Internal Rate of Return (IRR)

Developed by Pablo Leandro Capellari- s213666

Internal rate of return (IRR) is a parameter used in the financial analysis to determine the profitability of the investment, that is, it estimates the rate of return that the evaluated project could have. The term "internal" is because for the calculation of the IRR, external factors that could affect the profitability of the project, such as inflation, are not considered. In mathematical terms, the IRR is defined as the discount rate that causes the sum of the cash flows of the project to be zero[1]. In other words, if the net present value (NPV) of a project is 0 at a certain rate, that rate is the IRR[2]. Researchers in 2003[3] have validated the IRR as an alternative to the NPV as an indicator for project evaluation, considering that the IRR as from the point of view of the investor and the NPV from the point of view of the society. Its popular application is mainly because it defines the return on investment, sometimes seen as a measure of efficiency, beyond its documented limitations. For decision-makers, the IRR can be compared to the discount rate for rejecting or accepting projects. To be specific, for a project to be accepted, the IRR must be greater than the discount rate and when both are equivalent, a situation of indifference arises[1]. To resolve many deficiencies related to the traditional IRR, some researchers[4] have proposed to use the average internal rate of return (AIRR). The AIRR is based on the breakdown of the NPV of the project between the invested capital and the economic efficiency, maintaining the consistency of the NPV to decide the acceptance of a project. This breakdown generates valuable information helping to determine the uncertainty of a project allowing risk to be explored in more detail.

Contents |

Big idea

Describe the tool, concept or theory and explain its purpose. The section should reflect the current state of the art on the topic

Definition

It is common opinion that the Internal Rate of Return (IRR) may be the real estate industry's preferred performance measure as a means of evaluating the return on projected investments. However, finance textbooks (Brown and Matysiak (2000)) pointed out that the net present value (NPV) is a superior method to the IRR used to evaluate potential investments, however, in practice, the internal rate of return return still dominates. This is an easy-to-understand indicator that the appeal is that it meets the need for a single number compared to other opportunities or benchmarks. This simplicity belies its true nature and many of the problems that can arise when it is used to evaluate capital investment projects.

IRR Mathematically[2]

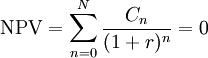

IRR is the discount rate (interest rate) that makes the sum of the present value of the cash flows zero. If the NPV of the project is zero at the selected discount rate, then that discount rate is, by definition, the IRR. IRR is algebraically equivalent. Mathematically expressed as:

where  is a cash flow in period

is a cash flow in period  and

and  is the IRR.

is the IRR.

Practical example

In the following example, a highway construction project is outlined to demonstrate the calculation of IRR and other parameters. For exemplification purposes, the following data have been used: The project opens in year 0 and has an evaluation period on 10 years, the project has the following first year impacts: –Time savings: 500,000 DKK. –Accident savings: 50,000 DKK. Operation and maintenance: 100,000 DKK.

| Discount rate | 0,03 |

|---|---|

| Traffic growth | 0,015 |

| Price growth | 0,01 |

In addition, different reference values have been used for this type of project, such as a discount rate of 3%, annual traffic growth of 3% and price growth of 1%.

| Year | - | -3 | -2 | -1 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Discount factor | - | 1,09 | 1,06 | 1,03 | 1,00 | 0,97 | 0,94 | 0,92 | 0,89 | 0,86 | 0,84 | 0,81 | 0,79 | 0,77 | 0,74 |

| Traffic growth | - | 0 | 0 | 0 | 1,00 | 1,02 | 1,03 | 1,05 | 1,06 | 1,08 | 1,09 | 1,11 | 1,13 | 1,14 | 1,16 |

| Price growth | - | 0 | 0 | 0 | 1,00 | 1,01 | 1,02 | 1,03 | 1,04 | 1,05 | 1,06 | 1,07 | 1,08 | 1,09 | 1,10 |

| Construction costs | ,-10.612.090 | -3.642.423 | -3.536.333 | -3.433.333 | |||||||||||

| Scrap value | 7.440.939 | ||||||||||||||

| Operation and maintenance | -953.020 | - | - | - | -100.000 | -97.087 | -94.260 | -91.514 | -88.849 | -86.261 | -83.748 | -81.309 | -78.941 | -76.642 | -74.409 |

| Time savings | 5.372.322 | - | - | - | 500.000 | 497.646 | 495.302 | 492.970 | 490.649 | 488.338 | 486.039 | 483.750 | 481.473 | 479.205 | 476.949 |

| Accidents | 476.510 | - | - | - | 50.000 | 48.544 | 47.130 | 45.757 | 44.424 | 43.130 | 41.874 | 40.655 | 39.470 | 38.321 | 37.205 |

| NPV | 1.724.661 | ||||||||||||||

| BCR | 1,16 | ||||||||||||||

| IRR | 4,57% |

The table displays year-over-year cash flows, plus calculations for Residual Value, Net Present Value (NPV), Benefit Cost Rate (BCR), and Internal Rate of Return (IRR). For the calculation of the IRR, the Excel function "What-If" has been used, where it allows estimating the IRR generating an NPV=0.

Negative IRRs

Application

Provide guidance on how to use the tool, concept or theory and when it is applicable

Average internal rate of return (AIRR)

Personal finance

Limitations

Critically reflect on the tool/concept/theory. When possible, substantiate your claims with literature

Multiple IRRs

Incorrect ranking of projects

Projects with large differences in scale

IRR single decision factor

Annotated Bibliography

- ↑ 1.0 1.1 Hartman, Joseph C., and Ingrid C. Schafrick. «THE RELEVANT INTERNAL RATE OF RETURN». The Engineering Economist, Vol. 49, no. 2, January 2004, p. 139-58. DOI.org (Crossref), https://doi.org/10.1080/00137910490453419.

- ↑ 2.0 2.1 Patrick, Michael, and Nick French. «The internal rate of return (IRR): projections, benchmarks and pitfalls». Journal of Property Investment & Finance, vol. 34, no. 6, January 2016, p. 664-69. Emerald Insight, https://doi.org/10.1108/JPIF-07-2016-0059.

- ↑ Tang, S.L., and H. John Tang. «TECHNICAL NOTE: THE VARIABLE FINANCIAL INDICATOR IRR AND THE CONSTANT ECONOMIC INDICATOR NPV». The Engineering Economist, Vol. 48, no. 1, January 2003, p. 69-78. DOI.org (Crossref), https://doi.org/10.1080/00137910308965052.

- ↑ Hazen, Gordon, and Carlo Alberto Magni. «Average Internal Rate of Return for Risky Projects». The Engineering Economist, Vol. 66, no. 2, April 2021, p. 90-120. DOI.org (Crossref), https://doi.org/10.1080/0013791X.2021.1894284.

Cite error: <ref> tag with name "Brown2000" defined in <references> is not used in prior text.