Earned value management (EVM)

| Line 191: | Line 191: | ||

[[File:Forecasting_MR.png|left|500px|thumb|Figure 5: Forecasting for Scenario 3 (own figure, based on xx)]] | [[File:Forecasting_MR.png|left|500px|thumb|Figure 5: Forecasting for Scenario 3 (own figure, based on xx)]] | ||

| + | |||

| + | === To Complete Indexes === | ||

| + | |||

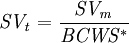

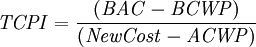

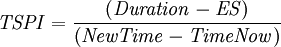

| + | The last step of Earned Value Management consists in defining the SPI and CPI indices the project should have in order to make up for the potential poor performance and reach the desired schedule and cost targets. To evaluate their actual concrete feasibility it is possible to calculate To Complete Schedule Index (TCPI) and To Complete Schedule Index (TSPI): | ||

| + | |||

| + | :<math> | ||

| + | \mathit{TCPI}=\frac{ {\left ({\mathit{BAC}}-{\mathit{BCWP}} \right )}} {\left ({\mathit{New Cost}}-{\mathit{ACWP}} \right )} | ||

| + | </math> | ||

| + | |||

| + | :<math> | ||

| + | \mathit{TSPI}=\frac{ {\left ({\mathit{Duration}}-{\mathit{ES}} \right )}} {\left ({\mathit{New Time}}-{\mathit{Time Now}} \right )} | ||

| + | </math> | ||

| + | |||

| + | Project managers should interpret these indices to understand whether it is really feasible to maintain them until the end of the project. With regards to this, a research conducted by the U.S. Department of Defense concluded that once a WBE is over 20% of its completion, CPI and SPI indices should not be increased by 10% <ref name="SO">Bartezzaghi, E.. (2019). ''L'organizzazione dell'impresa''. 4th ed. Milano: Rizzoli ETAS</ref> because the WBE is considered stable and therefore the final performance will not diverge a lot from the current one. | ||

== References == | == References == | ||

<references/> | <references/> | ||

Revision as of 22:40, 20 February 2021

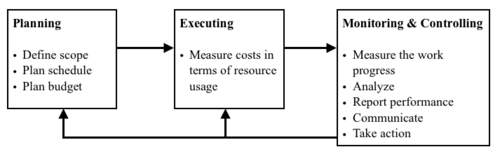

Earned value management (EVM) is a methodology for performance measurement which can be applied to individual projects across programs and portfolios [1]. EVM is used in the planning, executing and controlling phases of the PMI Project Management Standard and mainly involves the knowledge areas of scope, time, cost, communication and integration [2]. More specifically, EVM falls into the “project cost management” and “plan schedule and cost management” phases of the PMI Standard [3].

Figure 1 shows how earned value management relates to project management phases and the activities which it comprises. While it might appear as a tool mainly related to monitoring and controlling, earned value management methodology brings to the project managers’ attention the importance of performance measurement since the initial planning phase, with the need for accurate planning and for the realization of a project which is easy to execute and measure.

This article will describe the earned value management methodology applied to projects, with motivations of its relevance, prerequisites for a successful implementation as well as concrete explanations and applications of each of its key metrics. While earned value management is a topic already widely discussed and analyzed in project management from a theoretical point of view, this article will focus on outlining practical real life special cases of projects and how project managers should apply EVM in these case. Finally, the main limitations of EVM will be discussed thoroughly, including suggestions for project managers on how to face these challenges.

Contents |

Why project managers should use Earned Value Management?

Earned value management is a tool created and applied for the first time by the US Department of Defense in 1967 and later used to monitor the Department of Education projects, more specifically the U.S. Large Hadron Collider (LHC) of CERN [4], the world's largest and most powerful particle accelerator [5]. The ability to connect cost and schedule, to identify numerical project performance indicators and express cost and technical performance in an understandable way, led to the diffusion of this tool and to its increased application in the field of project management [6].

Earned value management encompasses earned value analysis, variance analysis and forecasting of future trends. It is important to point out that while the earned value analysis is limited to define and calculate a set of indices to monitor the project’s schedule and cost, earned value management uses the data from EVA to calculate variance and trend analysis, as well as predictions for the future. Therefore, EVM methodology provides a holistic view on the project’s progress and clarifies any deviations from the project plan and budget, allowing project managers to then react to these discrepancies by implementing corrective actions.

