally, how all these risks are going to affect renewable energy industry in the next years is discussed.

Risk Management: Main considerations

“Project risk is an uncertain event or condition that, if it occurs, has a positive or negative effect on the project objective”. To reach mitigation of the risks, some stages are outlined [12]:

- Planning: in this first stage the activities of the project are decided by the Project Manager.

- Identification: risk that could affect the project are addressed. It is important consider them all because if they are not considered, it will not be further analysis of them.

- Qualitative Analysis: analysing the different risk to prioritize them depending on their effects in the project.

- Quantitative Analysis: analysing the consequences vs the probabilities. This point is further explained in evaluation of the risk.

- Response Planning: manuals, procedures and techniques are set up to reduce possible threats over project´s goals.

- Monitoring and Control: finally, everything should be monitoring; impacts, consequences, mitigations, procedures and so on. This activity let the Project Manager take actions in the project risk, reducing impacts and consequences and improving mitigation actions.

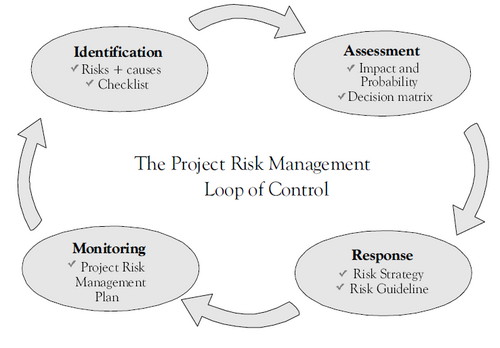

There is not a standardize procedure. Authors agree about main points but they used different structures given divergent importance to each point. In the next figure it is presented an example; “loop of control”, proposed by International Project Management Journal in 1999 [13]:

Risk Management in Renewable Energy Projects

Energy sector is ruled for the premise: safe and sustainable production. To archive this goal renewable energy is fundamental because it reduces environmental and human risks and CO2 emissions. New renewable technologies are a true reality in some countries, that are strongly boosting for them. European Union is the area where is more developed; with counties like Denmark, that has planned a 70% of renewable market share and to be the first country with a zero CO2 emissions capital in 2025 [14]. Other regions along the world are working hard in this direction like China or South America, having huge investments in renewable energy. Risk associated to these technologies are by far lower than risk in non-renewable projects. To keep on developing a sustainable industry, countries must include them in their policies. On the other hand, does it not have to be forgotten that renewable projects have also risk and manager should know how to face it. In the next section potential risks are presented and evaluated. Some of these risks have similar mitigations process than a traditional industry, but others should be faced with other perspective and proper actions should be taken. For instance, ethical problem of growing biomass to produce energy instead of growing food for people, when there are millions of people dying of hunger along the planet.

Type of risk

In renewable energy projects several risks could be addressed. The most important are political and social, economic and environmental. Three of them are discussed in PMBOK guide, it is outlined that managers must understand conditions and trends because social-economic-environmental influences have a major effect in the project development. [12]. Each of them has a different risk level and the mitigation tools vary.

- Political and social: society opinion could be determinant to decide in which technology invest. Generally, policies are linked with social tendencies. If a project is not accepted by citizens, government could publish a law to set barrier to that technology facilitating the implementation of another. For instance, USA elections in 2016, where faced Donald Trump, supporter of oil and gas technologies faced Hillary Clinton, supporter of renewable policies; Trump´s victory has brought a reduction in renewable projects in this country and companies has gone to invest in others [15].

