Key performance indicators for portfolio management

(→What is Key Performance Indicators (KPIs)?) |

(→Application) |

||

| Line 35: | Line 35: | ||

== Application == | == Application == | ||

| − | + | Many challenges can be identified when it comes to portfolio management in engineering consultancy. Firms take on multiple projects across departments that specialize in different subjects. Some of these projects can start next month and some are tender projects. A tender is defined as the invitation from the stakeholder to carry out and solve a problem for a project. It’s important to mention that tender projects are not projects won but in the phase of bidding. Portfolio managers, evaluate and manage the performance of many departments (programs) and their projects as a whole <ref> [Controlling a Multibillion Project Portfolio - Milestones as Key Performance Indicator for Project Portfolio Management] https://www.sciencedirect.com/science/article/pii/S1877042816308771 </ref> <ref> [Tender in Finance] https://www.investopedia.com/terms/t/tender.asp </ref>. Thus, it becomes important to track the progress of each department and see if more resource allocation is needed. Within engineering consultancy and consultancy in general, projects vary in size but also in priority. The field is a fast-paced environment and many initiatives come and go. Therefore, it is important to balance the distribution of resources on ongoing projects but also have resources and FTEs (Full-time employees) available for mega projects. This is where KPIs come in. Primary KPIs are used to track the overall performance of the portfolio, whereas secondary KPIs are used to track individual project performance. Primary KPIs may include revenue, profit, and deviation between target and budget for each department, while secondary KPIs may include a measure of project completion time, resource utilization, and project cost. | |

| − | + | The benefit of using primary and secondary KPIs in engineering consultancy portfolio management is the ability to track progress. The measure of KPIs at a regular frequency is crucial in ensuring everything runs smoothly and according to the project plan. By measuring the right KPIs at regular intervals, portfolio managers can identify trends and make strategic decisions to improve overall performance <ref> [The key performance indicators (KPIs) and their impact on overall organizational performance] https://link.springer.com/article/10.1007/s11135-013-9945-y </ref>. Through regular meetings with financial controllers and project managers, KPIs can be used to identify potential risks but also opportunities allowing firms to address the issues and capitalize on the strengths. | |

| − | + | Another important aspect of using KPIs in engineering consultancy is the ability to communicate progress and success to key stakeholders in the organization. Higher officials in the organization are often interested in measurable results and KPIs provide exactly a clear but also an objective way of demonstrating the value of the firm’s services. A balanced set of primary and secondary KPIs must cover financial, customer satisfaction, sustainability, and growth KPIs <ref> [The key performance indicators (KPIs) and their impact on overall organizational performance] https://link.springer.com/article/10.1007/s11135-013-9945-y </ref>. An example of primary KPIs is Turnover, EBIT margin, Accounts receivable (AR), Backlog, and EBIT. For secondary KPIs that could be WIP, Own production (OP), Project cost, contingency, and CO2 emissions. | |

| − | + | It's crucial to remember that KPIs should be carefully chosen and customized to the unique requirements of the company and its initiatives. Not all KPIs will be applicable or meaningful in every circumstance, and utilizing the incorrect KPIs may have unfavorable effects. KPIs should also be routinely checked to make sure they are still offering insightful data and are in line with the aims and objectives of the company <ref> [The key performance indicators (KPIs) and their impact on overall organizational performance] https://link.springer.com/article/10.1007/s11135-013-9945-y </ref> <ref> [Important KPIs and Metrics for Portfolio management] https://projectric.com/blog/kpis-and-metrics-for-project-portfolio-management-ppm/ </ref>. | |

| − | + | While there is no one-size-fits-all approach to selecting KPIs for portfolio management if there is a standardized way of reporting and consistency within the organization, the use of KPIs can change and different KPIs may be explored. The status quo on KPIs is that they are an essential tool for measuring and tracking portfolio performance <ref> [Important KPIs and Metrics for Portfolio management] https://projectric.com/blog/kpis-and-metrics-for-project-portfolio-management-ppm/ </ref> <ref> [Controlling a Multibillion Project Portfolio - Milestones as Key Performance Indicator for Project Portfolio Management] https://www.sciencedirect.com/science/article/pii/S1877042816308771 </ref>. The status quo on KPIs is that they are an essential tool for measuring and tracking portfolio performance. | |

