Risk Management Overview

(→Further Reading Material) |

|||

| (180 intermediate revisions by one user not shown) | |||

| Line 1: | Line 1: | ||

| + | ''Developed by Jonas Heiberg Larsen'' | ||

| + | |||

| + | |||

==Abstract== | ==Abstract== | ||

| − | Projects are part of a dynamic and fast | + | Projects are part of a dynamic and fast-changing world. Therefore there is a degree of uncertainty and unpredictability in projects. In order to minimize uncertainties and unforeseeable events related to a project, risks are identified and managed throughout the project lifecycle. A risk is an uncertain event that can have e negative effect on one or more objects in a project such as time, cost, performance or scope <ref name="HowToDoProjects" /> <ref name="iso31000" />. |

| − | + | This Wiki-article will describe the risk management Process, Risk matrix, Rumsfeld's Unknown-Knowns, inherent- and residual risks. | |

| + | At last limitations and advantages of risk management will be discussed and a brief overview of other relevant reading material is given. | ||

| − | + | Please note that this article only covers the risk (threat) management of a project and does not look into opportunities management (risks with a positive effect). | |

| − | + | In order to control and manage risks, the Risk Management Process (RMP) is used. RMP is divided into four main categories ''Identify risks'', ''Assess risks'', ''Treat risks'' and ''Monitor risks''. However, RMP is a continuous process, which happens throughout the lifecycle of a project. <ref name="iso31000" /> <ref name="RMGeorgUni" /> | |

| − | Risk | + | |

| − | + | The different natures of risks can be categorized with D. Rumsfeld's Unknown-Knowns and assessed with the risk matrix (both residual- & inherent risk). When treating a risk, the risk managers can choose to ''Avoid'', ''Reduce'', ''Share'' or ''Accept'' the risk. The risks can be monitored by using a risk register, where risks and countermeasures can be mapped. | |

| − | + | ||

| − | + | Risk management is an essential tool to use in project management and helps managers get an overview of potential obstacles that can occur or prevent a team from achieving their goals. | |

| + | Risk management is a highly importent discipline and should be present in all projects, however, its importance is often neglected. <ref name="iso31000" /> <ref name="RisikoRadio" /> | ||

==Introduction== | ==Introduction== | ||

=== Risk definition === | === Risk definition === | ||

| − | Risk can be defined as follows: "''Risk is an uncertain event or condition that | + | Risk can be defined as follows: "''Risk is an uncertain event or condition that if occurs, has a positive or negative effect on one or more project objectives such as time, cost and quality, or effect of uncertainty on objectives''" |

| − | All activities in an organization involve risks. These risks can be managed by identifying | + | All activities in an organization involve risks. These risks can be managed by identifying them, analyzing them and then evaluating whether the risk should be modified by risk treatment in order to satisfy the organization's risk criteria. |

| − | During this process, risk managers communicate with stakeholders and monitor the risk. The controls are modified | + | During this process, risk managers communicate with stakeholders and monitor the risk. The controls are modified to ensure that the amount of risk treatment is minimized. <ref name="iso31000" /><sup>(pV)</sup> |

| − | Risk identification | + | Risk identification is the "''process of finding, recognizing and describing risks''" <ref name="iso31000" /><sup>(p4)</sup>. Risk identification involves the identification of risk sources, event, causes and potential consequences. The identification can involve historical data, theoretical analysis, expert opinions, and stakeholder needs <ref name="iso31000" /><sup>(p4)</sup>. |

| − | However identification is only the first step, managers also need to analyze the risk to the most significant ones can be dealt with on an ongoing basis | + | However identification is only the first step, managers also need to analyze the risk to the most significant ones can be dealt with on an ongoing basis <ref name="PMBogen" /><sup>(p219)</sup>. |

=== Rumsfeld's Unknown-Knowns === | === Rumsfeld's Unknown-Knowns === | ||

| Line 31: | Line 34: | ||

*''Known-Unknowns'' describes the things we know are uncertain. For example, the delays because of a third party fail to deliver on deadline or human errors administration wise or misunderstandings. | *''Known-Unknowns'' describes the things we know are uncertain. For example, the delays because of a third party fail to deliver on deadline or human errors administration wise or misunderstandings. | ||

*''Unknown-Unknowns'' describes the things that we in no way could have seen or expected. This could be a sudden death, war or terrorist attack. | *''Unknown-Unknowns'' describes the things that we in no way could have seen or expected. This could be a sudden death, war or terrorist attack. | ||

| − | *''Unknown-Knowns'' describes the things we should have known, but we for various reason (mostly complexity) don't. An example could be when a terrorist attack happens on American solid, to some extent, this is an Unknown-Known for the CIA | + | *''Unknown-Knowns'' describes the things we should have known, but we for various reason (mostly complexity) don't. An example could be when a terrorist attack happens on American solid, to some extent, this is an Unknown-Known for the CIA <ref name="PMBogen" /><sup>(pp.219-220)</sup>. |

| − | === Risk | + | === Risk matrix === |

| − | [[File: | + | [[File:Risk_matrix_Pic.png|right|thumb|500px|Risk matrix <ref name="RiskMatrixPicture" />]] |

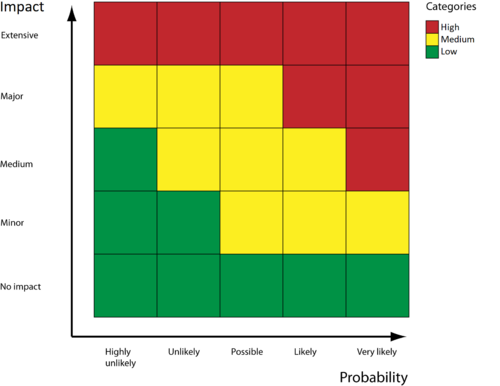

When the risk elements to be managed is identified, the next step is to ensure that either the likelihood is reduced or the impact of that activity occurring. | When the risk elements to be managed is identified, the next step is to ensure that either the likelihood is reduced or the impact of that activity occurring. | ||

| Line 40: | Line 43: | ||

The matrix can be used to determine the size of a risk & whether or not a risk is sufficiently controlled. | The matrix can be used to determine the size of a risk & whether or not a risk is sufficiently controlled. | ||

| − | The risk-matrix is compiled of two dimensions Probability (also called likelihood) and | + | The risk-matrix is compiled of two dimensions Probability (also called likelihood) and Impact (also called severity). Likelihood is the measure of how likely a given event is, and impact is the effect the risk can do. |

The combination of these two dimensions gives a collective risk rating in the matrix. | The combination of these two dimensions gives a collective risk rating in the matrix. | ||

Usually, the risk-matrix consists of 3 different risk ratings: Low (Acceptable), Medium and high (Not acceptable), however, some matrixes also have a 4. level very high <ref name="RiskMatrixPicture" />. | Usually, the risk-matrix consists of 3 different risk ratings: Low (Acceptable), Medium and high (Not acceptable), however, some matrixes also have a 4. level very high <ref name="RiskMatrixPicture" />. | ||

The horizontal and vertical scale can have different values or tags, however, in this case, both impact and probability have a scale from 1-5. | The horizontal and vertical scale can have different values or tags, however, in this case, both impact and probability have a scale from 1-5. | ||

| − | An example of a risk rating could have a probability of 3 (possible) and an impact of 2 (Minor) would have a collective risk ration of medium | + | An example of a risk rating could have a probability of 3 (possible), and an impact of 2 (Minor) would have a collective risk ration of medium <ref name="PMBogen" /><sup>(p223)</sup>. |

The numeric scale of 1-5 can be hard for managers to visualize and use, therefore more subjective values like unlikely and likely is often used, as seen in the table below. | The numeric scale of 1-5 can be hard for managers to visualize and use, therefore more subjective values like unlikely and likely is often used, as seen in the table below. | ||

| Line 52: | Line 55: | ||

|+ Objectively description of numeric scale | |+ Objectively description of numeric scale | ||