The prerequisites for a successful implementation of EVM

There are prerequisites project managers should be aware of in order to implement the methodology in the best possible way. These activities range from planning to monitoring, and consist of:

- Applying the work breakdown structure (WBS) in order to decompose all the activities in control accounts, manageable work of a project with a specific scope, cost and schedule. Subsequently, human and material resources have to be allocated to each work package using the organization breakdown structure (OBS)[2];

- Assigning management responsibility to each of the control account[2];

- Planning how to keep track of physical work progress and how to assign budgetary earned value for each activity [2];

- Evaluating the method used to capture expenditures during the life cycle of a project to compare it with the budget [2];

- Implementing change management plans to ensure EVM remains relevant if the scope changes [7];

- Using an adequate cost collection system to track actual cost and outstanding invoices to avoid delays of invoices [7];

- Conducting reporting activities in order to interpret the data obtained and subsequently communicate it to the relevant stakeholders [2].

How to implement EVM

The earned value management methodology comprises four main phases:

- Defining the time-phased budget

- Monitoring time and costs

- Analyzing deviations and defining relevant indices

- Forecasting

Earned value management consists in examining the relationship between three types curves:

- Budgeted Cost of Work Scheduled (BCWS): the planned and scheduled work - also called PV (planned value)

- Budgeted Cost of Work Performed (BCWP): the actual work performed according to the control account - also called EV (earned value)

- Actual Cost of Work Performed (ACWP): the actual expenditures of the control account up to the period of time in which the curve is analyzed - also called AC (actual cost)

Definition of the time-phased budget

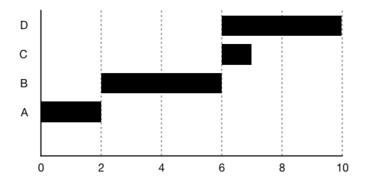

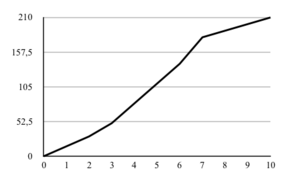

The first step of earned value management is representing the BCWS, also called the baseline of the project, which represents the cumulative cost of the activities for each period of time and therefore aggregates the budgeted cost of all control accounts. The curve can be obtained thanks to the Gantt diagram, which displays the scheduled activities of the project in each unit of time. An example is provided below to clarify this process.

The following set of activities is given, with information on predecessors, scheduled time and budgeted cost.

| Activity | Predecessor | Time | Cost | Monthly cost |

|---|---|---|---|---|

| A | / | 2 | 30 | 15 |

| B | A | 2 | 40 | 20 |

| C | A, B | 1 | 30 | 30 |

| D | B | 4 | 40 | 10 |

After creating the Gantt diagram, the BCWS is represented so that cumulated costs across all activities scheduled for each time period are displayed. More practically, the first step is looking at time axis and the activities axis of the Gantt graph, and checking which activities occur in which period of time.

Monitoring time and costs

Monitoring of costs during the life of a project allows to trace the ACWP, which is the actual cost of work performed. This is extremely relevant as the real costs spent on a project often diverge from the planned ones, as many unforeseen events can occur. Usually actual costs are calculated by checking the actual division of work among manpower and using tools such as cost and time reports, which show how the resources of a team spent their time and the amount of expenditures. [8]

Deviations analysis

BCWS and ACWP alone do not provide any information on the nature of a potential deviation. For example, if ACWP > BCWS, it might be that the project either is inefficient, so actual expenditures are higher than what planned in the budget, or work is being performed earlier compared to the schedule. For this reason it is key to build the third curve, the Budgeted Cost of Work Performed.

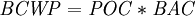

The budgeted cost of work performed can be calculated by multiplying the percentage of completion (POC) with the budget at completion (BAC), which is the total budget of the project. The calculation of the BCWP is probably the most complex one since it requires to define the percentage of work actually performed (POC). The different ways to calculate POC will be described further in chapter x.x.