| − | + | ||

| − | - | + | |

== Limitations == | == Limitations == | ||

Revision as of 14:38, 9 April 2023

Contents |

Introduction

The measurement and transparent reporting of key performance indicators (KPIs) are extremely beneficial for portfolio managers in making informed and improved decisions regarding resource allocation and risk management. By tracking specific metrics, portfolio managers can determine which programs and projects are delivering on time and which are underperforming. The metrics required by portfolio managers vary depending on the industry in which they operate. In this article, the focus will be on appropriate primary and secondary KPIs for managing a portfolio in the consultancy industry. In this industry, time is the commodity sold, with the product being derived from the knowledge, expertise, and advice provided to the client.

The main aim of this article is to differentiate between KPIs used in product, project, and portfolio management. The primary KPIs that will be discussed in portfolio management are Turnover, EBIT margin, Accounts Receivable, and Backlog, while the secondary KPIs discussed are Work-in-Progress (WIP), Own Production (OP), and Contingency. It is often assumed that the same KPIs are used in a project, program, and portfolio management, but that is not the case. KPIs used in project management tend to focus on the operational aspects of managing a project, while portfolio management considers the strategic implications of projects and programs. Furthermore, the application of KPIs in managing a large energy portfolio for a leading engineering consultancy will be demonstrated. Portfolios, unlike programs and projects with a short life cycle, often have longer longevity and thus require ongoing management attention. At last, the limitations of KPIs will be discussed, specifically the accuracy of data, contextual issues, and limited information. .[1] [2]

What is Key Performance Indicators (KPIs)?

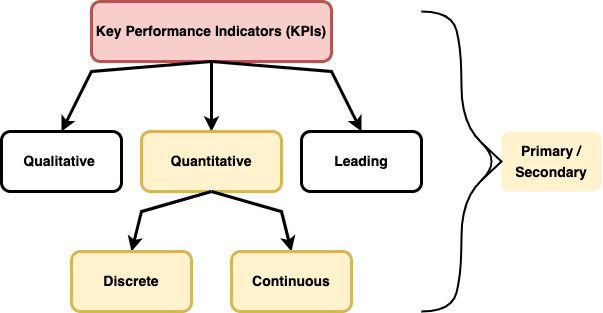

Peter Drucker, an Austrian American consultant, contributed to the philosophical and practical foundations of modern business corporations and management. He notably said, "What gets measured gets done… Even if it harms the purpose of the organization to do so." [3] [4] Measures and targets are essential management tools that help organizations, companies, and portfolio managers identify their strengths, weaknesses, and areas for improvement while also setting benchmarks with historical data. There are three overall types of Key Performance Indicators (KPIs): quantitative indicators measuring a target often set based on historical data, qualitative indicators measuring a target that cannot be expressed by numbers, and leading indicators that predict the outcome of a given process. Qualitative and leading indicators are essential KPIs and should not be overlooked when managing a portfolio. However, they are not the focus of this paper. [5] Examples of such indicators include employee satisfaction for qualitative indicators and average hours worked for leading indicators. Indicators of the quantitative type can be classified as either discrete variables or continuous variables. For instance, a KPI for a portfolio could be getting ten new projects in a specific month, which is classified as a discrete variable. Reaching a perfect Net Promoter Score (NPS) is a continuous variable as this value can range from -100 to 100. For context, the Net Promoter score is the gold standard in the corporate industry and especially in Consultancy which measures customer loyalty and satisfaction. NPS is a customer-centric KPI and is used to indicate the level of how a business is perceived by their customer. High NPS scores indicate highly satisfied customers who are more likely to come back and do business again. [6]

Primary Vs. Secondary KPIs in portfolio management

In addition to the three types of KPIs and the types of variables that exist within each category, Key Performance Indicators can also be categorized as primary and secondary KPIs. A primary KPI is a direct quantifiable measure of a process, while a secondary metric provides added information that aids in understanding the target of a portfolio, as it is not nearly tied to the actual result. Categorization of KPIs is not only used in monthly or weekly reporting of organizational performance but is also done on a portfolio management level. This enables portfolio managers to understand the performance and health of their specific portfolio, giving them governance over it.