! Scale (1-5) | ! Scale (1-5) | ||

| − | ! | + | ! Probability (Subjective values) |

! Impact (Subjective values) | ! Impact (Subjective values) | ||

|- | |- | ||

| Line 77: | Line 80: | ||

| − | It is important to notice that the risk matrix is only used to rank risks, and not as a decision tool itself. How to treat the individual risk the matrix does not answer - other tools and | + | It is important to notice that the risk matrix is only used to rank risks, and not as a decision tool itself. How to treat the individual risk the matrix does not answer - other tools and analysis should be used for this (see section [[#Treat risks/Control|Treat risks/Control]]). The tool, however, can be used to prioritize and categorize the risks, so the risks with the highest rating can be dealt with first and so forth. |

| + | Visually risks in the red and yellow area, should, if possible, move towards the green area, when mitigations and controls are applied. | ||

=== Residual - & Inherent risks === | === Residual - & Inherent risks === | ||

| Line 88: | Line 92: | ||

== Risk Management Process (RMP) == | == Risk Management Process (RMP) == | ||

[[File:IAMC.jpg|right|thumb|500px|Risk Management Process <ref name="RMPPic" />]] | [[File:IAMC.jpg|right|thumb|500px|Risk Management Process <ref name="RMPPic" />]] | ||

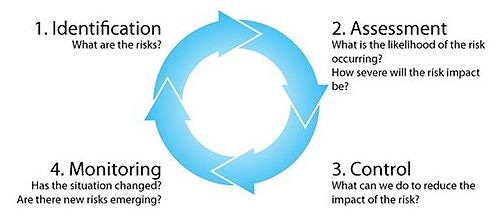

| − | The | + | The Risk Management Process can be divided into four main categories ''Identify risks'', ''Assess risks'', ''Treat risks'' and ''Monitor risks''. |

=== Identify risks === | === Identify risks === | ||

| − | The first process is "''Identify risks''", here potential risk events and their characteristics that can have a negative effect on the project is identified. The ''identification of risk'' is a repeatable process since | + | The first process is "''Identify risks''", here potential risk events and their characteristics that can have a negative effect on the project is identified. The ''identification of risk'' is a repeatable process since risks can change or new risks are discovered, throughout the project's lifecycle. The identification process can consist of a variety of different stakeholders, project management team, experts, senior managers, etc. |

=== Assess risks === | === Assess risks === | ||

| − | The second process is "''Assess risks''", which is used to measure and prioritize risks. In the ''assessment of risks'' the probability of each risk occurring & the corresponding impact for the project, if the risk does occur. The probability and impact are then used to prioritize the risks. This process is also repetitive throughout the project. The [[#Risk | + | The second process is "''Assess risks''", which is used to measure and prioritize risks. In the ''assessment of risks'' the probability of each risk occurring & the corresponding impact for the project, if the risk does occur. The probability and impact are then used to prioritize the risks. This process is also repetitive throughout the project. The [[#Risk matrix|Risk matrix]], as described earlier, can be used for accessing the risks. |

=== Treat risks/Control === | === Treat risks/Control === | ||

| − | The third process is "''Treat risks''", here actions to reduce risks, are developed and determined. The ''treatment of risks'' can consist of adding additional resources (manpower, budget) into the schedule. However, the treatment should be customized to fit the individual risk and be as realistic and cost-effective as possible. The process also includes measures to avoid, mitigate or deflect the risk. Another possibility is to develop contingency plans which can be used if the risk occurs | + | The third process is "''Treat risks''", here actions to reduce risks, are developed and determined. The ''treatment of risks'' can consist of adding additional resources (manpower, budget) into the schedule. However, the treatment should be customized to fit the individual risk and be as realistic and cost-effective as possible. The process also includes measures to avoid, mitigate or deflect the risk. Another possibility is to develop contingency plans which can be used if the risk occurs <ref name="HowToDoProjects" /><sup>(p138)</sup>. |

| − | ''Risk Treatment'' consists of a range of options for mitigating the risk, assessing options, and preparations for implementing action plans. As mentioned earlier the highest risks should be addressed first and so on and forth. Of course, the cost of treating the risk should be evaluated and compared with a potential loss by risk. | + | ''Risk Treatment'' consists of a range of options for mitigating the risk, assessing options, and preparations for implementing action plans. As mentioned earlier (in section [[#Risk matrix|Risk matrix]]) the highest risks should be addressed first and so on and forth. Of course, the cost of treating the risk should be evaluated and compared with a potential loss by risk. |

Depending on the type and nature of the risk, the following options are available <ref name="TreatRisks" />: | Depending on the type and nature of the risk, the following options are available <ref name="TreatRisks" />: | ||

*Avoid - The risk is avoided by stopping to proceed with the activity that introduced the risk. Instead, an alternative activity that still meets business objectives is chosen or a less risky approach or process. | *Avoid - The risk is avoided by stopping to proceed with the activity that introduced the risk. Instead, an alternative activity that still meets business objectives is chosen or a less risky approach or process. | ||

*Reduce - The likelihood or effect of the risk is reduced to an acceptable level. However in regards to time and expense, it is desirable to eliminate the risk <ref name="PMBogen" />. | *Reduce - The likelihood or effect of the risk is reduced to an acceptable level. However in regards to time and expense, it is desirable to eliminate the risk <ref name="PMBogen" />. | ||

*Share or Transfer - The risk is transferred away from the risk-owner. For instance by outsourcing the activities that the risk is tied to, making contracts with service providers or buying insurance that covers that risk. | *Share or Transfer - The risk is transferred away from the risk-owner. For instance by outsourcing the activities that the risk is tied to, making contracts with service providers or buying insurance that covers that risk. | ||

| − | *Accept - The risk is simply accepted, risks with very low impact and likelihood can often be accepted. A risk can also be accepted if the cost of the treatment outweighs the benefit. By accepting the risk no further action is taken to treat the risk, the risk is of cause still monitored and evaluated on an ongoing basis, | + | *Accept - The risk is simply accepted, risks with very low impact and likelihood can often be accepted. A risk can also be accepted if the cost of the treatment outweighs the benefit. By accepting the risk no further action is taken to treat the risk, the risk is of cause still monitored and evaluated on an ongoing basis, due to potential changes <ref name="TreatRisks" />. |

=== Monitor risks === | === Monitor risks === | ||

| Line 115: | Line 119: | ||

It is important to note that risks should be monitored, reviewed and controlled on an ongoing base. The controlling of risks is done by continuous tracking of identified risks while identifying and analyzing new risks. | It is important to note that risks should be monitored, reviewed and controlled on an ongoing base. The controlling of risks is done by continuous tracking of identified risks while identifying and analyzing new risks. | ||

| − | Risks and the effectiveness of controls and mitigations should be evaluated throughout the project life cycle | + | Risks and the effectiveness of controls and mitigations should be evaluated throughout the project life cycle <ref name="RMGeorgUni" /><sup>(p142)</sup>. |

== Risk management == | == Risk management == | ||

| − | |||

=== Risk management in different industries === | === Risk management in different industries === | ||

| − | Risk management is relevant for all industries | + | Risk management is relevant for all industries. However, the degree of importance and impact can vary a lot. |

| − | Risk management is highly | + | Risk management is highly essential in sectors like finance/banks, Formula One, drilling oil & gas or space programs. Where big money can be lost, reputations ruined or even lives lost. |

Risk management is especially important in the following areas: | Risk management is especially important in the following areas: | ||