- Economy and market: fifty years ago, renewable energies were not viable but the technological improvements in the last decades has become them viable or potentially viable. There are still some barriers which difficulties their entrance in the energy market. Economically there are mainly two barriers; high discount rates which creates a long-time amortization, impossible to fulfil for some technologies like Compressed Air Energy Storage (CAES), in these cases the best option to support them is government incentives in the first stages [16]. In the market barrier renewable projects have to face restricted access to technology, for being not available or available at high cost due to other companies have the patents stages [16]. This is the main reason why companies and government in this sector invest huge amount of money in R&D. Finally, the control of the energy sector. Energy is a key resource and governments and companies have a strong control over the pool. The entrance of new companies with new products is a tough enterprise, being not viable investment in some technologies. An example is the wind energy, windmills started to be highly used when governments and companies start to invest, reducing the cost, creating new power stations and introducing new policies.

- Environmental: it have been to be discussed in the academic field if renewable energy is as good as used to say. Some author outline that they are completely clean because they use resources that are infinite so they will never run out of energy source; wind in wind energy or sun radiation in solar energy are some examples. On the other hand, there are author that question this statement, although there are not clear evidences of this fact [17]. In order to produce electric energy with these technologies are necessary other materials, like rare earths, which are extremely scarce. The use of these technologies could be limited not for the energy resource, as happen in non-renewable energies, but for the materials needed to produce windmills and solar panels [18] .

Evaluation of the risk

There are differences indicator to measure risk. Project Managers should evaluate them to obtain both risk impact and risk likelihood. [19]

- Safety: generally, renewable energy projects are safer than non-renewable energy projects, wind farms or solar vs nuclear or coal power stations. For this reason, safety is not considering a key aspect in the evaluation of the risk in renewable energy projects.

- Environmental impact: this point is one of the most favourable for renewable energy projects. The CO2 emissions are quite low in the production stage, which is normally the most evaluated, placing these projects as an optimal decision for the zero emission objectives of many companies. Some examples of energy firms which has included renewable energy projects as its core business are Ørsted [20]; Acciona [21] or Iberdrola S.A [22] .

- Cost: thought the years this variable has been improving in renewable energy projects. In the first stages of the technology development cost was the main reason to choose non-renewable energy project over renewable energy project. Develop, construction and financing were extremely high and these projects were only possible with governments incentives and aids. These situations have improved and it is easier finance Energy Project Management. Wind energy is an example of this improvement.

- Schedule: Management of Portfolios outline that this point is highly relevant in the Project Management tasks. Activities should be correctly planned taken into consideration all the stakeholder [1]. Renewable energy projects used to Long-term horizon, being especially sensitive for this point. A mediocre schedule could be fatal for projects like biomass or hydraulic power stations.

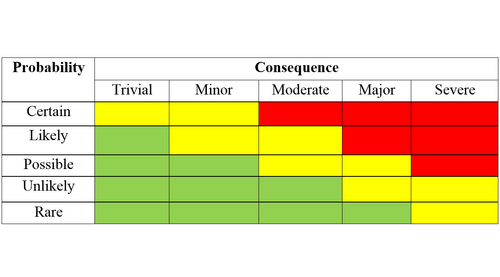

Project Manager is responsible of study these risks and reach to conclusions. After analysing all of them is should be done a Risk Matrix to evaluate which of them are the most and the less important. This matrix has two axes; risk impact risk in the x-axis and risk likelihood in the y-axis. This is the analysis of both of them:

- Risk probability: some risks are more likely to happen than others; this is reflected in the following table where likelihood are assigned to each category. A five-point scale, going from one, when incident is not planned to happen, to five, when it is known that that consequence is going to happen.

| Scale | Category | Risk definition | Likelihood (%) |

|---|---|---|---|

| 5 | Certain | Incident is going to happen | 100 |

| 4 | Likely | There are high expectances that incident will happen | 70 |

| 3 | Possible | Incident could happen, but it is not highly likely | 15 |

| 2 | Unlikely | Incident could happen, but it is highly unlikely | 5 |

| 1 | Rare | Incident is not planned | 1 |

- Risk Impact: the consequences of the risks vary. Some of them could be extremely harmful and others could be do not be important. In the following table is proposed a five-point scale, typically used in these types of projects. The scales go from one, which represent a trivial risk that is almost not harmful, to five, which represent a severe risk that is extremely dangerous.