Depending on the size, type of projects/programs, and industry, some KPIs might be more useful and provide a more holistic overview. As previously mentioned in the introduction, the industry being discussed is the consultancy industry, specifically the type of consultancy where time is the commodity sold. Some primary KPIs that are used to measure such a portfolio are: (Peterson Drake & Fabozzi, 2010, Chapter 4). [7]

- Turnover: The measure of the revenue generated by projects or programs in a portfolio in a specific period, including taxes. The following metric provides valuable insights into the financial performance and can help gauge its growth trajectory. [8]

- EBIT Margin: Measuring the overall portfolio performance and portfolio’s operating profitability. This KPI is calculated in simple terms by dividing the EBIT by turnover and provides a measure of the portfolio’s ability to generate profits from its operations. The EBIT margin may vary from the industry due to the competitive environment, the cost structure of the firm, and market demand. For instance, airlines and manufacturing industries tend to have a lower EBIT margin while consulting and software have much higher margins. Part of the reason is due to their highly skilled and specialized workforce and expertise that comes at a high-cost price; thus consultancy is considered a high-value service [9]. his was especially evident during COVID, of which major tech firms presented strong financial results [10].

- Accounts receivable (AR): AR refers to the amount of money owed to the portfolio for the work done on a project/program that has been delivered but not yet paid. A high AR can be an indication of potential cash flow issues, and managing it effectively is essential for the financial health of a consultancy. Specifically, in consultancy (and depending on the payment structure), portfolios with high AR tend to have projects that are still active, since projects are paid off after project handover.

- Backlog: The amount of work contracted (Won and signed), but either not started or not completed. This KPI provides insights into the demand for a consultancy's services and can help them plan their resources and capacity more effectively. By tracking backlog, a consultancy can ensure that it has a healthy pipeline of work and can manage its resources more efficiently [11].

The above-mentioned KPIs are excellent for tracking a portfolio as they provide great governance over the health and progress of the portfolio. For instance, accounts receivable (AR) provides information on the "balance of money due to a firm for goods or services delivered or used but not yet paid for by the customer" [12]. Meanwhile, backlog provides the portfolio manager with knowledge of the number of projects/programs won but not yet started. This is extremely important as it provides insight to the portfolio manager on how much-expected revenue is yet to be realized. This information is also greatly beneficial to the portfolio manager as they can prioritize projects and schedule them in a manner that doesn’t overload their employees with stress or work overload.

Furthermore, some secondary KPIs used to track progress and health of a portfolio in the consultancy industry could be as follows:

- Work-in-Progress (WIP): The measure of the partially completed work on projects/ programs. The following secondary KPI provides insight into the progress of the work and how much is yet to be completed. Tracking Work-in-progress ensures the status of the work and thus the Portfolio manager can identify potential delays or issues that may impact the timeline or/ and the budget.[13]

- Own Production (OP): This KPI measures the work done on projects or programs by a company using its resources. It is calculated by multiplying the hours spent by the base rate of each employee on the project. This KPI helps to measure the effectiveness of a portfolio's resource allocation and utilization of its internal operations. PMs monitor this specific KPI to identify the area of improvement and reduce cost.

- Contingency: The measure of the provision set aside to cover unforeseen risks that may impact a project's timeline, scope, or in the worst case budget. Contingency serves as a safety net as it helps the PM to manage the risk and uncertainty associated with the portfolio. By having a contingency plan in place, a PM can better manage unexpected events, and reduce the impact on the overall budget of the portfolio [14].