*Construction | *Construction | ||

| Line 131: | Line 134: | ||

*Large government projects | *Large government projects | ||

*Pharmaceutical sector | *Pharmaceutical sector | ||

| − | The parameters used to measure the impact can also vary a lot. For an R&D project, the impact measurements could be delays, financial and mistakes while a bank could use reputational, regulatory, and financial scales to measure the impact. The space program could be an operational risk such as the risk of burning up when astronauts are reentering the atmosphere. While financial institutions could | + | The parameters used to measure the impact can also vary a lot. For an R&D project, the impact measurements could be delays, financial and mistakes while a bank could use reputational, regulatory, and financial scales to measure the impact. The space program could be an operational risk such as the risk of burning up when astronauts are reentering the atmosphere. While financial institutions could loose reputation or customers if they have a security breach, like hacking or transferring the wrong amount of money from one customer to another. |

====Examples of good and bad risk management==== | ====Examples of good and bad risk management==== | ||

'''Bad:''' | '''Bad:''' | ||

| − | *''Volkswagen - Dieselgate'': In 2015 it was discovered that car manufacturer VW was cheating in emissions test, which made their cars seem more eco-friendly. This resulted in a recall which costed around 6.7 billion euro and resulted in the company posting its first quarterly loss in 15 years. <ref name="VWArticle" /> | + | *''Volkswagen - Dieselgate'': In 2015 it was discovered that car manufacturer VW was cheating in emissions test, which made their cars seem more eco-friendly. This act resulted in a recall which costed around 6.7 billion euro and resulted in the company posting its first quarterly loss in 15 years. <ref name="VWArticle" /> |

*''Samsung - Galaxy Note 7 smartphone explosions'': When Samsung launched Galaxy Note 7 in August 2017, there was a fatal error with the batteries which caused them to explode, and Samsung was forced to recall 2 million devices with an estimated cost of 5.3 billion USD. <ref name="SamsungArticle" /> | *''Samsung - Galaxy Note 7 smartphone explosions'': When Samsung launched Galaxy Note 7 in August 2017, there was a fatal error with the batteries which caused them to explode, and Samsung was forced to recall 2 million devices with an estimated cost of 5.3 billion USD. <ref name="SamsungArticle" /> | ||

*''Deutsche Bank -Fined 14 billion USD'': Deutsche Bank was fined 14 billion USD, by the US for misselling mortgage securities in the US. The bank selected mortgages, packed them into bonds (RMBS) and sold on to investors.<ref name="DBArticle" /> | *''Deutsche Bank -Fined 14 billion USD'': Deutsche Bank was fined 14 billion USD, by the US for misselling mortgage securities in the US. The bank selected mortgages, packed them into bonds (RMBS) and sold on to investors.<ref name="DBArticle" /> | ||

| Line 142: | Line 145: | ||

'''Good:''' | '''Good:''' | ||

*''NASA - mission planning and real-time mission operations'': NASA is known for having a lot of risks in their projects, and have managed to excel in risk management. | *''NASA - mission planning and real-time mission operations'': NASA is known for having a lot of risks in their projects, and have managed to excel in risk management. | ||

| − | *''Formula One racing'' - Is high-performance racer sport, where safety and risk management is taken very seriously. Resulting in a 20-year streak with no fatal incidents, until October 2014 <ref name="FOneArticle" />. Former Formula One driver Jackie Stewart did even say: "''There is no doubt that Formula | + | *''Formula One racing'' - Is high-performance racer sport, where safety and risk management is taken very seriously. Resulting in a 20-year streak with no fatal incidents, until October 2014 <ref name="FOneArticle" />. Former Formula One driver Jackie Stewart did even say: "''There is no doubt that Formula One has the best risk management of any sport and any industry in the world''"<ref name="FOneQoute" /> |

| − | == Limitations and advantages of | + | == Implementing Risk management == |

| + | [[File:ReducingRisk.jpg|right|thumb|500px|Steps in implementing Risk management <ref name="ProjectManager" />]] | ||

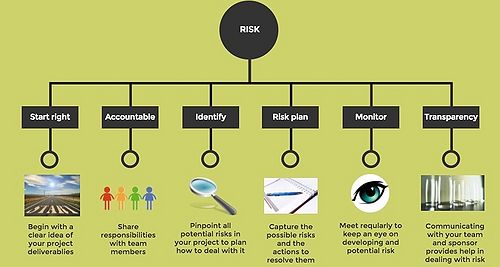

| + | The steps to implementing risk management can be divided into the following steps <ref name="ProjectManager" />: | ||

| + | |||

| + | #'''Start right''' - It is important to have a clear and precise definition of what the project outcome should be, along with project vision, objectives, scope, and deliverables<ref name="ProjectManager" /> <ref name="iso31000" /><sup>(p12)</sup>. | ||

| + | #'''Accountable''' - Involve the whole team and share responsibilities among team members. | ||

| + | #'''Identify''' - Start with identifying the risks (step 1-2 in the [[#Risk Management Process (RMP)|Risk Management Process (RMP)]]) | ||

| + | #'''Risk plan''' - The actions to counter risks is planned and mapped (step 3 in RMP) | ||

| + | #'''Monitor''' - The identified risks are monitored and tracked (Step 4 in RMP) | ||

| + | #'''Transparency''' - Is about communication, being clear and straight up with stakeholders, bosses and employees, which will make the project easier<ref name="ProjectManager" /><ref name="iso31000" /><sup>(p12)</sup>. | ||

| + | |||

| + | |||

| + | Project Managers can use these six steps to implement risk management into their projects. Since projects are different, variations in the implementation can occur. However, these steps are a good guideline. | ||

| + | |||

| + | == Limitations and advantages of Risk management (discussion) == | ||

=== Advantages === | === Advantages === | ||

By having an effective and structured risk management system, organizations will get the following benefits: | By having an effective and structured risk management system, organizations will get the following benefits: | ||

| − | *Increased ability to deliver projects on time, since there will be fewer | + | *Increased ability to deliver projects on time, since there will be fewer surprises. |

*Better use of resources. | *Better use of resources. | ||

*Overview of risks and losses. | *Overview of risks and losses. | ||

*Better quality data for decision making. | *Better quality data for decision making. | ||

| − | |||

*Budgets are less relying on guesswork. | *Budgets are less relying on guesswork. | ||

| − | There are many more benefits of good risk management than just the ones listed here, but this is some of the | + | There are many more benefits of good risk management than just the ones listed here, but this is some of the important ones for organizations. |

| − | Risk management helps organization overview and control risks and therefore make better decisions. Risk management is therefore highly | + | Risk management helps organization overview and control risks and therefore make better decisions. Risk management is therefore highly relevant and should be implemented and used in organizations. |

=== Limitations === | === Limitations === | ||

| − | Risk management has an array of advantages | + | Risk management has an array of advantages. However, risk management also has some limitations: |

*No matter how much preparation is done, accidents and unforeseen events will always happen. | *No matter how much preparation is done, accidents and unforeseen events will always happen. | ||

*Risk management will not delay or remove all risks. | *Risk management will not delay or remove all risks. | ||

*It can be used as decision support, but not as a decision tool. | *It can be used as decision support, but not as a decision tool. | ||

| − | *Risk | + | *Risk management uses a lot of time, to gather information, it has information and can be difficult to implement. <ref name="AdvantageDisadvantage" /> |

| − | Risk Management Process is concerned with managing the identified and quantified risks & mitigations and does not tackle other types of uncertainty | + | Risk Management Process is concerned with managing the identified and quantified risks & mitigations and does not tackle other types of uncertainty like the cost to develop a new prototype or if customers will buy the product <ref name="HowToDoProjects" /><sup>(pp.134-135)</sup>. |

| − | Furthermore, a lot of time and resources can potentially be spent on prioritizing and assessing, risks that are not likely to occur, which will divert resources that could have | + | Furthermore, a lot of time and resources can potentially be spent on prioritizing and assessing, risks that are not likely to occur, which will divert resources that could have allocated more efficiently. |

