Net Present Value (NPV) - Discounted cash flow

(→Abstract) |

(→Abstract) |

||

| Line 6: | Line 6: | ||

On the one hand, Discounted Cash Flow (DCF) is a valuation method that estimates the present value of future cash flows, determining how much they are worth in today’s time. <ref name="NPV vs DCF"> The Heart Ford: Net Present Value and Discounted Cash Flow "https://sba.thehartford.com/finance/cash-flow/discounted-cash-flow-versus-net-present-value/#:~:text=The%20discounted%20cash%20flow%20analysis,is%20taken%20in%20and%20spent"</ref> It involves forecasting the future cash flows that a project or investment is expected to generate, and then discounting those values back to the present using a discount rate or required rate of return. <ref name="CFI DCF"> Corporate Finance Institute: Discounted Cash Flow "https://corporatefinanceinstitute.com/resources/valuation/discounted-cash-flow-dcf/"</ref> | On the one hand, Discounted Cash Flow (DCF) is a valuation method that estimates the present value of future cash flows, determining how much they are worth in today’s time. <ref name="NPV vs DCF"> The Heart Ford: Net Present Value and Discounted Cash Flow "https://sba.thehartford.com/finance/cash-flow/discounted-cash-flow-versus-net-present-value/#:~:text=The%20discounted%20cash%20flow%20analysis,is%20taken%20in%20and%20spent"</ref> It involves forecasting the future cash flows that a project or investment is expected to generate, and then discounting those values back to the present using a discount rate or required rate of return. <ref name="CFI DCF"> Corporate Finance Institute: Discounted Cash Flow "https://corporatefinanceinstitute.com/resources/valuation/discounted-cash-flow-dcf/"</ref> | ||

| − | On the other hand, Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. It express the net return on the investment after accounting for startup costs. <ref name=" | + | On the other hand, Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. It express the net return on the investment after accounting for startup costs. <ref name = "Brealey"/> <ref name ="NPV vs DCF" /> As it takes into consideration the time value of money and provides a concrete number (rates of return for the investment) that managers can use easily compare when making decisions. <ref name="HBR NPV"> Harvard Business Review: A Refresher on Net Present Value "https://hbr.org/2014/11/a-refresher-on-net-present-value" </ref> |

As can be assumed from the previous lines, the calculation of discounted cash flows for future years becomes critical for the investment decision, when it is based on the net present value of the considered project. | As can be assumed from the previous lines, the calculation of discounted cash flows for future years becomes critical for the investment decision, when it is based on the net present value of the considered project. | ||

Revision as of 17:18, 5 May 2023

Contents |

Abstract

Net Present Value (NPV) and Discounted Cash Flow (DCF) are two financial concepts, strongly connected to each other, that are used when evaluating projects and investments opportunities. Both these concepts operate under the time value of money principle, which assumes that money is worth more today than it is in the future. [1] When making a project, program or portfolio decision, NPV and DCF emerge as two of the of the most commonly used financial metrics but show slightly different results.

On the one hand, Discounted Cash Flow (DCF) is a valuation method that estimates the present value of future cash flows, determining how much they are worth in today’s time. [2] It involves forecasting the future cash flows that a project or investment is expected to generate, and then discounting those values back to the present using a discount rate or required rate of return. [3]

On the other hand, Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. It express the net return on the investment after accounting for startup costs. [1] [2] As it takes into consideration the time value of money and provides a concrete number (rates of return for the investment) that managers can use easily compare when making decisions. [4]

As can be assumed from the previous lines, the calculation of discounted cash flows for future years becomes critical for the investment decision, when it is based on the net present value of the considered project.

The article is structures explaining relevant concepts (Time Value of Money, Discount rates), explaining the connection between Net Present Value and Discounted Cash Flows, followed by an analysis of the different ways of creating discounted cash flows. Advantages and disadvantages are also considered and presented. At the end, the article briefly highlights the key references used.

Big Idea

As stated in the abstract, the financial methods being considered in this report are strongly connected to each other. The NPV approach consists in discounting all future cash flows (both in- and out-flow) resulting from the project or investment opportunity under consideration with a given discount rate and then summing them together. [5]

A core principle for the mentioned methods is the Time Value of Money, a concept that expresses how money is worth more today than tomorrow. The second relevant concept is the discount rate used to determine the present value of future cash flows in NPV calculation. The choice of the discount rate can dramatically change the NPV since the NPV is an inverse function of the discount rate, so it has to be carefully selected. [6] It requires careful consideration of various factors, including the risk profile of the investment, the company's cost of capital and the expected return on alternative investments.