These secondary KPIs provide an indirect overview of the portfolio as they are not directly tied to primary KPIs such as turnover or EBIT. Work-in-Progress (WIP) provides portfolio managers with great insight into ongoing projects and helps manage the work done on projects. This KPI is often used in parallel with Backlog to gain a holistic understanding of the production process and the demand for the project/program. This information is used by the portfolio manager to forecast future revenue and cash flow and identify potential bottlenecks or capacity constraints, which can then be used to make informed decisions about resource allocation and planning. For example, if the portfolio manager notices that the backlog is low and the WIP is high, then a project/program is running efficiently and there is an excess capacity of employees that could be reallocated to other ongoing projects/programs in the portfolio. (Peterson Drake & Fabozzi, 2010, Chapter 13). [15]

Application

Many challenges can be identified when it comes to portfolio management in engineering consultancy. Firms take on multiple projects across departments that specialize in different subjects. Some of these projects can start next month and some are tender projects. A tender is defined as the invitation from the stakeholder to carry out and solve a problem for a project. It’s important to mention that tender projects are not projects won but in the phase of bidding. Portfolio managers, evaluate and manage the performance of many departments (programs) and their projects as a whole [16] [17]. Thus, it becomes important to track the progress of each department and see if more resource allocation is needed. Within engineering consultancy and consultancy in general, projects vary in size but also in priority. The field is a fast-paced environment and many initiatives come and go. Therefore, it is important to balance the distribution of resources on ongoing projects but also have resources and FTEs (Full-time employees) available for mega projects. This is where KPIs come in. Primary KPIs are used to track the overall performance of the portfolio, whereas secondary KPIs are used to track individual project performance. Primary KPIs may include revenue, profit, and deviation between target and budget for each department, while secondary KPIs may include a measure of project completion time, resource utilization, and project cost.

The benefit of using primary and secondary KPIs in engineering consultancy portfolio management is the ability to track progress. The measure of KPIs at a regular frequency is crucial in ensuring everything runs smoothly and according to the project plan. By measuring the right KPIs at regular intervals, portfolio managers can identify trends and make strategic decisions to improve overall performance [18]. Through regular meetings with financial controllers and project managers, KPIs can be used to identify potential risks but also opportunities allowing firms to address the issues and capitalize on the strengths.

Another important aspect of using KPIs in engineering consultancy is the ability to communicate progress and success to key stakeholders in the organization. Higher officials in the organization are often interested in measurable results and KPIs provide exactly a clear but also an objective way of demonstrating the value of the firm’s services. A balanced set of primary and secondary KPIs must cover financial, customer satisfaction, sustainability, and growth KPIs [19]. An example of primary KPIs is Turnover, EBIT margin, Accounts receivable (AR), Backlog, and EBIT. For secondary KPIs that could be WIP, Own production (OP), Project cost, contingency, and CO2 emissions.

It's crucial to remember that KPIs should be carefully chosen and customized to the unique requirements of the company and its initiatives. Not all KPIs will be applicable or meaningful in every circumstance, and utilizing the incorrect KPIs may have unfavorable effects. KPIs should also be routinely checked to make sure they are still offering insightful data and are in line with the aims and objectives of the company [20] [21].

While there is no one-size-fits-all approach to selecting KPIs for portfolio management if there is a standardized way of reporting and consistency within the organization, the use of KPIs can change and different KPIs may be explored. The status quo on KPIs is that they are an essential tool for measuring and tracking portfolio performance [22] [23]. The status quo on KPIs is that they are an essential tool for measuring and tracking portfolio performance.

Limitations

Accuracy of data

- Driving these KPIs and the measure of them all requires proper data structure and good validation. For instance, concise reporting and autonomous updating of reports. Real life data and not on monthly basis. Problems must be dealt with right away and not at the end of the month.

Contextual issues

- The governance and overview must not be all about numbers and data. Sometimes problems are much bigger than this. For example, a portfolio manager may see that a project is behind schedule, but without additional context, it may not be clear why the project is behind schedule or what impact this will have on the portfolio.

Limited information

- KPIs might not give the whole picture of what is really going on in a project. For example, a portfolio manager may see that a project is on budget, but without additional information, it may not be clear whether the project is progressing according to plan or if other aspects of the project are causing problems. o All about tracking on the right KPIs and use them in a sensible manner.

Reflection

In conclusion, paying attention to KPIs is essential to achieve optimal performance and align with organizational strategies, goals, and objectives.