''' ISO 31000 ''' | ''' ISO 31000 ''' | ||

| − | The ISO 31000 is probably the most used | + | The ISO 31000 is probably the most used risk management standard. However, it has some flaws, which managers need to take into consideration. |

| − | First, a considerable amount of scientific literature arguing for the ISO 31000 is outdated since it uses ideas of risk assessment and characterization as used in the 1970s and 1980s <ref name="CriticArticle" />. | + | First, a considerable amount of scientific literature arguing for the ISO 31000 is outdated since it uses ideas of risk assessment and characterization as used in the 1970s and 1980s, which does not take the fast-changing and connected world which projects happens in today into account <ref name="CriticArticle" />. |

| − | Second | + | Second, the ISO 31000 is often criticized for having a narrow scope, for instance, the standard does not include setting objectives, but it does require that objectives are set. |

| − | + | Furthermore, the guidelines provided in the ISO 31000 can be harder to understand and implement in ''Small and Medium-sized Enterprises'' which is why the ISO 31000 SME <ref name="iso31000sme" /> can be an additional standard, which managers need to take into consideration. | |

| − | + | ||

| − | + | Therefore it is vital that risk managers do not blindly follow the ISO 31000, but read material from multiple sources, for instance, the literature listed in section [[#Annotated Bibliography|Annotated Bibliography]]. | |

| − | + | ||

| − | Therefore it is | + | |

== Conclusion == | == Conclusion == | ||

| − | There will always be risks in projects, and how they are managed will have a large impact on the success of a project | + | There will always be risks in projects, and how they are managed will have a large impact on the success of a project <ref name="PMBogen" /><sup>(p232)</sup>. |

| − | Bad risk management can lead to immense losses and complications, whereas great risk management will lead to better decision making, quality, and budgets for projects. | + | Bad or no risk management can lead to immense losses and complications, whereas great risk management will lead to better decision making, quality, and budgets for projects. |

| − | Naturally, risk management has some limitations such as | + | Naturally, risk management has some limitations such as its time consumption and the missing ability to remove all delays/risks. |

The RMP helps manages to get an overview of potential obstacles that can occur or prevent the team from achieving their goals. By identifying the risks, managers can map them and initiate appropriate measurements to counter them. | The RMP helps manages to get an overview of potential obstacles that can occur or prevent the team from achieving their goals. By identifying the risks, managers can map them and initiate appropriate measurements to counter them. | ||

It is important that managers use risk management, and spent time on improving and develop the risk management programme of companies. | It is important that managers use risk management, and spent time on improving and develop the risk management programme of companies. | ||

| − | Even though risk management naturally is a more integrated and important discipline in some industries, it is recommended that it is used at least to some degree throughout all companies. | + | Even though risk management naturally is a more integrated and important discipline in some industries, it is recommended that it is used at least to some degree throughout all projects and companies. |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

==Literature== | ==Literature== | ||

| Line 217: | Line 215: | ||

*<ref name="RisikoRadio" />: Is a podcast produced by a Danish radio called ''Risiko Radio'', which specialize in risk. However this podcast is in Danish, which can be problematic, the interviewed author J.L. Jensen, also argues for this in his book ''Redefining Risk & Return - The Economic Red Phone Explained'' (ISBN 978-3-319-41368-6). | *<ref name="RisikoRadio" />: Is a podcast produced by a Danish radio called ''Risiko Radio'', which specialize in risk. However this podcast is in Danish, which can be problematic, the interviewed author J.L. Jensen, also argues for this in his book ''Redefining Risk & Return - The Economic Red Phone Explained'' (ISBN 978-3-319-41368-6). | ||

*<ref name="KnownKnownsWiki" />: ''Wikipedia'' is often criticised for is reliability since everybody can edit the pages. However, since this source is used in combination with the book Project Management by H. Pearson <ref name="PMBogen" /> and since this article is a Wikipedia itself, this is not a huge issue. Last modified 02-02-2018 | *<ref name="KnownKnownsWiki" />: ''Wikipedia'' is often criticised for is reliability since everybody can edit the pages. However, since this source is used in combination with the book Project Management by H. Pearson <ref name="PMBogen" /> and since this article is a Wikipedia itself, this is not a huge issue. Last modified 02-02-2018 | ||

| − | *<ref name="RiskMatrixPicture" />: Is written by ''CGE Academy'' which is a information site created by the company ''CGE - Risk Management Solutions''. ''CGE'' is a multinational company which specializes in risk management solutions. The company has over 10.000 end users and a 21% growth over the last five years and it is fair to say that ''CGE'' is a reliable source considering Risk Management. (https://www.cgerisk.com/about-us/) Last modified 24-07-2017 | + | *<ref name="RiskMatrixPicture" />: Is written by ''CGE Academy'' which is a information site created by the company ''CGE - Risk Management Solutions''. ''CGE'' is a multinational company which specializes in risk management solutions. The company has over 10.000 end users and a 21% growth over the last five years, and it is fair to say that ''CGE'' is a reliable source considering Risk Management. (https://www.cgerisk.com/about-us/) Last modified 24-07-2017 |

*<ref name="ResidualInherent" />: ''Nasdaq BWise'' is a global company which helps streamline risk management activities, furthermore the information from their webpage was compared with information from the ISO 31000 <ref name="iso31000" />. (http://www.bwise.com/about) Last modified 29-09-2015 | *<ref name="ResidualInherent" />: ''Nasdaq BWise'' is a global company which helps streamline risk management activities, furthermore the information from their webpage was compared with information from the ISO 31000 <ref name="iso31000" />. (http://www.bwise.com/about) Last modified 29-09-2015 | ||

*<ref name="RMPPic" />: ''Procurement Journey'' is a webpage written by the Schottish Government (http://www.gov.scot/About) and can be seen as a credible source. Last modified 2016 | *<ref name="RMPPic" />: ''Procurement Journey'' is a webpage written by the Schottish Government (http://www.gov.scot/About) and can be seen as a credible source. Last modified 2016 | ||

| − | *<ref name="TreatRisks" />: Is written by ''Chartered Accountants'', which is | + | *<ref name="TreatRisks" />: Is written by ''Chartered Accountants'', which is New Zealand based. They provide business and finance support to over 100.000 members, which is a huge company and therefore must have a lot and specialized knowledge within their field (https://www.charteredaccountantsanz.com/about-us). Furthermore the ISO 31000 <ref name="iso31000" /> is used as a reference on the page. |

| − | *<ref name="AdvantageDisadvantage" /> Is an article published on the business site Wisestep, which can be seen as a credible source. The article was last modified/ | + | *<ref name="ProjectManager" /> Is written by the CEO of "Projectmanager.com, which is a company that produces Project Management software. The company has more than 10.000 users, including NASA, VOLVO, and UN (https://www.projectmanager.com/). The webpage can be seen as credible. However information from webpage is used in combination with information from the ISO 31000 <ref name="iso31000" />. |

| + | *<ref name="AdvantageDisadvantage" /> Is an article published on the business site Wisestep, which can be seen as a credible source. The article was last modified/published 12-02-2018. | ||

However, a more general critic of the use of online source could be based on the following: | However, a more general critic of the use of online source could be based on the following: | ||

| Line 230: | Line 229: | ||

#Information can be twisted to reflect a person or companies interests. | #Information can be twisted to reflect a person or companies interests. | ||

| − | As earlier stated the used online sources are relatively credible (point 1-2). When considering the change and outdatedness (point 3-4) the webpages was last edited between 29-09-2015 and 02-02-2018, which is relatively new and relevant. | + | As earlier stated the used online sources are relatively credible (point 1-2). When considering the change and outdatedness (point 3-4), the webpages was last edited between 29-09-2015 and 02-02-2018, which is relatively new and relevant. |

| − | Since all the internet pages used are on a factual and information level, and not analytical | + | Since all the internet pages used are on a factual and information level, and not analytical the risk of exposure to company interests are minimal (point 5). |

