Portfolio Management using the BCG-Matrix

(→Strategic Business Units (SBU) and Product Markets) |

|||

| Line 33: | Line 33: | ||

#'''Question Marks''' | #'''Question Marks''' | ||

#:Question marks are in the upper right quadrant. With high growth but low market share question marks have the worst cash characteristics. Because of high growth they require huge amounts of cash but only provide very little as their market position is weak. Many businesses within a company fall into this category and key will be if a company can develop these business towards stars or cash cows. However, if this attempt fails, question marks become the ultimate ''cash trap'' as they only absorb large amounts of cash throughout their existence. A company has to make thoughtful decisions in which (few) question marks should be further invested and which ones should be liquidated on time in order to save resources. | #:Question marks are in the upper right quadrant. With high growth but low market share question marks have the worst cash characteristics. Because of high growth they require huge amounts of cash but only provide very little as their market position is weak. Many businesses within a company fall into this category and key will be if a company can develop these business towards stars or cash cows. However, if this attempt fails, question marks become the ultimate ''cash trap'' as they only absorb large amounts of cash throughout their existence. A company has to make thoughtful decisions in which (few) question marks should be further invested and which ones should be liquidated on time in order to save resources. | ||

| + | |||

| + | === Balance of Cash Flows === | ||

| + | The key concept of the BCG-Matrix is to reach a balance of positive and negative cash flows between the different businesses. As shown before, each field can be defined as a net cash generator or cash user. Therefore, the assumptions regarding the cash situation for each of the four fields is essential that the concept works. Following the matrix, each company should have stars that assure the future of the company with their high share and growth. Secondly, cash cows are vital as they provide the money for future investment and cover today's expenses. Moreover, a selected range of question marks is necessary, as they can be turned into stars when funds are added. Dogs are not necessary at all, they are a sign of failure and should be liquidated. | ||

| + | |||

== Annotated bibliography == | == Annotated bibliography == | ||

<references /> | <references /> | ||

Revision as of 11:32, 12 September 2016

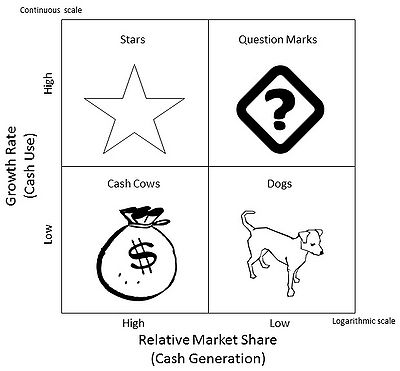

The Boston Consulting Group (BCG) matrix, also known as growth share matrix, is a tool to manage a company's business portfolio and derive appropriate actions towards a higher total performance. Depending on the growth rate and market share, each business is individually assigned to one of the four clusters inside the two-dimensional matrix. Based on that, the optimal combination of individual business strategies is developed to manage a company's business portfolio in such a way, that it can make the most out of its opportunities [1]. Initially developed in 1970 by Bruce D. Henderson [2], a senior partner of the management consulting firm BCG, the concept has been widely applied since then and can be seen as a foundation for similar tools. Although the BCG describes it still as a relevant tool today, the growth share matrix has been criticized by professionals and academics for its limitations and underlying assumptions. The following article will present the matrix developed by Henderson with its foundations and core elements. Hereafter, the application of the tool is shown with its implications for the business portfolio. These serve as a guideline for a company's overall strategy. Finally, limitations of the matrix are discussed based on empirical research and new findings.

Contents |

Key Assumptions and Core Elements of the Matrix

When the BCG-Matrix was developed, it met a real market need. Based on only a limited amount of input data (relative market share and market growth), senior executives gained a clear picture of their business portfolio in an increasingly complex environment. Furthermore, it could be used to communicate decisions to subsidiaries within the company [3]. At the time Henderson said about the matrix [2]:

"Such a single chart with a projected position five years out is sufficient alone to tell a company's profitability, debt capacity, growth potential, dividend potential and competitive strength."

In order to understand this position, the underlying assumptions and core elements of the matrix are presented in the following. Basically, the matrix can be divided into six core elements, each with specific assumptions [3] [4]. These are:

Strategic Business Units (SBU) and Product Markets

Within the portfolio analysis usually different SBU’s are analyzed. These describe a business focused on a particular product-market combination. It is essential that these are mostly independent from each other but have similar structures and resources. This is required to make decisions for each SBU independently without affecting others in the portfolio. However, the definition of SBU’s might be challenging, as products within a SBU might have different market growth and relative market shares. Inside the matrix the relative significance of each SBU is displayed by the diameter of a circle, which can be made proportional to either sales or assets [1].