Annotated bibliography

1.1 Purpose of The Standard for Portfolio Management

KPIs for effective portfolio management

Referenfes

- ↑ [1.1 Purpose of the standard for Portfolio Management] https://content.knovel.com/content/pdf/13786/51975_01.pdf?ekey=f2AgMtPziM6rvTNh5JfrbVinHPOx3NMTm4v3_d5aDHGzHAowSUCkBwnfmZAGnYSOWa

- ↑ [KPIs for effective portfolio management] https://thinkingportfolio.com/en/7-key-kpis-for-effective-project-portfolio-management/

- ↑ [Peter Drucker management theory] https://www.businessnewsdaily.com/10634-peter-drucker-management-theory.html

- ↑ [Peter Drucker famous quote. From Corporate finance review ] https://static.store.tax.thomsonreuters.com/static/relatedresource/CMJ--15-01%20sample-article.pdf

- ↑ [Guide to types of KPIs] https://www.brightgauge.com/blog/quick-guide-to-11-types-of-kpis

- ↑ [Good and bad market research: A critical review of Net Promoter Score] https://onlinelibrary.wiley.com/doi/full/10.1002/asmb.2417?casa_token=KnYnaDzXVP4AAAAA%3AfDrktMvhgLlfHuNWARfVJ9sh_R9V3gUrfWje590vrk5ri5S0UH4gUGtP4BLmVlX4zCRRFu51_Wv7OSO1

- ↑ [The basics of finance: An introduction to financial markets, business finance and portfolio management] http://dspace.vnbrims.org:13000/jspui/bitstream/123456789/4796/1/The%20Basics%20of%20Finance%20An%20Introduction%20to%20Financial%20Markets%2C%20Business%20Finance%2C%20and%20Portfolio%20Management.pdf

- ↑ [Corporate growth of engineering consulting firms: a European review] https://www.tandfonline.com/doi/epdf/10.1080/01446190210139487?needAccess=true

- ↑ [Industries and EBITDA] https://www.investopedia.com/ask/answers/052015/which-industries-tend-have-greatest-ebitda-margins.asp

- ↑ [Prospering in the pandemic: Winners and losers of the COVID era] https://www.ft.com/content/8075a9c5-3c43-48a5-b507-5b8f5904f443

- ↑ [Backlog] https://www.investopedia.com/terms/b/backlog.asp

- ↑ [Accounts recivable information ] https://www.investopedia.com/terms/a/accountsreceivable.asp

- ↑ [Managing work-in-progress (WIP) by Focusing on finishing] https://www.pmi.org/disciplined-agile/da-value-stream-consultant-resources/manage-work-in-process-wip

- ↑ [Contingency-based approach to firm performance in construction] https://ascelibrary.org/doi/abs/10.1061/(ASCE)CO.1943-7862.0000738

- ↑ [The basics of finance: An introduction to financial markets, business finance and portfolio management] http://dspace.vnbrims.org:13000/jspui/bitstream/123456789/4796/1/The%20Basics%20of%20Finance%20An%20Introduction%20to%20Financial%20Markets%2C%20Business%20Finance%2C%20and%20Portfolio%20Management.pdf

- ↑ [Controlling a Multibillion Project Portfolio - Milestones as Key Performance Indicator for Project Portfolio Management] https://www.sciencedirect.com/science/article/pii/S1877042816308771

- ↑ [Tender in Finance] https://www.investopedia.com/terms/t/tender.asp

- ↑ [The key performance indicators (KPIs) and their impact on overall organizational performance] https://link.springer.com/article/10.1007/s11135-013-9945-y

- ↑ [The key performance indicators (KPIs) and their impact on overall organizational performance] https://link.springer.com/article/10.1007/s11135-013-9945-y

- ↑ [The key performance indicators (KPIs) and their impact on overall organizational performance] https://link.springer.com/article/10.1007/s11135-013-9945-y

- ↑ [Important KPIs and Metrics for Portfolio management] https://projectric.com/blog/kpis-and-metrics-for-project-portfolio-management-ppm/

- ↑ [Important KPIs and Metrics for Portfolio management] https://projectric.com/blog/kpis-and-metrics-for-project-portfolio-management-ppm/

- ↑ [Controlling a Multibillion Project Portfolio - Milestones as Key Performance Indicator for Project Portfolio Management] https://www.sciencedirect.com/science/article/pii/S1877042816308771