In conclusion, the used internet pages are credible sources. | In conclusion, the used internet pages are credible sources. | ||

| Line 237: | Line 236: | ||

<references> | <references> | ||

| − | <ref name="PMBogen">H. | + | <ref name="PMBogen">Pearson H. "Project Management", ''Pearson Education Limited''. 4th. Edition; 2010.</ref> |

| − | <ref name="iso31000sme">ISO | + | <ref name="iso31000sme">ISO. "31000 Risk Management for smes", ''ISO''; 2015. https://www.iso.org/iso/iso_31000_for_smes.pdf, Visited 07-02-2018</ref> |

| − | <ref name="iso31000">ISO | + | <ref name="iso31000">ISO. "31000 Risk management — Principles and guidelines", ''International Standard''; 2009. </ref> |

| − | <ref name="RiskMatrixPicture">CGE Academy | + | <ref name="RiskMatrixPicture">CGE Academy. "Risk matrices", https://www.cgerisk.com/knowledgebase/Risk_matrices, Visited 05-02-2018</ref> |

| − | <ref name="ResidualInherent">Nasdaq | + | <ref name="ResidualInherent">Nasdaq. "Assessing Risks: Inherent or Residual", http://www.bwise.com/blog/assessing-risks-inherent-or-residual/obj5382859, Visited 08-02-2018</ref> |

| − | <ref name="KnownKnownsWiki">Wikipedia | + | <ref name="KnownKnownsWiki">Wikipedia. "There are known knowns", https://en.wikipedia.org/wiki/There_are_known_knowns, Visited 03-02-2018</ref> |

| − | <ref name="HowToDoProjects">J | + | <ref name="HowToDoProjects">Geraldi J, Thuesen C, Oehmen J. "How to Do Projects". 1st ed. ''Dansk Standard''; 2017.</ref> |

<ref name="TreatRisks">Chartered Accountants, "Treat Risks", https://survey.charteredaccountantsanz.com/risk_management/midsize-firms/treat.aspx, Visited 09-02-2018</ref> | <ref name="TreatRisks">Chartered Accountants, "Treat Risks", https://survey.charteredaccountantsanz.com/risk_management/midsize-firms/treat.aspx, Visited 09-02-2018</ref> | ||

| − | <ref name="RMGeorgUni">Georgetown University | + | <ref name="RMGeorgUni">Georgetown University. "Risk Management Overview", https://riskmanagement.georgetown.edu/overview, Visited 10-02-2018</ref> |

| − | <ref name="RMPPic">Procurement Journey | + | <ref name="RMPPic">Procurement Journey. "Risk Management Process", https://www.procurementjourney.scot/risk-management-process, Visited 10-02-2018</ref> |

| − | <ref name="CriticArticle">T. | + | <ref name="CriticArticle">Aven T. "The flaws of the ISO 31000 conceptualisation of risk", ''Proceedings of the Institution of Mechanical Engineers, Part O: Journal of Risk and Reliability''; 2017.</ref> |

| − | <ref name="RisikoRadio">Risko Radio | + | <ref name="RisikoRadio">Risko Radio. "Episode 027: Hvad er en Risikoejer? Interview med Jesper Lyng Jensen", https://podtail.com/da/podcast/risiko-radio/episode-027-hvad-er-en-risikoejer-interview-med-je/, Visited 13-02-2018</ref> |

| − | <ref name="AdvantageDisadvantage">C. | + | <ref name="AdvantageDisadvantage">Reddy C. "Advantage and Disadvantage of Risk Management" (published: 12/02-2018), ''Wisestep'', https://content.wisestep.com/advantage-disadvantage-risk-management/, Visited 13-02-2018</ref> |

| − | + | <ref name="SamsungArticle">Lopez M. "Samsung Explains Note 7 Battery Explosions, And Turns Crisis Into Opportunity" (published: 22/01-2017), ''Forbes'', https://www.forbes.com/sites/maribellopez/2017/01/22/samsung-reveals-cause-of-note-7-issue-turns-crisis-into-opportunity/#9a47e4b24f12, Visited 15-02-2018</ref> | |

| − | <ref name="SamsungArticle">M. | + | <ref name="VWArticle">Hotten R. "Volkswagen: The scandal explained" (published: 10/12-2015), ''BBC'', http://www.bbc.com/news/business-34324772, Visited 15-02-2018</ref> |

| − | <ref name="VWArticle">R. | + | <ref name="DBArticle">Treanor J. "The $14bn Deutsche Bank fine – all you need to know" (published: 06/09-2016), ''The Guardian'', https://www.theguardian.com/business/2016/sep/16/deutsche-bank-14bn-dollar-fine-doj-q-and-a, Visited 15-02-2018</ref> |

| − | <ref name="DBArticle">J. | + | <ref name="FOneArticle">Gonzalez G. "Formula One risk management strives to prevent racing deaths after tragedies" (published: 16/10-2017), ''Business Insurance'', http://www.businessinsurance.com/article/00010101/NEWS06/912316546/Formula-One-risk-management-strives-to-prevent-racing-deaths-after-tragedies, Visited 15-02-2018</ref> |

| − | <ref name="FOneArticle">G. | + | <ref name="FOneQoute">vGroup. "DFA Launch", http://www.vgroupinternational.com/news-and-media/latest-news/dfa-launch, Visited 15-02-2018</ref> |

| − | <ref name="FOneQoute">vGroup | + | |

| + | <ref name="ProjectManager">Westland J. ProjectManager.com, "What Is Project Risk and Why Should You Care?", https://www.projectmanager.com/blog/what-is-project-risk-and-why-should-you-care, Visited 23-02-2018</ref> | ||

</references> | </references> | ||

| − | === | + | ===Annotated Bibliography=== |

'''Wikipedia articles''' | '''Wikipedia articles''' | ||

| Line 267: | Line 266: | ||

*[[Risk and Opportunities Management]] | *[[Risk and Opportunities Management]] | ||

| − | *[[ | + | *[[#https://en.wikipedia.org/wiki/There_are_known_knowns|There are known knowns]] |

*[[Risk Management in Renewable Energy Projects]] | *[[Risk Management in Renewable Energy Projects]] | ||

| Line 281: | Line 280: | ||

*[[Including Risk Management in Construction Projects]] | *[[Including Risk Management in Construction Projects]] | ||

| − | *[[ISO 31000]] | + | *[[#ISO_31000|ISO 31000]] |

'''Books''' | '''Books''' | ||

| − | + | *Chapter 10 in: Maylor H. "Project Management".4th ed. ''Pearson Education Limited''; 2010. | |

| − | *Chapter 10 in: H. | + | ::This chapter is about Risk & Opportunities Management and describes: ''risk matrix, Rumsfeld's Known-unknowns, qualitative and quantitative approaches, sensitivity analysis, PERT technique'' and ''Monte Carlo simulation''. |

| − | + | *ISO. "31000 Risk management — Principles and guidelines". ''International Standard''; 2009. | |

| − | *ISO | + | ::The golden standard within risk management, it gives a great overview of definitions and approaches to risk management and is, therefore, a must-read. |

| − | + | *Chapter 11 in Project Management Institute. "A guide to the project management body of knowledge: PMBOK Guide". ''Project Management Institute''; 2000. | |

| − | *Chapter 11 in | + | ::This chapter is about Project Risk Management and describes: ''risk Management Planning, Risk Identification, Qualitative Risk Analysis, Quantitative Risk Analysis, Risk Response Planning'' and ''Risk Monitoring and Control. |

| − | *Committee on Foundations of risk analysis | + | *Committee on Foundations of risk analysis. "SRA glossary ". ''Committee on Foundations of risk analysis''; 2015. (Link: http://www.sra.org/sites/default/files/pdf/SRA-glossary-approved22june2015-x.pdf) |

| + | ::The SRA is similar to the ISO 31000, in the way it gives an overview of definitions and approaches to risk management. | ||

| + | *Jensen JL. "Risk & Return - The Economic Red Phone Explained". ''Springer International Publishing AG''; 2017. | ||

| + | ::This book attempt to re-define objective risk, and addresses the critical factor of defining a risk owner. It argues for defining risk owner at the lowest possible management level, and the importance of proper risk management. | ||

'''Articles''' | '''Articles''' | ||

| − | * | + | *Nassim NT, Goldstein DG, Spitznagel MW. "The Six Mistakes Executives Make in Risk Management". ''Harvard Business School Publishing Corporation''. 2009;87(10):123-123 |

| + | ::This article outlines some of the general mistakes managers make when doing risk management, and have some great arguments which managers should take into consideration. | ||

Latest revision as of 15:34, 16 November 2018

Developed by Jonas Heiberg Larsen

Contents |

[edit] Abstract

Projects are part of a dynamic and fast-changing world. Therefore there is a degree of uncertainty and unpredictability in projects. In order to minimize uncertainties and unforeseeable events related to a project, risks are identified and managed throughout the project lifecycle. A risk is an uncertain event that can have e negative effect on one or more objects in a project such as time, cost, performance or scope [1] [2].

