Risk Management Overview

(→Risk Matrix) |

(→Risk Matrix) |

||

| Line 40: | Line 40: | ||

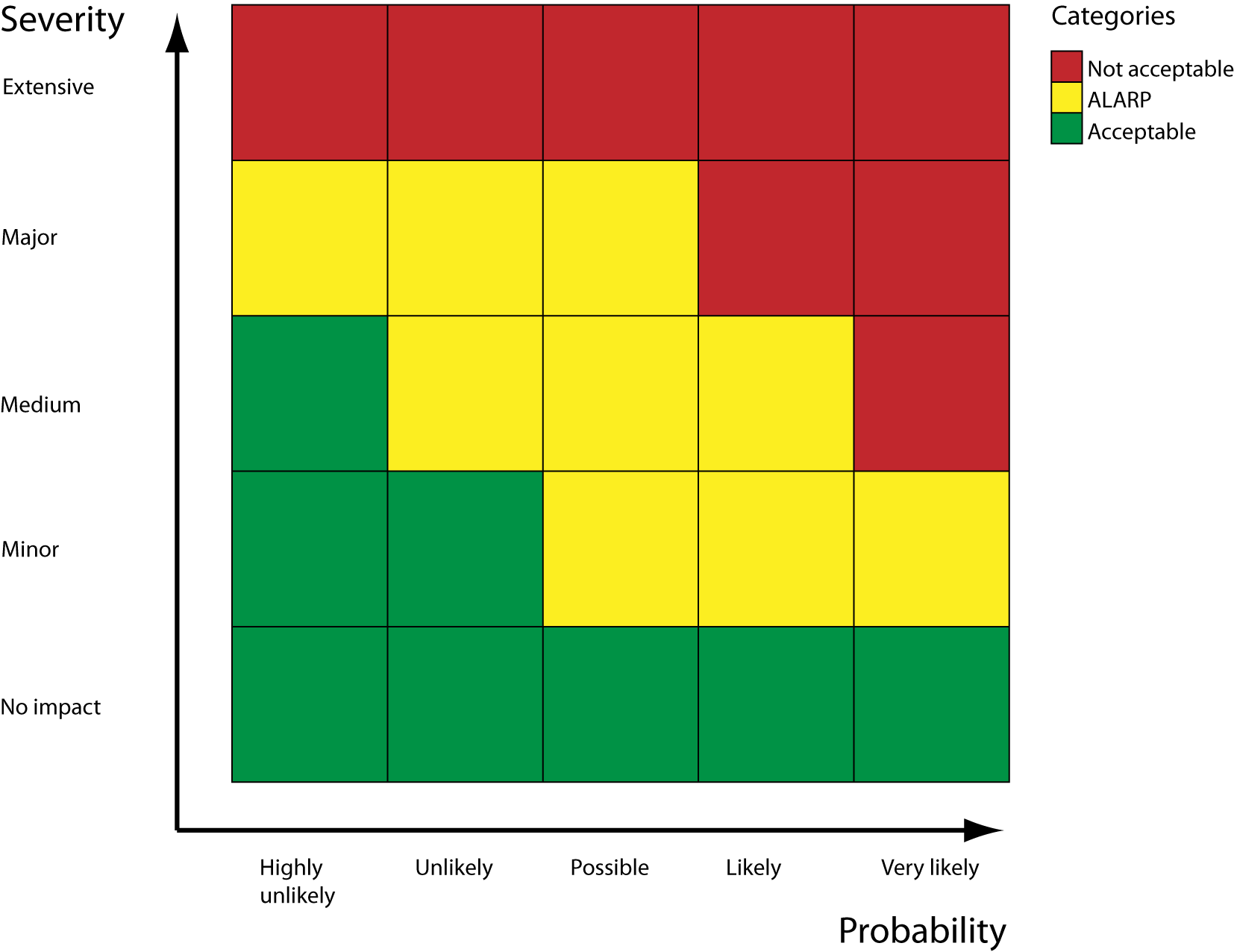

=== Risk Matrix === | === Risk Matrix === | ||

... text text text | ... text text text | ||

| − | [[File:Rm3.png|frame|caption| | + | [[File:Rm3.png|frame|caption|500px|]] |

text text text ... | text text text ... | ||

Revision as of 10:08, 10 February 2018

Contents |

Abstract

Projects are part of a dynamic and fast changeling world. Therefore there are a degree of uncertainty and unpredictability in projects. In-order to minimize uncertainties and unforeseeable events related to the project, risk are identified and managed throughout the project life cycle, Rumsfeld's Unknown-Knowns and Risk categorization (mitigate, control, monitor).