| Consequence | Scale |

|---|---|

| Severe | 5 |

| Major | 4 |

| Moderate | 3 |

| Minor | 2 |

| Trivial | 1 |

Finally, both risk impact and risk probability should be combined into the Risk Matrix [12]. In this case it is a standard 5x5 matrix, but other types too, for example, a 3x3 matrix with external vs immediate project risks. [23]. A proper evaluation is important to get a good risk matrix, in order to develop a proper Portfolio Risk Response which addressed the risks by priority and incorporates the corresponding resources and activities in the budget, schedule and portfolio management plan. [24]

Case Analysis: Wind Energy

Wind Energy is the most used renewable energy in the world. Some countries like Denmark, 42.5% of electricity generation on 2016 [25], or Spain 19.1% of total electricity generation in 2014 are leaders of the sector [26]. Large investments have been done in the last decades and several technologies have been appearing. Nowadays, predominant wind model is three blades windmill and the goal of the companies is increase the size, increasing both energy production and efficiency. In this section is studied the main risks faced for this technology; evaluation of the risks is done based on the indicators outlined in the previous sections. Wind energy faces the three-risk proposed by PMBOK; political and social, environmental and economical [12]. The most of the authors say that political and social are the most influential. Economical factor it is also important but it is preceded by political one considering that wind energy cost is very dependant of the regulations and future policies. Lastly, environmental risk has not been a primary concern in the last years due to the renewable characteristic of the power stations. Meanwhile, the numbers of authors discussing this “completely clean” technology has increased.

- Economical and market risks: there are three potential risk that should be addressed. Firstly, high price and long-term investment; along the years cost has been reducing and now it is easier for companies develop these products economical [27]. However, good planning and excellent timing management is fundamental for success in wind energy projects. Secondly, competitive market with large and strong companies, they have the best projects with most of the MW of the share pool. Finally, expensive technology; this creates barriers to other companies who wants to enter in the market, being highly risky enter in this new market without a partner who is just inside. Furthermore, this prevent from enter into the market to smaller and medium firms, for the benefit of bigger companies.

- Environmental risks: as discussed earlier, the major advantage of renewable energy projects are the lower environmental impacts, nevertheless, there are some risk that should be taken into account because of concerning of stakeholders and authors. Bird damage has suffered a great criticism by environmental organizations like World Council for Nature (WCFN) [28], for example. Some populations of animals have been specially affected by windmills, like vultures, being killed by windmill´s blades while they were flying. Others risks are related with neighbourhoods close to wind power stations. Blades sound is a big problem due to it produces noise that affects human sleep, causing sleep disorders. [29]. Energy companies has faced some claim for these injuries, having paid thousands of dollars in fines. The last one is the visual risk, this is a more subjective risk but there are also problems for changing the visual environments setting a windmill in the middle of a valley or sea [30].

- Political and social risks: this point is especially critical for Project Managers. A good stakeholder’s managements should be done to have a good project execution. Two actors should be taken into account, citizens and governments. Citizens used to be in favour of these technologies but environmental risk could trigger a non-aligned mindset with wind technology. For example, noise and visual contaminations of the windmill could create demonstrations against their implementation by the neighbours, and bird’s danger could conduct to environmental protest by environmental groups. On the other hand, governments are pressured by citizens, NGOs and other governments to publish new laws and standards which fulfil the stakeholder’s requirements, new laws could affect the economic equilibrium of the projects [27]. For these reason is important that Project Managers consider political and social stability in wind projects in order to not put them into risk.

