Porter's Five Forces Framework

(→Abstract) |

(→Abstract) |

||

| Line 2: | Line 2: | ||

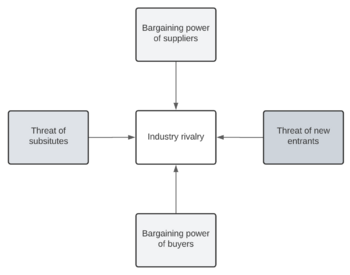

[[File:PorterFiveForces.png|350px|thumb|right|'''Figure 1''': Porter's Five Forces Framework. Own creation based on Porter's Five Forces publication. <ref name="R1" />]] | [[File:PorterFiveForces.png|350px|thumb|right|'''Figure 1''': Porter's Five Forces Framework. Own creation based on Porter's Five Forces publication. <ref name="R1" />]] | ||

| − | The competitive forces model, better known as Porter’s Five Forces, is a method used for analysing the operating competitive environment of a company. Porter’s Five Forces Framework was published in Harvard Business Review by Michael E. Porter of Harvard University in 1979. <ref name="R1" /> The framework consists of five fundamental | + | The competitive forces model, better known as Porter’s Five Forces, is a method used in industrial economics (IO) for analysing the operating competitive environment of a company. Porter’s Five Forces Framework was published in Harvard Business Review by Michael E. Porter of Harvard University in 1979. <ref name="R1" /> The framework consists of five fundamental powers that drive industry competition, namely: bargaining power of suppliers, bargaining power of buyers, threat of substitutes and complementary goods, threat of new entrants to the market, and internal competition within the market. <ref name="R1" /> Three forces represent 'horizontal' competition: threat of substitutes and complementary goods, threat of new entrants to the market, and internal competition. Vertical competition is represented by the bargaining power of both suppliers and customers. |

| − | Analysing Porter’s Five Forces | + | The five competitive forces can be assessed to determine the profitability potential of markets and industries for a company. Analysing Porter’s Five Forces can be of great value to companies for exploring and examining market entry opportunities, with regards to expanding and evaluating a project portfolio – for example, in the field of product and service development. By assessing the risk of industries, managers can make strategic decisions with regards to current and future projects in the company portfolio. |

This article is structured as follows. First, each of Porter’s Five Forces is explained in depth, after which the application of the forces in the context of project and portfolio management is described. Besides, limitations with regards to the competitive forces model will be given, and annotated bibliography for further readings is listed. | This article is structured as follows. First, each of Porter’s Five Forces is explained in depth, after which the application of the forces in the context of project and portfolio management is described. Besides, limitations with regards to the competitive forces model will be given, and annotated bibliography for further readings is listed. | ||

Revision as of 12:59, 10 February 2022

Abstract

The competitive forces model, better known as Porter’s Five Forces, is a method used in industrial economics (IO) for analysing the operating competitive environment of a company. Porter’s Five Forces Framework was published in Harvard Business Review by Michael E. Porter of Harvard University in 1979. [1] The framework consists of five fundamental powers that drive industry competition, namely: bargaining power of suppliers, bargaining power of buyers, threat of substitutes and complementary goods, threat of new entrants to the market, and internal competition within the market. [1] Three forces represent 'horizontal' competition: threat of substitutes and complementary goods, threat of new entrants to the market, and internal competition. Vertical competition is represented by the bargaining power of both suppliers and customers.

The five competitive forces can be assessed to determine the profitability potential of markets and industries for a company. Analysing Porter’s Five Forces can be of great value to companies for exploring and examining market entry opportunities, with regards to expanding and evaluating a project portfolio – for example, in the field of product and service development. By assessing the risk of industries, managers can make strategic decisions with regards to current and future projects in the company portfolio.

This article is structured as follows. First, each of Porter’s Five Forces is explained in depth, after which the application of the forces in the context of project and portfolio management is described. Besides, limitations with regards to the competitive forces model will be given, and annotated bibliography for further readings is listed.

Contents |

Big idea

Describe the tool, concept or theory and explain its purpose. The section should reflect the current state of the art on the topic

Threat of new entrants

Threat of substitutes

Bargaining power of customers

Bargaining power of suppliers

Competitive rivalry

Application

provide guidance on how to use the tool, concept or theory and when it is applicable

Limitations

critically reflect on the tool/concept/theory. When possible, substantiate your claims with literature

Annotated bibliography

Provide key references (3-10), where a reader can find additional information on the subject. Summarize and outline the relevance of each reference to the topic. (around 100 words per reference). The bibliography is not counted in the suggested 3000 word target length of the article.