Risk management is impotent tool to use in project management, even-though the Risk management is only estimates of potential future situations. Risk identification help the manager get an overview of potential obstacles that can occur or prevent the team from achieving their goals. By identifying the risks, managers can map them and initiate appropriate measurements to counter them. Risk management is highly impotent discipline and is therefore present in most projects. [1]

The Risk Management Process is a continuous process, which can be divided in to divided in to five steps steps [1] [2]

The risks are identified and managed by using quantitative & qualitative tools. This Wiki-article will focus on Risk categorization, Risk Matrix, actions to take against identified risks and Rumsfeld's Unknown-Knowns. Furthermore describing inherent and residual risks, and parameters which a company can use to measure impact. At last limitations and advantages of Risk Management will be discussed. Furthermore this article will give a brief overview of other relevant reading material.

Please note that this article only covers the risk (threat) management of a project and does not look in to opportunities management (risks with positive effect).

Test [3] [4] [1] [5] [6] [7] [8] [9] [10] [2]

Introduction

Risk definition

Risk can be defined as follows: "Risk is an uncertain event or condition that if occurs, has a positive or negative effect on one or more project objectives such as time, cost and quality, or effect of uncertainty on objectives" All activities in a organization involve risks. These risks can be managed by identifying it, analyzing it and then evaluating whether the risk should be modified by risk treatment in order to satisfy the organization's risk criteria. During this process risk managers communicate with stakeholders and monitor the risk. The controls are modified in-order to ensure that the amount of risk treatment is minimized. [p. V][1]

Risk identification (RI) is the "process of finding, recognizing and describing risks" [p. 4][1]. RI involves the identification of risk sources, event, causes and potential consequences. The identification can involve historical data, theoretical analysis, expert opinions, and stakeholder needs [p. 4][1].

However identifications is only the first step, managers also need to analyze the risk so the most significant ones can be deltwith on a ongoing basis [p. 219][3].

Rumsfeld's Unknown-Knowns

The different nature of risks, can be categorized whit former US Defense Secretary, Donald Rumsfeld's destination. Rumsfeld categorizes risks as the following [7] :

- Known-Knowns describes the things we know we know. An example could be the fact that we know that there are some risks in every project or maybe learning's from a previous project.

- Known-Unknowns describes the things we know are uncertain. For example the delays because of third party fails to deliver on deadline or human errors administration wise or misunderstandings.

- Unknown-Unknowns describes the things that we in noway could have seen or expected. This could be a sudden death, war or terrorist attack.

- Unknown-Knowns describes the things we should have known, but we for various reason (mostly complexity) don't. An example could be when a terrorist attack happens on American solid, to some extent this is a Unknown-Known for the CIA [p. 219-220][3].

Risk Matrix

... text text text

text text text ...

Further Reading Material

Risk Management in Renewable Energy Projects

Risk and Opportunities Management

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 ISO, "31000 Risk management — Principles and guidelines", INTERNATIONAL STANDARD, (2009):.

- ↑ 2.0 2.1 Georgetown University, "RISK MANAGEMENT OVERVIEW", https://riskmanagement.georgetown.edu/overview, Visited 10-02-2018

- ↑ 3.0 3.1 3.2 H. Pearson, "Project Management", Pearson Education Limited, 4th. Edition (2010):.

- ↑ ISO, "31000 Risk Management for smes", ISO, (2015):. https://www.iso.org/iso/iso_31000_for_smes.pdf, Visited 07-02-2018

- ↑ CGE Academy, "Risk matrices", https://www.cgerisk.com/knowledgebase/Risk_matrices, Visited 05-02-2018

- ↑ Nasdaq, "ASSESSING RISKS: INHERENT OR RESIDUAL", http://www.bwise.com/blog/assessing-risks-inherent-or-residual/obj5382859, Visited 08-02-2018

- ↑ 7.0 7.1 Wikipedia, "There are known knowns", https://en.wikipedia.org/wiki/There_are_known_knowns, Visited 03-02-2018

- ↑ J. Geraldi, C. Thuesen and J. Oehmen, "How to Do Projects", Dansk Standard, (2017):.

- ↑ Chartered Accountants, "Treat Risks", https://survey.charteredaccountantsanz.com/risk_management/midsize-firms/treat.aspx, Visited 09-02-2018

- ↑ D. Hillson, "Effective Opportunity Management for Projects: Exploiting Positive Risk", Taylor & Francis, (2003):.