Conclusion

A safe energy market is an objective in which governments along the world are working. Sustainable production, non-stop system, zero emission technologies or zero risk for human health production are some examples. The future is not clear and new technologies will shape for new policies. Risk Management is a key aspect to reach this goal. There are numerous factors that could risk an energy project. In this article some examples have been addressed; lack of supply for biomass power plants, new policies and regulations for the wind energy, complex and long-term project for hydraulic power stations or high cost and financing problems in solar energy projects. Project Managers should follow the PMI guides; planning, identifying, analysing and controlling risk in order to get maximum mitigation. Risk matrix is a visual and easy way to show the risk analysis, being one of the most used tools in the management environment. However, there are some limitations in the risk management study for renewable energy projects. In many cases risks are not clear enough and project managers have several ways to identify, analyse and control them; depending of the type of project, country or firm. Others fields, like construction, has a clear understanding of the risks, so, Project Managers in renewable energy projects should be aware of these limitations. To solve this, it is a priority standardizing the most of the risk analysis in renewable energy projects. Further studies should be done to get a better understanding of these risks, taking into account that energy sector is changing and new risks are appearing.

References

- ↑ 1.0 1.1 Office of Government Commerce (2011). Management of Portfolios. TSO. 978-0-11-331294-8

- ↑ Office of Government Commerce (2009). Managing Successful Projects with PRINCE2™. TSO. 978-0-11-331059-3

- ↑ A. Eydeland and K.Wolyniec (2003). Energy and Power Risk Management. John Wiley & Sons, Inc., Hoboken, New Jersey

- ↑ 4.0 4.1 C. Wing, J. Zhong (2014). Financing and risk management of renewable energy projects with a hybrid bond. Department of Electrical and Electronic Engineering, The University of Hong Kong, Hong Kong

- ↑ Ministry of Business, Innovation and Employement of New Zealand https://www.nzpam.govt.nz/our-industry/nz-petroleum/phases/. Visited 07-02-2018

- ↑ Deloitte https://www2.deloitte.com/us/en/pages/energy-and-resources/articles/risk-management-oil-gas-industry-weak-commodity-prices.html. Visited 07-02-2018

- ↑ Forbes https://www.forbes.com/sites/christopherhelman/2016/05/09/the-15-biggest-oil-bankruptcies-so-far/#4e410d317ff9. Visited 07-02-2018

- ↑ The Guardian https://www.theguardian.com/business/2002/dec/02/oil.spain. Visited 07-02-2018

- ↑ 9.0 9.1 Paul Slovic (1987). Perceived Risk, Trust, and Democracy. Decision Research. 1201 Oak Street Eugene, Oregon 97401

- ↑ Roger et al. (1998). The Social Amplification of Risk A Conceptual Framework. Risk Analysis, Vol. 8, No. 2, 1988.

- ↑ World Nuclear Organization http://www.world-nuclear.org/information-library/country-profiles/countries-o-s/spain.aspx. Visited 07-02-2018

- ↑ 12.0 12.1 12.2 12.3 PMI (2000). PMBOK Guide. Project Management Institute. Newton Square, Pennsylvania USA

- ↑ 13.0 13.1 PMI (1999). International Project Management Journal. Project Management Association Finland. Vol. 5, No.1 1999. ISSN 1455-4186

- ↑ The Guardian https://www.theguardian.com/environment/2013/apr/12/copenhagen-push-carbon-neutral-2025 Visited 07-02-2018

- ↑ The Guardian https://www.nytimes.com/2017/06/06/climate/renewable-energy-push-is-strongest-in-the-reddest-states.html. Visited 07-02-2018

- ↑ 16.0 16.1 J.P. Painuly (2000). Barriers to renewable energy penetration; a framework for analysis. UNEP Collaborating Centre on Energy and Environment, Risø National Laboratory, Roskilde-4000, Denmark

- ↑ M. Pehnt (2005). Dynamic life cycle assessment (LCA) of renewable energy technologies. Institute for Energy and Environmental Research Heidelberg (Ifeu), Wilckensstr. 3, D-69120 Heidelberg, Germany. 2005

- ↑ Karen Smith Stegen (2015). Heavy rare earths, permanent magnets, and renewable energies: An imminent crisis. Jacobs University, Campus Ring 1, 28759 Bremen, Germany. 2005

- ↑ J. Michelez et al (2011). Risk Quantification and Risk Management in Renewable Energy Projects. Altran GMbH & Co.KG. Konstantin Graf. Veritaskai 3. 21079 Hamburg, Germany.

