Decision making under risk

| Line 7: | Line 7: | ||

| − | Risk analysis and risk management is an important tool in the construction management process. Risk implies a degree of uncertainty and an inability to fully control the outcomes or consequences of such an action. The objective of a decision analysis is to discover the most advantageous alternative under the circumstances. | + | Risk analysis and risk management is an important tool in the construction management process. Risk implies a degree of uncertainty and an inability to fully control the outcomes or consequences of such an action. The objective of a decision analysis is to discover the most advantageous alternative under the circumstances. |

| − | Decision analysis is a management technique for analyzing management decisions under conditions of uncertainty. The decision problems can be represented using different statistical tools applied to the mathematical models of real-world problems. An important and relevant decision tool to represent a decision problem is a decision trees. A decision tree is a graphical representation of the alternatives and possible solutions, also challenges and uncertainties. In decision analysis, formulating the decision problem in terms of a decison tree is a | + | Decision analysis is a management technique for analyzing management decisions under conditions of uncertainty. The decision problems can be represented using different statistical tools applied to the mathematical models of real-world problems. An important and relevant decision tool to represent a decision problem is a decision trees. A decision tree is a graphical representation of the alternatives and possible solutions, also challenges and uncertainties. In decision analysis, formulating the decision problem in terms of a decison tree is a favorable visual and analytical support tool, where the expected values of competing alternatives are calculated. |

| Line 53: | Line 53: | ||

<gallery widths=450px heights=280px perrow=1> | <gallery widths=450px heights=280px perrow=1> | ||

| − | File: | + | File:Simple.jpg|Figure 1 - Decision tree |

</gallery> | </gallery> | ||

| Line 73: | Line 73: | ||

The construction of the decision tree is the tool provided to show the process. | The construction of the decision tree is the tool provided to show the process. | ||

The decision theory is the theory used in the decision process. The values calculated are EVM. | The decision theory is the theory used in the decision process. The values calculated are EVM. | ||

| + | |||

| + | Risk defines decision situations in which the probabilities are objective or given, such as betting on a flip of a fair coin, a roll of a balanced die, or a spin of a roulette wheel. Uncertainty defines situations in which the probabilities are subjective (i.e., the decision maker must estimate | ||

| + | or infer the probabilities). | ||

When the utility function has been defined and the probabilities of the various state | When the utility function has been defined and the probabilities of the various state | ||

| Line 107: | Line 110: | ||

== Annotated bibliography == | == Annotated bibliography == | ||

| − | ''' | + | '''Wu, G., Zhang, J. and Gonzalez, R. (2004) ''Decision Under Risk, in Blackwell Handbook of Judgment and Decision Making'':''' This chapter of the handbook provides and introduction to decision making under risk, it present many phases in the history of risky decision-making research and highlight the |

| + | differences and similarities between how economists and psychologists have approached this subject. | ||

| + | |||

| + | (eds D. J. Koehler and N. Harvey), Blackwell Publishing Ltd, Malden, MA, USA. doi: 10.1002/9780470752937.ch2 | ||

| + | |||

| + | ''' Knight, F. H. (1921) ''Risk, Uncertainty, and Profit'':''' This book presents the work of Frank Knight, a economist at University of Chicago, who distinguished risk and uncertainty. Knights point of view, was that an ever-changing world provides new opportunities for the industry to create profit, but also brings imperfect knowledge related to future events. | ||

| + | |||

| − | + | Knight, F. H. (1921) Risk, Uncertainty, and Profit. New York: Houghton Mifflin. | |

'''Raf Dua (1999) ''Implementing Best Practice in Hospital Project Management Utilising EVPM methodology'':''' Dua applies EVA in the context of Earned Value Performance Management (EVPM) within the optimization of risk management and process control in hospital project management. His motivation is that healthcare sector usually does not face the competitive pressure as other industries. He therefore works out and describes extensively the EVM methodology and the implementation requirements in order introduce these to hospital sector, providing a case study and special research in that area. | '''Raf Dua (1999) ''Implementing Best Practice in Hospital Project Management Utilising EVPM methodology'':''' Dua applies EVA in the context of Earned Value Performance Management (EVPM) within the optimization of risk management and process control in hospital project management. His motivation is that healthcare sector usually does not face the competitive pressure as other industries. He therefore works out and describes extensively the EVM methodology and the implementation requirements in order introduce these to hospital sector, providing a case study and special research in that area. | ||