This Wiki-article will describe the risk management Process, Risk matrix, Rumsfeld's Unknown-Knowns, inherent- and residual risks. At last limitations and advantages of risk management will be discussed and a brief overview of other relevant reading material is given.

Please note that this article only covers the risk (threat) management of a project and does not look into opportunities management (risks with a positive effect).

In order to control and manage risks, the Risk Management Process (RMP) is used. RMP is divided into four main categories Identify risks, Assess risks, Treat risks and Monitor risks. However, RMP is a continuous process, which happens throughout the lifecycle of a project. [2] [3]

The different natures of risks can be categorized with D. Rumsfeld's Unknown-Knowns and assessed with the risk matrix (both residual- & inherent risk). When treating a risk, the risk managers can choose to Avoid, Reduce, Share or Accept the risk. The risks can be monitored by using a risk register, where risks and countermeasures can be mapped.

Risk management is an essential tool to use in project management and helps managers get an overview of potential obstacles that can occur or prevent a team from achieving their goals. Risk management is a highly importent discipline and should be present in all projects, however, its importance is often neglected. [2] [4]

[edit] Introduction

[edit] Risk definition

Risk can be defined as follows: "Risk is an uncertain event or condition that if occurs, has a positive or negative effect on one or more project objectives such as time, cost and quality, or effect of uncertainty on objectives" All activities in an organization involve risks. These risks can be managed by identifying them, analyzing them and then evaluating whether the risk should be modified by risk treatment in order to satisfy the organization's risk criteria. During this process, risk managers communicate with stakeholders and monitor the risk. The controls are modified to ensure that the amount of risk treatment is minimized. [2](pV)

Risk identification is the "process of finding, recognizing and describing risks" [2](p4). Risk identification involves the identification of risk sources, event, causes and potential consequences. The identification can involve historical data, theoretical analysis, expert opinions, and stakeholder needs [2](p4).

However identification is only the first step, managers also need to analyze the risk to the most significant ones can be dealt with on an ongoing basis [5](p219).

[edit] Rumsfeld's Unknown-Knowns

The different nature of risks can be categorized with former US Defense Secretary, Donald Rumsfeld's definition. Rumsfeld categorizes risks as the following [6] :

- Known-Knowns describes the things we know we know. An example could be the fact that we know that there are some risks in every project or maybe learning's from a previous project.

- Known-Unknowns describes the things we know are uncertain. For example, the delays because of a third party fail to deliver on deadline or human errors administration wise or misunderstandings.

- Unknown-Unknowns describes the things that we in no way could have seen or expected. This could be a sudden death, war or terrorist attack.

- Unknown-Knowns describes the things we should have known, but we for various reason (mostly complexity) don't. An example could be when a terrorist attack happens on American solid, to some extent, this is an Unknown-Known for the CIA [5](pp.219-220).

[edit] Risk matrix

When the risk elements to be managed is identified, the next step is to ensure that either the likelihood is reduced or the impact of that activity occurring.

The risk matrix is one of the most used tools for risk evaluation. The matrix can be used to determine the size of a risk & whether or not a risk is sufficiently controlled.

The risk-matrix is compiled of two dimensions Probability (also called likelihood) and Impact (also called severity). Likelihood is the measure of how likely a given event is, and impact is the effect the risk can do. The combination of these two dimensions gives a collective risk rating in the matrix. Usually, the risk-matrix consists of 3 different risk ratings: Low (Acceptable), Medium and high (Not acceptable), however, some matrixes also have a 4. level very high [7].

The horizontal and vertical scale can have different values or tags, however, in this case, both impact and probability have a scale from 1-5. An example of a risk rating could have a probability of 3 (possible), and an impact of 2 (Minor) would have a collective risk ration of medium [5](p223).

The numeric scale of 1-5 can be hard for managers to visualize and use, therefore more subjective values like unlikely and likely is often used, as seen in the table below.

| Scale (1-5) | Probability (Subjective values) | Impact (Subjective values) |

|---|---|---|

| 1 | Highly unlikely | No impact |

| 2 | Unlikely | Minor |

| 3 | Possible | Medium |

| 4 | Likely | Major |

| 5 | Very likely | Extensive |

It is important to notice that the risk matrix is only used to rank risks, and not as a decision tool itself. How to treat the individual risk the matrix does not answer - other tools and analysis should be used for this (see section Treat risks/Control). The tool, however, can be used to prioritize and categorize the risks, so the risks with the highest rating can be dealt with first and so forth.

Visually risks in the red and yellow area, should, if possible, move towards the green area, when mitigations and controls are applied.

[edit] Residual - & Inherent risks

Identified risks can be categorized into two different categories, depending on, if controls fail or not. The residual risk is the identified risk as it is today, with the controls in place. An example could be the risk of "financial loss if the bank is robbed", however, we have a control in place and hired security people. The inherent risk is the risk we face if the controls for the residual risk fail. For instance, all the security people get food poisoning, and the bank's protection is therefore gone. Naturally the Impact/Probability for the inherent risk should be greater or equal to the ratings in the residual [2] [8].

[edit] Risk Management Process (RMP)

The Risk Management Process can be divided into four main categories Identify risks, Assess risks, Treat risks and Monitor risks.

[edit] Identify risks

The first process is "Identify risks", here potential risk events and their characteristics that can have a negative effect on the project is identified. The identification of risk is a repeatable process since risks can change or new risks are discovered, throughout the project's lifecycle. The identification process can consist of a variety of different stakeholders, project management team, experts, senior managers, etc.

[edit] Assess risks

The second process is "Assess risks", which is used to measure and prioritize risks. In the assessment of risks the probability of each risk occurring & the corresponding impact for the project, if the risk does occur. The probability and impact are then used to prioritize the risks. This process is also repetitive throughout the project. The Risk matrix, as described earlier, can be used for accessing the risks.

[edit] Treat risks/Control

The third process is "Treat risks", here actions to reduce risks, are developed and determined. The treatment of risks can consist of adding additional resources (manpower, budget) into the schedule. However, the treatment should be customized to fit the individual risk and be as realistic and cost-effective as possible. The process also includes measures to avoid, mitigate or deflect the risk. Another possibility is to develop contingency plans which can be used if the risk occurs [1](p138).

Risk Treatment consists of a range of options for mitigating the risk, assessing options, and preparations for implementing action plans. As mentioned earlier (in section Risk matrix) the highest risks should be addressed first and so on and forth. Of course, the cost of treating the risk should be evaluated and compared with a potential loss by risk. Depending on the type and nature of the risk, the following options are available [10]:

- Avoid - The risk is avoided by stopping to proceed with the activity that introduced the risk. Instead, an alternative activity that still meets business objectives is chosen or a less risky approach or process.