- ↑ Ørsted https://orsted.com/en. Visited 09-02-2018

- ↑ Acciona https://www.acciona.com/business-divisions/energy/. Visited 09-02-2018

- ↑ Iberdrola S.A https://www.iberdrola.com/about-us/lines-business/renewables. Visited 09-02-2018

- ↑ Datta, S. & Mukherjee, S. K. (2001). Developing a risk management matrix for effective project planning – an empirical study. Project Management Journal, 32(2), 45–57.

- ↑ PMI (2008). The Standard for Portfolio Management. Project Management Institute. ISBN-13: 978-1-933890-53-1

- ↑ IEA Denmark (2017). Denmark 2017 Review. International Energy Agency

- ↑ IEA Spain (2015). Spain 2015 Review. International Energy Agency

- ↑ 27.0 27.1 Wustenhagen & Menichetti (2011). Strategic choices for renewable energy investment: Conceptual framework and opportunities for further research. R. Wustenhagen, E. Menichetti. University of St. Gallen, Good Energies Chair for Management of Renewable Energies, Tigerbergstrasse 2, CH-9000 St. Gallen, Switzerland

- ↑ World Council for Nature https://wcfn.org/2015/06/04/covering-up-the-massacre/ Visited 11-02-2018

- ↑ Independent http://www.independent.co.uk/environment/green-living/are-wind-farms-a-health-risk-us-scientist-identifies-wind-turbine-syndrome-1766254.html Visited 13-02-2018

- ↑ New York Times http://www.nytimes.com/2010/10/06/business/energy-environment/06noise.html Visited 13-02-2018

Annotated bibliography

- Reference 1: Management of Portfolios is a Project Management Book where the is a guide that provides practical guidance for managers of portfolios and those working in portfolio offices as well as those filling portfolio management roles outside a formal PfMO role. In Chapter 7: Portfolio delivery cycle: practices risk is discussed.

- Reference 2: Managing Successful Projects with PRINCE2 is a Project Management Book where it is discussed PRINCE2. This method is firmly established as the world’s most practiced method for project management and is globally recognized for delivering successful projects. Risk is discussed in Chapter 8: Risk.

- Reference 3: The subject of this book is assessing and managing the risks of complex derivative structures arising in energy markets. It shows how important is risk in the energy sector.

- Reference 4: The hybrid bond consists of a portfolio of renewable energy projects. It does not only financially support the initial capital costs, but also manages the risks associated with renewable energy investment. Key risks including market risks, credit risks, liquidity risks, operational risks and political risks are identified and managed

- Reference 5: Support the processes cited about

- Reference 6: Across the oil and gas industry, many companies are buckling under the steep decline in commodity prices. In this article Deloitte discuss risk in the oil sector and outline the main problems of this source of energy in terms of economic and political risks.

- Reference 7: Forbes explains and analyses the 15 Biggest Oil Bankruptcies along the times. It supports the argument that oil industry is highly risky and renewable models should be followed.

- Reference 8: Give an example how environmental risky could be the oil industry with an article of one of the biggest Spanish newspaper informing about Prestige catastrophe.

- Reference 9: This paper discuss how risk management has become increasingly politicized and contentious. Polarized views, controversy, and overt conflict have become pervasive. Risk-perception research has recently begun to provide a new perspective on this problem. Support the argument than public opinion has a strong power over the decision because people tend to amplify the real risk.

- Reference 10: this paper outlines that one of the most perplexing problems in risk analysis is why some relatively minor risks or risk events, as assessed by technical experts, often elicit strong public concerns and result in substantial impacts upon society and economy. Support the argument than public opinion has a strong power over the decision because people tend to amplify the real risk.