Based on the experience curve concept, which Henderson introduced prior to the matrix in 1968, it is assumed that the company with the highest market share has the highest profit margin. The reason is, that the stronger the company’s position relative to its competitors, the higher profits should be and the simplest measure of relative competitive position is relative market share. It can be computed by the market share of a business (i.e. SBU) divided by that of the largest other competitor [1]. That means the higher the relative market share is the more cash the business will generate.

Market Growth and Cash Use

The assumption made here is that market growth relates to the opportunity for investments. Growing business offer the ideal vehicle for investment, as money put into the business will compound over time and provide even higher returns in the future. However, the lager a market is growing the more cash is required to maintain market share and competitive position. Within the BCG-Matrix market growth is the only indicator for the attractiveness of a market.

Classification of Businesses into four Portfolio Categories

Henderson defines the four categories according to their potential for cash generation and cash requirement. These are defined as followed: [2]

- Stars

- Stars are in the upper left quadrant. Because of their rapid growth they require large amounts of cash, but at the same time they provide cash through their strong relative market position. Usually, these businesses are self-sufficient in cash flow. However, over time market growth will slow down which offers two choices. If stars can hold their market share they might become cash cows and net generators of cash, if they fail to be competitive they become dogs. Only few businesses within a company are stars.

- Cash Cows

- Cash cows are in the lower left quadrant. In these businesses growth is low but relative market share is high. This translates into businesses which generate far more cash than they require. Cash cows are vital for a company as they pay the dividends, cover the corporate overhead and provide the money for future investments. As with stars, a company usually only owns a few cash cows.

- Dogs

- Dogs are in the lower right quadrant. Operating in slow growing markets with a weak position, these businesses are known as cash traps as they provide little earnings but at the same time require some cash. Overall, they are worthless and a company should seek to minimize the assets within this category.

- Question Marks

- Question marks are in the upper right quadrant. With high growth but low market share question marks have the worst cash characteristics. Because of high growth they require huge amounts of cash but only provide very little as their market position is weak. Many businesses within a company fall into this category and key will be if a company can develop these business towards stars or cash cows. However, if this attempt fails, question marks become the ultimate cash trap as they only absorb large amounts of cash throughout their existence. A company has to make thoughtful decisions in which (few) question marks should be further invested and which ones should be liquidated on time in order to save resources.

Balance of Cash Flows

The key concept of the BCG-Matrix is to reach a balance of positive and negative cash flows between the different businesses. As shown before, each field can be defined as a net cash generator or cash user. Therefore, the assumptions regarding the cash situation for each of the four fields is essential that the concept works. Following the matrix, each company should have stars that assure the future of the company with their high share and growth. Secondly, cash cows are vital as they provide the money for future investment and cover today's expenses. Moreover, a selected range of question marks is necessary, as they can be turned into stars when funds are added. Dogs are not necessary at all, they are a sign of failure and should be liquidated.

Annotated bibliography

- ↑ 1.0 1.1 1.2 Barry Hedley 1977; Strategy and the "Business Portfolio" p. 9-15 Annotation: Hedley, a director of BCG at the time, describes the importance of portfolio management and how the growth share matrix can be used to increase a company's performance.

- ↑ 2.0 2.1 2.2 Bruce D. Henderson 1970; The Experience Curve - Reviewed IV. The Growth Share Matrix or The Product Portfolio Annotation: In this article Henderson describes the initial concept of the growth share matrix and outlines the basic underlying assumptions. However, Henderson and employees of BCG developed the matrix further with minor adaptations until 1973.

- ↑ 3.0 3.1 Alan Morrison and Robin Wensley; Boxing up or Boxed in ?: A Short History of the Boston Consulting Group Share/Growth Matrix; Journal of Marketing Management, 1991, 7, p. 105-129 Annotation: Besides describing the history of the BCG Matrix, the authors also explain the core elements, its application in US industry since the 1970's and evaluate academic criticism. The paper can be seen as one of the most comprehensive works about the tool.

- ↑ Hanno Drews; Farewell to the Growth Share matrix after more than 35 years of usage? A Critical examination of the BCG Matrix; Zeitschrift für Planung & Unternehmenssteuerung, 2008, 19, p. 39-57 Annotation: Drews gives a short overview of the BCG Matrix and examines empirical research about the matrix. Based on academic papers and a self-conducted case study on the German airline Lufthansa, he concludes that due to its limitations the BCG Matrix should not be applied.