- Reduce - The likelihood or effect of the risk is reduced to an acceptable level. However in regards to time and expense, it is desirable to eliminate the risk [5].

- Share or Transfer - The risk is transferred away from the risk-owner. For instance by outsourcing the activities that the risk is tied to, making contracts with service providers or buying insurance that covers that risk.

- Accept - The risk is simply accepted, risks with very low impact and likelihood can often be accepted. A risk can also be accepted if the cost of the treatment outweighs the benefit. By accepting the risk no further action is taken to treat the risk, the risk is of cause still monitored and evaluated on an ongoing basis, due to potential changes [10].

[edit] Monitor risks

The fourth process is "Monitor risks", here actions to track and monitor risks are developed. One of the most common approaches to risk monitoring is to use a risk register, which is initiated at the start of a project and continually reviewed and updated. A risk register should as a minimum contain the following information:

- Risk identification number (Used for identification of risks)

- Risk Owner (Should be clearly defined and registered in the risk register)

- Description of Risk (Makes it easier to communicate risk)

- Results of assessment (Probability/Impact) and assessment date

- Mitigating Actions (Actions to address the risk)

- Date for next risk review [9].

It is important to note that risks should be monitored, reviewed and controlled on an ongoing base. The controlling of risks is done by continuous tracking of identified risks while identifying and analyzing new risks. Risks and the effectiveness of controls and mitigations should be evaluated throughout the project life cycle [3](p142).

[edit] Risk management

[edit] Risk management in different industries

Risk management is relevant for all industries. However, the degree of importance and impact can vary a lot. Risk management is highly essential in sectors like finance/banks, Formula One, drilling oil & gas or space programs. Where big money can be lost, reputations ruined or even lives lost. Risk management is especially important in the following areas:

- Construction

- Medical procedures

- Disaster and terrorism management

- Tech companies

- Oil and gas

- Financial

- Large government projects

- Pharmaceutical sector

The parameters used to measure the impact can also vary a lot. For an R&D project, the impact measurements could be delays, financial and mistakes while a bank could use reputational, regulatory, and financial scales to measure the impact. The space program could be an operational risk such as the risk of burning up when astronauts are reentering the atmosphere. While financial institutions could loose reputation or customers if they have a security breach, like hacking or transferring the wrong amount of money from one customer to another.

[edit] Examples of good and bad risk management

Bad:

- Volkswagen - Dieselgate: In 2015 it was discovered that car manufacturer VW was cheating in emissions test, which made their cars seem more eco-friendly. This act resulted in a recall which costed around 6.7 billion euro and resulted in the company posting its first quarterly loss in 15 years. [11]

- Samsung - Galaxy Note 7 smartphone explosions: When Samsung launched Galaxy Note 7 in August 2017, there was a fatal error with the batteries which caused them to explode, and Samsung was forced to recall 2 million devices with an estimated cost of 5.3 billion USD. [12]

- Deutsche Bank -Fined 14 billion USD: Deutsche Bank was fined 14 billion USD, by the US for misselling mortgage securities in the US. The bank selected mortgages, packed them into bonds (RMBS) and sold on to investors.[13]

Good:

- NASA - mission planning and real-time mission operations: NASA is known for having a lot of risks in their projects, and have managed to excel in risk management.

- Formula One racing - Is high-performance racer sport, where safety and risk management is taken very seriously. Resulting in a 20-year streak with no fatal incidents, until October 2014 [14]. Former Formula One driver Jackie Stewart did even say: "There is no doubt that Formula One has the best risk management of any sport and any industry in the world"[15]

[edit] Implementing Risk management

The steps to implementing risk management can be divided into the following steps [16]:

- Start right - It is important to have a clear and precise definition of what the project outcome should be, along with project vision, objectives, scope, and deliverables[16] [2](p12).

- Accountable - Involve the whole team and share responsibilities among team members.

- Identify - Start with identifying the risks (step 1-2 in the Risk Management Process (RMP))

- Risk plan - The actions to counter risks is planned and mapped (step 3 in RMP)

- Monitor - The identified risks are monitored and tracked (Step 4 in RMP)

- Transparency - Is about communication, being clear and straight up with stakeholders, bosses and employees, which will make the project easier[16][2](p12).

Project Managers can use these six steps to implement risk management into their projects. Since projects are different, variations in the implementation can occur. However, these steps are a good guideline.

[edit] Limitations and advantages of Risk management (discussion)

[edit] Advantages

By having an effective and structured risk management system, organizations will get the following benefits:

- Increased ability to deliver projects on time, since there will be fewer surprises.

- Better use of resources.

- Overview of risks and losses.

- Better quality data for decision making.

- Budgets are less relying on guesswork.

There are many more benefits of good risk management than just the ones listed here, but this is some of the important ones for organizations. Risk management helps organization overview and control risks and therefore make better decisions. Risk management is therefore highly relevant and should be implemented and used in organizations.

[edit] Limitations

Risk management has an array of advantages. However, risk management also has some limitations:

- No matter how much preparation is done, accidents and unforeseen events will always happen.

- Risk management will not delay or remove all risks.

- It can be used as decision support, but not as a decision tool.

- Risk management uses a lot of time, to gather information, it has information and can be difficult to implement. [17]

Risk Management Process is concerned with managing the identified and quantified risks & mitigations and does not tackle other types of uncertainty like the cost to develop a new prototype or if customers will buy the product [1](pp.134-135). Furthermore, a lot of time and resources can potentially be spent on prioritizing and assessing, risks that are not likely to occur, which will divert resources that could have allocated more efficiently.

ISO 31000

The ISO 31000 is probably the most used risk management standard. However, it has some flaws, which managers need to take into consideration.

First, a considerable amount of scientific literature arguing for the ISO 31000 is outdated since it uses ideas of risk assessment and characterization as used in the 1970s and 1980s, which does not take the fast-changing and connected world which projects happens in today into account [18].

Second, the ISO 31000 is often criticized for having a narrow scope, for instance, the standard does not include setting objectives, but it does require that objectives are set. Furthermore, the guidelines provided in the ISO 31000 can be harder to understand and implement in Small and Medium-sized Enterprises which is why the ISO 31000 SME [19] can be an additional standard, which managers need to take into consideration.

Therefore it is vital that risk managers do not blindly follow the ISO 31000, but read material from multiple sources, for instance, the literature listed in section Annotated Bibliography.

[edit] Conclusion

There will always be risks in projects, and how they are managed will have a large impact on the success of a project [5](p232).

Bad or no risk management can lead to immense losses and complications, whereas great risk management will lead to better decision making, quality, and budgets for projects. Naturally, risk management has some limitations such as its time consumption and the missing ability to remove all delays/risks.

The RMP helps manages to get an overview of potential obstacles that can occur or prevent the team from achieving their goals. By identifying the risks, managers can map them and initiate appropriate measurements to counter them. It is important that managers use risk management, and spent time on improving and develop the risk management programme of companies.

Even though risk management naturally is a more integrated and important discipline in some industries, it is recommended that it is used at least to some degree throughout all projects and companies.

[edit] Literature

[edit] References Credibility

This section contains a brief discussion of the used online sources credibility. This is done to ensure transparency and provide a high-quality list of sourcing which the reader can follow up on.

- [3]: Is written by the Office of risk management at Georgetown University and can, therefore, be seen as an academically valid source.

- [4]: Is a podcast produced by a Danish radio called Risiko Radio, which specialize in risk. However this podcast is in Danish, which can be problematic, the interviewed author J.L. Jensen, also argues for this in his book Redefining Risk & Return - The Economic Red Phone Explained (ISBN 978-3-319-41368-6).