- Reference 11: Give an example how nuclear energy is following a closure tendency due to strong public opinion.

- Reference 12: This book supports the basis of PMI to make good practices as PMP. Risk is discussed in Chapter 11: Project Risk Manager. Different tools and techniques to manage risk are presented, as well as several stages of this process that is presented as a mandatory step of a project.

- Reference 13: The rationale for this editorial is to construct a concrete description of the business

setting and project management setting in a project-oriented company. Risk is discussed in these publications where are outline different models, it is used “loop of control”, included as imaged too.

- Reference 14: The Guardian discuss Copenhagen's ambitious push to be carbon-neutral by 2025

- Reference 15: New policies in the states are discussing, showing the reading how important are policies and government in the risk involved in energy sector. In this case it could be seen how renewable energies suffer after Trump victory in USA elections.

- Reference 16: There are some problems which provokes that renewable energy integration was difficult. These barriers increased the risk of the project and are analysed like barriers to renewable energy penetration.

- Reference 17: Discuss if the renewable energy is completely clean. Different arguments are presents and it is interesting understand this point of view. If they are not as clean as they used to be presented, investment in these technologies could be highly risky in the following years.

- Reference 18: Support the argument of rare earth. These materials are scarce and could be aim to problems in the manufacturing supply to produce windmills and solar panels. This could be an inflexion point because risk would

- Reference 19: This paper outlines the importance of the environmental impact in the risk analysis because it is one of the main concerns of the companies nowadays. Evaluations indications presented in this book are used to build the evaluation risk analysis of the article.

- Reference 20: Example of energy firm which has included renewable energy projects as its core business. Outline the importance of the environmental impact in the risk analysis because it is one of the main concerns of the companies nowadays.

- Reference 21: Example of energy firm which has included renewable energy projects as its core business. Outline the importance of the environmental impact in the risk analysis because it is one of the main concerns of the companies nowadays.

- Reference 22: Example of energy firm which has included renewable energy projects as its core business. Outline the importance of the environmental impact in the risk analysis because it is one of the main concerns of the companies nowadays.

- Reference 23: This paper presents a risk management matrix for effective planning of industrial projects. A schematic view of the project environment has been suggested to systematically identify the effects of various project environments, and thereby take a holistic view of risks arising out of immediate and external environments. Various subfactors within each risk element are presented. Give us an alternative side of the risk matrix.

- Reference 24: Portfolio managers oversee a collection of projects, programs and other activities that are grouped together to meet strategic business objectives. The practice of portfolio management is integral to the implementation of an organization’s overall strategic plan. In Chapter 5: PORTFOLIO RISK MANAGEMEN. Risk analysis is done and helps to support risk theory of the article and the risk matrix presented.

- Reference 25: This report supports the data presented in the article relating to energy generation in Denmark. It is used and reliable source, International Energy Agency.

- Reference 26: This report supports the data presented in the article relating to energy generation in Spain. It is used and reliable source, International Energy Agency.

- Reference 27: This paper supports that renewable projects are normally long-term projects, being quite risky. This is one of the main factor why there are economic problem with wind power plants, being necessary subsides from governments.

- Reference 28: World Council for Nature defend that bird killing by windmills is a massacre. This exemplify how windmills are risky for these animals and how some NOGs organizations are against the. This could increase risk in construction of this stations because of social rejection. *Reference 29: In this case, environmental problems with human health are discussed. Problems with noise are outlined and how some neighbourhood do not agree with wind technology and want to close the wind farms. This could increase risk in construction of this stations because of social rejection.

- Reference 30: Another environmental problem is discussed. This one is more subjective but it is highly interesting analysed how different could be society opinions. Visual impact is considered as an addition environmental effect of this technology. This could increase risk in construction of this stations because of social rejection.