Revision as of 06:59, 22 June 2017

Decision making is one of the most important tasks in the management process and it is often a very difficult one. When having knowledge regarding the states of nature, subjective probability estimates for the occurrence of each state can be assigned. In such cases, the problem is classified as decision making under risk. In the decision making process, all relevant information is evaluated through decision analysis (DA). The decision analysis process consist of the use of a decison tool and a decsion theory. The decision tree is the most commonly applied decision tool in the decision analysis. The decision theory of interest in the decision analysis, regarding the decision making under risk, is the expected value of criterion also reffered to as the Bayesian principle. This is the only one of the four decision methods that incorporates the probabilities of the states of nature.

Contents |

Methologdy

Risk analysis and risk management is an important tool in the construction management process. Risk implies a degree of uncertainty and an inability to fully control the outcomes or consequences of such an action. The objective of a decision analysis is to discover the most advantageous alternative under the circumstances.

Decision analysis is a management technique for analyzing management decisions under conditions of uncertainty. The decision problems can be represented using different statistical tools applied to the mathematical models of real-world problems. An important and relevant decision tool to represent a decision problem is a decision trees. A decision tree is a graphical representation of the alternatives and possible solutions, also challenges and uncertainties. In decision analysis, formulating the decision problem in terms of a decison tree is a favorable visual and analytical support tool, where the expected values of competing alternatives are calculated.

Decision tree

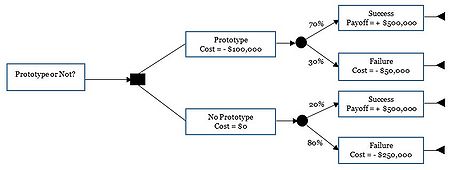

A decision tree is a schematic, tree-shaped diagram representation of a problem and all possible courses of action in a particular situation and all possible outcomes for each possible course of action.

Decision trees is an effective decision tool in the decision-making, because it:

- Clearly lay out the problem so that all options can be challenged

- allow to fully analyse the possible consequences of a decision

- provides a framework in which to quantify the values of outcomes and the probabilities of achieving them

- helps make the best decisions on the basis of existing information and best guesses.

It is particularly useful where there are a series of decisions to be made and/or several outcomes arising at each stage of the decision-making process. The decision may be dependent on more than one uncertain variable.

Construction of decision tree

A decision tree consists of three type of nodes, there is no universal set of symbols used when drawing a decision tree but the most common ones is:

- Decision (choice) Node – square

- Chance (event) Node - circles

- Terminal (consequence) Node – triangles

A Decision Tree is a chronological representation of the decision process. For the understanding of the decision tree analysis, a simple example is provided.

Example

The example consist of a simple situation, that could represent a every-day situation in the constrution mangemant process. A prototype for a project (example a mock-up on the facades) are being constructed. The cost of the prototype is $100,000, and not cost is related if the prototype aren't being prusued. The first step is therefore the decsion, do the prototype or not? Figure 1 represent the onstruiton of the decision node process.

The decision tree is drawn chronological from left to right. The construction of a simple decision tree is provided in this article. Figure 1 shows the first step, which consists of the decision node. The example is based on the use of a prototype, the first decision is weather or not to do the prototype.

Let’s work through an example to understand DTA’s real world applicability.

To begin your analysis, start from the left and move from the left to the right. First, draw the event in a rectangle for the event — “Prototype or Not.” This obviously will lead to a decision node (in the small, filled-up square node as shown below).

From there, you have two options — “Do Prototype” and “Don’t Prototype.” They are also put in rectangles as shown below.

Since there are two options, the tree is constructed with two branches coming from the decision point.

- Simple.jpg

Figure 1 - Decision tree

The people involved in constructing a decision tree (sometimes referred to as framing the problem) have the responsibility of including all possible choices for each choice node.

Decision theory

The construction of the decision tree is the tool provided to show the process. The decision theory is the theory used in the decision process. The values calculated are EVM.