- [6]: Wikipedia is often criticised for is reliability since everybody can edit the pages. However, since this source is used in combination with the book Project Management by H. Pearson [5] and since this article is a Wikipedia itself, this is not a huge issue. Last modified 02-02-2018

- [7]: Is written by CGE Academy which is a information site created by the company CGE - Risk Management Solutions. CGE is a multinational company which specializes in risk management solutions. The company has over 10.000 end users and a 21% growth over the last five years, and it is fair to say that CGE is a reliable source considering Risk Management. (https://www.cgerisk.com/about-us/) Last modified 24-07-2017

- [8]: Nasdaq BWise is a global company which helps streamline risk management activities, furthermore the information from their webpage was compared with information from the ISO 31000 [2]. (http://www.bwise.com/about) Last modified 29-09-2015

- [9]: Procurement Journey is a webpage written by the Schottish Government (http://www.gov.scot/About) and can be seen as a credible source. Last modified 2016

- [10]: Is written by Chartered Accountants, which is New Zealand based. They provide business and finance support to over 100.000 members, which is a huge company and therefore must have a lot and specialized knowledge within their field (https://www.charteredaccountantsanz.com/about-us). Furthermore the ISO 31000 [2] is used as a reference on the page.

- [16] Is written by the CEO of "Projectmanager.com, which is a company that produces Project Management software. The company has more than 10.000 users, including NASA, VOLVO, and UN (https://www.projectmanager.com/). The webpage can be seen as credible. However information from webpage is used in combination with information from the ISO 31000 [2].

- [17] Is an article published on the business site Wisestep, which can be seen as a credible source. The article was last modified/published 12-02-2018.

However, a more general critic of the use of online source could be based on the following:

- Information available on the Internet is not regulated for quality or accuracy.

- Almost anyone can publish anything they wish on the internet.

- The information on a given webpage can change over time.

- The information can be outdated.

- Information can be twisted to reflect a person or companies interests.

As earlier stated the used online sources are relatively credible (point 1-2). When considering the change and outdatedness (point 3-4), the webpages was last edited between 29-09-2015 and 02-02-2018, which is relatively new and relevant. Since all the internet pages used are on a factual and information level, and not analytical the risk of exposure to company interests are minimal (point 5). In conclusion, the used internet pages are credible sources.

[edit] References

- ↑ 1.0 1.1 1.2 Geraldi J, Thuesen C, Oehmen J. "How to Do Projects". 1st ed. Dansk Standard; 2017.

- ↑ 2.00 2.01 2.02 2.03 2.04 2.05 2.06 2.07 2.08 2.09 2.10 2.11 ISO. "31000 Risk management — Principles and guidelines", International Standard; 2009.

- ↑ 3.0 3.1 3.2 Georgetown University. "Risk Management Overview", https://riskmanagement.georgetown.edu/overview, Visited 10-02-2018

- ↑ 4.0 4.1 Risko Radio. "Episode 027: Hvad er en Risikoejer? Interview med Jesper Lyng Jensen", https://podtail.com/da/podcast/risiko-radio/episode-027-hvad-er-en-risikoejer-interview-med-je/, Visited 13-02-2018

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 Pearson H. "Project Management", Pearson Education Limited. 4th. Edition; 2010.

- ↑ 6.0 6.1 Wikipedia. "There are known knowns", https://en.wikipedia.org/wiki/There_are_known_knowns, Visited 03-02-2018

- ↑ 7.0 7.1 7.2 CGE Academy. "Risk matrices", https://www.cgerisk.com/knowledgebase/Risk_matrices, Visited 05-02-2018

- ↑ 8.0 8.1 Nasdaq. "Assessing Risks: Inherent or Residual", http://www.bwise.com/blog/assessing-risks-inherent-or-residual/obj5382859, Visited 08-02-2018

- ↑ 9.0 9.1 9.2 Procurement Journey. "Risk Management Process", https://www.procurementjourney.scot/risk-management-process, Visited 10-02-2018

- ↑ 10.0 10.1 10.2 Chartered Accountants, "Treat Risks", https://survey.charteredaccountantsanz.com/risk_management/midsize-firms/treat.aspx, Visited 09-02-2018

- ↑ Hotten R. "Volkswagen: The scandal explained" (published: 10/12-2015), BBC, http://www.bbc.com/news/business-34324772, Visited 15-02-2018

- ↑ Lopez M. "Samsung Explains Note 7 Battery Explosions, And Turns Crisis Into Opportunity" (published: 22/01-2017), Forbes, https://www.forbes.com/sites/maribellopez/2017/01/22/samsung-reveals-cause-of-note-7-issue-turns-crisis-into-opportunity/#9a47e4b24f12, Visited 15-02-2018

- ↑ Treanor J. "The $14bn Deutsche Bank fine – all you need to know" (published: 06/09-2016), The Guardian, https://www.theguardian.com/business/2016/sep/16/deutsche-bank-14bn-dollar-fine-doj-q-and-a, Visited 15-02-2018

- ↑ Gonzalez G. "Formula One risk management strives to prevent racing deaths after tragedies" (published: 16/10-2017), Business Insurance, http://www.businessinsurance.com/article/00010101/NEWS06/912316546/Formula-One-risk-management-strives-to-prevent-racing-deaths-after-tragedies, Visited 15-02-2018

- ↑ vGroup. "DFA Launch", http://www.vgroupinternational.com/news-and-media/latest-news/dfa-launch, Visited 15-02-2018

- ↑ 16.0 16.1 16.2 16.3 16.4 Westland J. ProjectManager.com, "What Is Project Risk and Why Should You Care?", https://www.projectmanager.com/blog/what-is-project-risk-and-why-should-you-care, Visited 23-02-2018

- ↑ 17.0 17.1 Reddy C. "Advantage and Disadvantage of Risk Management" (published: 12/02-2018), Wisestep, https://content.wisestep.com/advantage-disadvantage-risk-management/, Visited 13-02-2018

- ↑ Aven T. "The flaws of the ISO 31000 conceptualisation of risk", Proceedings of the Institution of Mechanical Engineers, Part O: Journal of Risk and Reliability; 2017.

- ↑ ISO. "31000 Risk Management for smes", ISO; 2015. https://www.iso.org/iso/iso_31000_for_smes.pdf, Visited 07-02-2018

[edit] Annotated Bibliography

Wikipedia articles

Books

- Chapter 10 in: Maylor H. "Project Management".4th ed. Pearson Education Limited; 2010.

- This chapter is about Risk & Opportunities Management and describes: risk matrix, Rumsfeld's Known-unknowns, qualitative and quantitative approaches, sensitivity analysis, PERT technique and Monte Carlo simulation.

- ISO. "31000 Risk management — Principles and guidelines". International Standard; 2009.

- The golden standard within risk management, it gives a great overview of definitions and approaches to risk management and is, therefore, a must-read.

- Chapter 11 in Project Management Institute. "A guide to the project management body of knowledge: PMBOK Guide". Project Management Institute; 2000.

- This chapter is about Project Risk Management and describes: risk Management Planning, Risk Identification, Qualitative Risk Analysis, Quantitative Risk Analysis, Risk Response Planning and Risk Monitoring and Control.

- Committee on Foundations of risk analysis. "SRA glossary ". Committee on Foundations of risk analysis; 2015. (Link: http://www.sra.org/sites/default/files/pdf/SRA-glossary-approved22june2015-x.pdf)

- The SRA is similar to the ISO 31000, in the way it gives an overview of definitions and approaches to risk management.

- Jensen JL. "Risk & Return - The Economic Red Phone Explained". Springer International Publishing AG; 2017.

- This book attempt to re-define objective risk, and addresses the critical factor of defining a risk owner. It argues for defining risk owner at the lowest possible management level, and the importance of proper risk management.

Articles

- Nassim NT, Goldstein DG, Spitznagel MW. "The Six Mistakes Executives Make in Risk Management". Harvard Business School Publishing Corporation. 2009;87(10):123-123

- This article outlines some of the general mistakes managers make when doing risk management, and have some great arguments which managers should take into consideration.