Time Value of Money

$1 of today is worth more than $1 of tomorrow

Time value of money (TVM) is a core financial principle that states a sum of money is worth more now than it will be in the future. [1]. This is because when the investor has the money available, it can be re-inverted generating more profits. Money available at different points in time has different values, which means that a sum of money’s value depends on how long you must wait to use it. The sooner you can use it, the more valuable it is. [7]

TVM plays a crucial role in investment analysis, particularly when assessing future cash flows and expected investment returns. Investors rely on this concept to assess businesses’ present values based on projected future returns, which helps them decide which investment opportunities to prioritize and pursue. [7] When investment options vary in time horizons, the TVM helps in determining the most profitable choice based on the present and future value of the money invested.

Discount Rate

In corporate finance, a Discount Rate is the rate of return used to discount future cash flows back to their present value. It takes into consideration the time value of money and the risk associated with an investment. In other words, the discount rate is the interest rate used to convert future cash flows into their equivalent value in today’s dollars.[8]

Regarding the choice of the discount rate it is important to consider that the NPV is an inverse function of the discount rate, meaning that the higher the interest rate, the smaller the net present value. [6]

When making project, program or portfolio management decisions, this rate value is often defined as the minimum acceptable rate of return that investors deem acceptable on an investment. The discount rate is determined by assessing the cost of capital, risks involved, opportunities in business expansion, rates of return for similar investments or projects, and other factors that could directly affect an investment or project under consideration. [9]

- Cost of Capital: is the minimum required rate of return that an investor expects to earn on an investment to compensate the risk associated to it. The cost of capital is often used as a discount rate for evaluating investments that are similar in risk to the overall operations of the company. [10]

- Weighted Average Cost of Capital (WACC): WACC is a specific type of cost of capital where the cost of each type of capital is weighted by its percentage of total capital and they are added together. WACC is often used as a discount rate for projects or investments that are expected to have a similar risk profile as the overall operations of the company. [11]

Net Present Value (NPV)

The Net Present Value can be defined as the present value of the investment. It compares future net cash flows discounted to its present value, with the initial investment of the project. The result obtained, represents the increase in the wealth of the investor along the time. As previously mentioned, the NPV analysis accounts for the time value of the money and can be used to compare different investment projects being under consideration. [12] The discount rate used to discount the cash flows is defined for each project under analysis and is associated with the investment risk profile. Riskier projects are discounted heavily. [5]

In corporate finance, the Net Present Value analysis is one of the tools that investors use when comparing investment projects and deciding which one to pursue. This method provides a concrete number that managers can use to easily compare an initial outlay of cash against the present value of the return. [4]

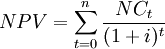

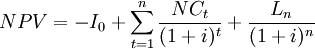

NPV combines projections of all net cash flows to assess the overall value of a project from the present view. Therefore the NPV is given by:

The difference between the cash inflows and cash outflows, gives the net cash flow,  of the corresponding period. For investments which are characterized by initial investment,

of the corresponding period. For investments which are characterized by initial investment,  , subtracting it from the present value of the net cash flows gives the net present value. If a possible final payment,

, subtracting it from the present value of the net cash flows gives the net present value. If a possible final payment,  , for the liquidation of the investment in t = n is also considered, the NPV can be calculated as follows [5]:

, for the liquidation of the investment in t = n is also considered, the NPV can be calculated as follows [5]:

The outcome of this method can be either positive or negative. A positive outcome could signify a worthwhile investment, resulting in a profitable return, whereas a negative value would indicate that the project’s return is not enough to make it profitable.

A decisión rule is defined for the outcome obtained from the calculation of the NPV.[6]

- If the Net Present Value (NPV) is positive (NPV > 0), it means that the benefits deriving from the investment opportunity exceed the costs in the amount of the NPV. In this case, then the investment deserves to be made.

- On the contrary, a negative result (NPV < 0), will imply that the discounted cash flows doesn’t cover the initial investment generating a decreased profit in an amount equal to the negative NPV. In these cases, the investment can be rejected.

- If NPV = 0, it means that the sum of the cash flows discounted to their present value are equal to the amount of the initial investment. In this case, the opportunity doesn’t generate profits or losses and other decision criteria should be implemented.

Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) is a valuation method that helps to estimate what an asset is worth today by using expected future cash flows. It is a way of valuing a project or purchase to determine whether its return is worth the investment. A DCF analysis reports how much money can be spent on the investment in the present in order to get a desired return in the future. It can be used to calculate the value of another business, stock, real state, equipment or any long term asset. [13] This method operates under the time value of money principle and can be used to determine if in an investment or project is worthwhile comparing it to other alternatives. The mentioned analysis can be applied to value a stock, company, project, and many other assets or activities, and thus is widely used in both the investment industry and corporate finance management.

The purpose of DCF analysis is to estimate the money an investor would receive from an investment, adjusted for the time value of money and compare it with the initial investment. If the DCF is greater than the present cost, the investment is profitable. The higher the DCF, the greater return the investment generates. If the DCF is lower than the present cost, investors should rather hold the cash. [14] This method adjusts the value of the future cash flows to the present value using a discount rate, that is associated with each individual project or investment.

To make a Discounted Cash Flow analysis, the following key elements are needed: [13]

- Time frame or periods of time of the investment.

- The investment's projected annual cash flows.

- An interest rate or discount rate.

Bibliography

Brealey, R., Myers, S., Allen, F., Principles of Corporate Finance, 10th edition, McGraw-Hill Irwin, 2010

Benninga, S., Financial Modeling, 4th edition, The MIT Press, 2014

Žižlavský O., Net present value approach: method for economic assessment of innovation projects., 19th International Scientific Conference, Economics and Management, (2014), pp. 506-512

The research paper provides a comprehensive understanding of the NPV method for project appraisal. It emphasizes the importance of the time value of money and selecting an appropriate discount rate. This paper serves as a valuable resource for anyone seeking to gain insights into the NPV approach.

Ferrari, C., Bottasso, A., Conti, M. and Tei, A., Ch. 5 - Investment Appraisal. In: Economic role of transport infrastructure: Theory and models (2018), pp. 85-114

Chapter 5 covers financial appraisal methods, highlighting the importance of net present value (NPV) and its relationship with discount rates. It stresses the need to select appropriate discount rates when appraising projects using NPV and introduces sensitivity analysis as a crucial tool for accurate financial evaluations. Overall, the chapter provides readers with the necessary knowledge to make informed financial decisions and maximize profitability.

References

- ↑ 1.0 1.1 1.2 Brealey, R., Myers, S., Allen, F., Principles of Corporate Finance, 10th edition, McGraw-Hill Irwin, 2010

- ↑ 2.0 2.1 The Heart Ford: Net Present Value and Discounted Cash Flow "https://sba.thehartford.com/finance/cash-flow/discounted-cash-flow-versus-net-present-value/#:~:text=The%20discounted%20cash%20flow%20analysis,is%20taken%20in%20and%20spent"

- ↑ Corporate Finance Institute: Discounted Cash Flow "https://corporatefinanceinstitute.com/resources/valuation/discounted-cash-flow-dcf/"

- ↑ 4.0 4.1 Harvard Business Review: A Refresher on Net Present Value "https://hbr.org/2014/11/a-refresher-on-net-present-value"

- ↑ 5.0 5.1 5.2 Žižlavský O., Net present value approach: method for economic assessment of innovation projects., 19th International Scientific Conference, Economics and Management, (2014), pp. 506-512

- ↑ 6.0 6.1 6.2 Ferrari, C., Bottasso, A., Conti, M. and Tei, A., Ch. 5 - Investment Appraisal. In: Economic role of transport infrastructure: Theory and models (2018), pp. 85-114

- ↑ 7.0 7.1 Harvard Business School: Time Value of Money "https://online.hbs.edu/blog/post/time-value-of-money"

- ↑ Corporate Finance Institute: Discount Rate "https://corporatefinanceinstitute.com/resources/valuation/discount-rate/"

- ↑ Corporate Finance Institute: Hurdle Rate "https://corporatefinanceinstitute.com/resources/valuation/hurdle-rate-definition/"

- ↑ Harvard Business Review: Cost of Capital "https://hbr.org/2015/04/a-refresher-on-cost-of-capital"

- ↑ Corporate Finance Institute: Weighted Average Cost of Capital "https://corporatefinanceinstitute.com/resources/valuation/what-is-wacc-formula/"

- ↑ Corporate Finance Institute: Net Present Value "https://corporatefinanceinstitute.com/resources/valuation/net-present-value-npv/

- ↑ 13.0 13.1 The Heart Ford: Discounted Cash flow "https://sba.thehartford.com/finance/cash-flow/discounted-cash-flow/"

- ↑ Corporate Finance Institute: Discounted Cash Flow "https://corporatefinanceinstitute.com/resources/valuation/discounted-cash-flow-dcf/"