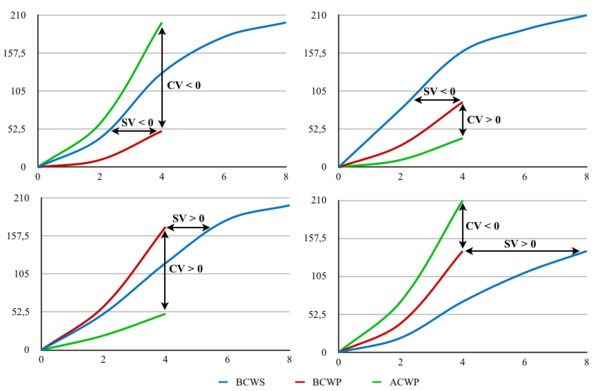

A useful way to conduct deviation analysis is to group the 3 metrics into one graph, so that it is easier to compare them. This analysis generates  scenarios, where n is the number of parameters being studied. Being that with earned value management, the parameters are time and cost, the possible scenarios are four:

scenarios, where n is the number of parameters being studied. Being that with earned value management, the parameters are time and cost, the possible scenarios are four:

- Project late compared to the schedule and inefficient

- Project late compared to the schedule and efficient

- Project on time/early compared to the schedule and efficient

- Project on time/early compared to the schedule and inefficient

Other than graphically, it is also possible to evaluate time and costs with indicators, both relative and absolute, with the former expressing deviations in percentage, while the latter in monetary units.

Relative indices

Relative indices are cost performance index (CPI) and schedule performance index (SPI). If these indices are greater than one, then the project is efficient and ahead of schedule respectively.

Absolute indices

Absolute indices provide the same information of the relative indices but with different formulas, as shown below. In this case, it is preferred to have values larger than 0 for both cost variance (CV) as well as schedule variance (SV).

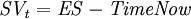

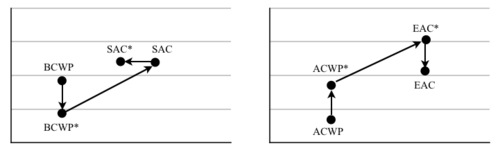

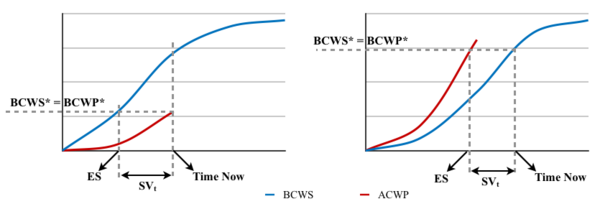

It is important to notice that the schedule variance is expressed in monetary units instead of time units, which would be easier to interpret. This topic was widely discussed from the 1970s, as earned value management originally did not include schedule deviations in time units. According to the article «Earned Schedule: An Emerging Enhancement to Earned Value Management», this situation led over time to project managers using the earned value management methodology primarily to understand costs rather than schedule [[6]]. However, in 2002 the “earned schedule” concept was introduced, a metric which indicates the instant of time in which the BCWS is equal to the BCWP. If these two curves do not match, the projection of the first one onto the second one is the amount of work performed which should be earned according to the schedule (BCWS). The earned schedule is the time from when the project begins up to the projection of this intersection onto the time axis.

In this way, schedule variance can be expressed in time units by subtracting the current period (which in this article will be referred to as Time Now) from the earned schedule. If this value is greater than zero, then it means the project is ahead of schedule. Figure 5 shows the reasoning behind formula (x), where BCWS* corresponds to the Earned Schedule (ES), whereas BCWP* indicates the value at Time Now.

If the trend of the BCWS is constant in the interval of time considered, meaning that the same activity is taking place during the entire time, then the schedule variance in time units can also be expressed with the following formula:

The case in which the BCWS is not constant will be discussed in chapter x.

Forecasting

By calculating deviation indices, project managers have a picture of the project’s performance in that specific moment. However, before implementing any corrective actions, it is necessary to understand what would be the final arrival point of the project if it continued with the same trend. In fact, identifying, planning, and mobilizing resources to implement corrective actions are time consuming and expensive activities, and may not be necessary if the final performance of the project is within the acceptable range.

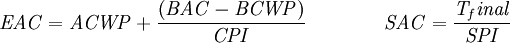

The key metrics to forecast future trends are EAC and SAC, which stands for Estimate At Completion and Schedule at Completion. In addition to these metrics, there is also Variance at Completion, which will not be covered in this article (read more about it at [2]). From a graphical point of view, these metrics are obtained by extending the ACWP and the BCWP until the end of the project.