Risk defines decision situations in which the probabilities are objective or given, such as betting on a flip of a fair coin, a roll of a balanced die, or a spin of a roulette wheel. Uncertainty defines situations in which the probabilities are subjective (i.e., the decision maker must estimate or infer the probabilities).

When the utility function has been defined and the probabilities of the various state of nature corresponding to different consequences have been estimated, the analysis is reduced to the calculation of the expected utilities corresponding to the different action alternatives. In the following examples the utility is represented in a simplified manner through the costs whereby the optimal decisions now should be identified as the decisions minimizing expected costs, which then is equivalent to maximizing expected utility.

Prior ananlysis- decision analysis with given information

The considered scenario is the Prior analysis with given information.

Example

The prior analysis uses the exmaple provided in figure 1. Now the costs and probabailities are added to the case. The sceneario consists of a deteroitation of a bridge,

Key benefits

Limitations and pitfalls

References

Annotated bibliography

Wu, G., Zhang, J. and Gonzalez, R. (2004) Decision Under Risk, in Blackwell Handbook of Judgment and Decision Making: This chapter of the handbook provides and introduction to decision making under risk, it present many phases in the history of risky decision-making research and highlight the differences and similarities between how economists and psychologists have approached this subject.

(eds D. J. Koehler and N. Harvey), Blackwell Publishing Ltd, Malden, MA, USA. doi: 10.1002/9780470752937.ch2

Knight, F. H. (1921) Risk, Uncertainty, and Profit: This book presents the work of Frank Knight, a economist at University of Chicago, who distinguished risk and uncertainty. Knights point of view, was that an ever-changing world provides new opportunities for the industry to create profit, but also brings imperfect knowledge related to future events.

Knight, F. H. (1921) Risk, Uncertainty, and Profit. New York: Houghton Mifflin.

Raf Dua (1999) Implementing Best Practice in Hospital Project Management Utilising EVPM methodology: Dua applies EVA in the context of Earned Value Performance Management (EVPM) within the optimization of risk management and process control in hospital project management. His motivation is that healthcare sector usually does not face the competitive pressure as other industries. He therefore works out and describes extensively the EVM methodology and the implementation requirements in order introduce these to hospital sector, providing a case study and special research in that area.

Howes, R. (2000) Improving the performance of Earned Value Analysis as a construction project management tool: Howes, similar to Lukas stated above, takes a rather critical position towards EVA. In his paper, he attempts to refine and improve the performance of traditional EVA by the introduction of a hybrid methodology based on work packages and logical time analysis entitled Work Package Methodology (WPM). In a nutshell, he in his approach applies EVA calculations to individual work packages in order to take into consideration their unique characteristics.

Michael Raby (2000), Project management via earned value: This article very clearly outlines the main characteristics of EVA and the benefits of its' application in project management. While doing so in a nicely summarized way, he provides a quick introduction and a step-by-step guide for execution of the method.

National Defense Industrial Association, Integrated Program Management Division (2014), EIA-748-EVMS Standard, Revision C Intent Guide: This intent guide describes the main requirements within the EIA standard for EVMS and the 32 key consideration to be included. The very specific instructions are summarized, clustered in 5 dimensions and their overall relevance for businesses is explained.

Howard Hunter, Richard Fitzgerald, Dewey Barlow (2014), Improved cost monitoring and control through the Earned Value Management System: This article introduces EVMS in order to optimize performance measurement in Space Department. In order to provide a consistent, standard framework for assessing project performance, which has already been implemented in a reference project, the key characteristics are summarized nicely before the article very specifically treat the particularities of the case study.

Ferguson, J., Kissler, K.H. (2002), Earned Value Management: A very quick but convenient introduction to the EVM requirements, objectives, followed by a general application in the contracting environment of the european institute for nuclear research (CERN).

Kedi, Zhu and Hongping, Yang (2010), Application of Earned Value Analysis in Project Monitoring and control of CMMI: This article reflects upon EVA as a software project controlling method in the context of the CMMI maturity model. They provide detailed schemes for interpretation of EVA indicators. Furthermore, the methods applicability is linked to the overall capabilities of an organization to provide cost, schedule and budget metrics.

Hayes, Heather (2002) Using Earned-Value Analysis to Better Manage Projects: A short introduction to the benefits of EVA, followed by a description of it's relevance for pharmaceutical sector according to a generic example.