Mathematically, it is important to define which type of potential effects the deviation analysis in step 3 has on the project. The possible scenarios are three.

Scenario 1: The effect of the issue on the project is limited

This is the case of deviations from original planning due to external factors which impacted the project but have ended their effect. For example, this is the case of higher prices for raw materials and therefore higher costs which impact only limited initial activities of the project.

Scenario 2: The effect of the issue on the project is extended

The second category of issues is when the issue impacting the delay and/or the inefficiency of a project is expected to continue in the future and have impacts on the entire project. This is the case that the raw materials transportation was an activity conducted during all the project. There are also other alternatives to this calculation which can be found at Practice Standard for Earned Value Management of Project Management Institute, pg. 21 [2].

Scenario 3: Both types of issues affect the project

Practically speaking, it is possible that the project falls into a grey zone in between the two scenarios and that there are two components of deviations, one for each scenario. In this case, article xxx suggests the following steps to calculate EAC and SAC. The suggested process is valid if cost and time deviations of scenario 1 are efficiency (lowercost_1 in the formula) and anticipation compared to the schedule (earlierschedule_1 in the formula) respectively. In the opposite case in which scenario 1 deviations are problematic, step 1 and 3 formulas will result having the opposite sign.

- Remove the positive deviation with limited effect and calculate the new ACWP* and BCWP*;

- Calculate CPI* and SPI* and the corresponding EAC* and SAC*. These are the forecasted values which account only for deviations of scenario 2;

- Calculate EAC and SAC by reintroducing the deviation of scenario 1

To Complete Indexes

The last step of Earned Value Management consists in defining the SPI and CPI indices the project should have in order to make up for the potential poor performance and reach the desired schedule and cost targets. To evaluate their actual concrete feasibility it is possible to calculate To Complete Schedule Index (TCPI) and To Complete Schedule Index (TSPI):

Project managers should interpret these indices to understand whether it is really feasible to maintain them until the end of the project. With regards to this, a research conducted by the U.S. Department of Defense concluded that once a WBE is over 20% of its completion, CPI and SPI indices should not be increased by 10% [10] because the WBE is considered stable and therefore the final performance will not diverge a lot from the current one.

References

- ↑ Cable, J. H., Ordonez, J. F., Chintalapani, G., & Plaisant, C. (2004). Project portfolio earned value management using Treemaps. Paper presented at PMI® Research Conference: Innovations, London, England. Newtown Square, PA: Project Management Institute. Retrieved from https://www.pmi.org/learning/library/project-portfolio-evm-treemaps-maturity-8341

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 Project Management Institute, Inc.. (2005). Practice Standard for Earned Value Management. Pennsylvania, USA: Project Management Institute, Inc.

- ↑ Project Management Institute, Inc.. (2017). Guide to the Project Management Body of Knowledge (PMBOK® Guide) (6th Edition). Project Management Institute, Inc. (PMI). Retrieved from https://app.knovel.com/hotlink/toc/id:kpGPMBKP02/guide-project-management/guide-project-management

- ↑ J.Ferguson, K.H.Kissler (2002). EARNED VALUE MANAGEMENT. CERN-AS-2002-010.[pdf]

- ↑ CERN.(n.d.).The Large Hadron Collider. [online] Retrieved from https://home.cern/science/accelerators/large-hadron-collider

- ↑ 6.0 6.1 Lipke W.; Henderson K..(2010).Earned Schedule: An Emerging Enhancement to Earned Value Management[pdf]

- ↑ 7.0 7.1 Lukas J.A.. (2008). Earned Value Analysis – Why it Doesn't Work. Retrieved from http://www.icoste.org/LukasPaper.pdf

- ↑ Andawei, M..(2014). Project cost monitoring and control: A case of cost/time variance and earned value analysis. IOSR Journal of Engineering (IOSRJEN), 04(02), p.23. Retrieved from http://iosrjen.org/Papers/vol4_issue2%20(part-1)/C04212225.pdf

- ↑ 9.0 9.1 9.2 Vanhoucke, M.. (2016). Integrated Project Management Sourcebook. Switzerland: Springer

- ↑ Bartezzaghi, E.. (2019). L'organizzazione dell'impresa. 4th ed. Milano: Rizzoli ETAS