Key performance indicators for portfolio management

Contents |

Introduction

The measurement and transparent reporting of key performance indicators (KPIs) is extremely beneficial for portfolio managers in making informed and improved decisions regarding resource allocation and risk management. By tracking specific metrics, portfolio managers can determine which programs and projects are delivering on time and which are underperforming. The metrics required by portfolio managers vary depending on the industry in which they operate. In this article, the focus will be on appropriate primary and secondary KPIs for managing a portfolio in the consultancy industry. In this industry, time is the commodity sold, with the product being derived from the knowledge, expertise, and advice provided to the client.

The main aim of this article is to differentiate between KPIs used in product, project, and portfolio management. The primary KPIs that will be discussed in portfolio management are Turnover, EBIT margin, Accounts Receivable, and Backlog, while the secondary KPIs discussed are Work-in-Progress (WIP), Own Production (OP), and Contingency. It is often assumed that the same KPIs are used in project, program, and portfolio management, but that is not the case. KPIs used in project management tend to focus on the operational aspects of managing a project, while portfolio management considers the strategic implications of projects and programs. Furthermore, the application of KPIs in managing a large energy portfolio for a leading engineering consultancy will be demonstrated. Portfolios, unlike programs and projects with a short life cycle, often have a longer longevity and thus require ongoing management attention. At last, limitations of KPIs will be discussed, specifically the accuracy of data, contextual issues, and limited information.[1] [2]

What is Key Performance Indicators (KPIs)?

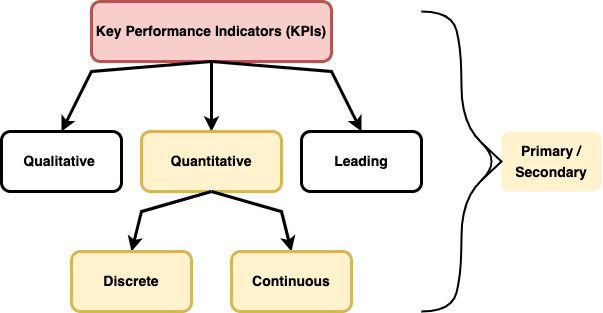

Peter Drucker, an Austrian American consultant, contributed to the philosophical and practical foundations of modern business corporations and management. He notably said, "What gets measured gets done… Even if it harms the purpose of the organization to do so." [3] [4] Measures and targets are essential management tools that help organizations, companies, and portfolio managers identify their strengths, weaknesses, and areas for improvement while also setting benchmarks with historical data. There are three overall types of Key Performance Indicators (KPIs): quantitative indicators measuring a target often set based on historical data, qualitative indicators measuring a target that cannot be expressed by numbers, and leading indicators that predict the outcome of a given process. Qualitative and leading indicators are essential KPIs and should not be overlooked when managing a portfolio. However, they are not the focus of this paper. Examples of such indicators include employee satisfaction for qualitative indicators and average hours worked for leading indicators. Indicators of the quantitative type can be classified as either discrete variables or continuous variables. For instance, a KPI for a portfolio could be getting ten new projects in a specific month, which is classified as a discrete variable. Reaching a perfect Net Promoter Score (NPS) is a continuous variable as this value can range from -100 to 100.

Primary Vs. Secondary KPIs in portfolio management

In addition to the three types of KPIs and the types of variables that exist within each category, Key Performance Indicators can also be categorized as primary and secondary KPIs. A primary KPI is a direct quantifiable measure of a process, while a secondary metric provides added information that aids in understanding the target of a portfolio, as it is not nearly tied to the actual result. Categorization of KPIs is not only used in monthly or weekly reporting of organizational performance but is also done on a portfolio management level. This enables portfolio managers to understand the performance and health of their specific portfolio, giving them governance over it.

Depending on the size, type of projects/programs, and industry, some KPIs might be more useful and provide a more holistic overview. As previously mentioned in the introduction, the industry being discussed is the consultancy industry, specifically the type of consultancy where time is the commodity sold. Some primary KPIs that are used to measure such a portfolio are:

- Turnover: Measure of revenue generated by projects/ programs in a portfolio in a specific period. Including taxes.

- EBIT Margin: Measure of portfolio’s operating profitability. Calculated by dividing EBIT with turnover.

- Accounts receivable (AR): The amount of money owed to a portfolio for the work on a project/ program that has been delivered but not yet paid.

- Backlog: The amount of work contracted (Won and signed), but either not started or not completed.

These KPIs are excellent for tracking a portfolio as they provide great governance over the health and progress of the portfolio. For instance, accounts receivable (AR) provides information on the "balance of money due to a firm for goods or services delivered or used but not yet paid for by the customer" [5]. Meanwhile, backlog provides the portfolio manager with knowledge on the quantity of projects/programs won but not yet started. This is extremely important as it provides insight to the PM on how much expected revenue is yet to be realized. This information is also greatly beneficial to the portfolio manager as they can prioritize projects and schedule them in a manner that doesn’t overload their employees with stress or work overload.

Furthermore, some secondary KPIs used to track progress and health of a portfolio in the consultancy industry could be as follows:

- Work-in-Progress (WIP): The measure of the partially completed work on projects/ programs.

- Own Production (OP): The work/ production done on projects/ programs by a company using its own resources. This is calculated by multiplying the hours spent with the base rate of each employee on the project/ program.

- Contingency: The measure of provision set aside to cover unforeseen risks that may impact a projects timeline, scope or in worst case budget. Contingency serves as a safety net as it helps the PM to manage the risk and uncertainty associated with the portfolio.

These secondary KPIs provide an indirect overview of the portfolio as they are not directly tied to primary KPIs such as turnover or EBIT. Work-in-Progress (WIP) provides portfolio managers with great insight into ongoing projects and helps manage the work done on projects. This KPI is often used in parallel with Backlog to gain a holistic understanding of the production process and the demand for the project/program. This information is used by the portfolio manager to forecast future revenue and cash flow, identify potential bottlenecks or capacity constraints, which can then be used to make informed decisions about resource allocation and planning. For example, if the portfolio manager notices that the backlog is low and the WIP is high, then a project/program is running efficiently and there is an excess capacity of employees that could be reallocated to other ongoing projects/programs in the portfolio.

Status Quo on KPIs and Portfolio management

KPIs are a classical portfolio management method in bringing focus to strategic improvements which will lead to more efficient operations.

Application

Application of KPIs in engineering consultancy

- Give insight into how an engineering consultancy is managing a portfolio of energy projects.

Primary and secondary KPIs in energy portfolio

- Examples of primary and secondary KPIs and how different they are from project and program management.

Improvements

- What other KPIs that portfolio managers may consider to add, and how it could benefit in providing a greater overview.

Limitations

Accuracy of data

- Driving these KPIs and the measure of them all requires proper data structure and good validation. For instance, concise reporting and autonomous updating of reports. Real life data and not on monthly basis. Problems must be dealt with right away and not at the end of the month.

Contextual issues

- The governance and overview must not be all about numbers and data. Sometimes problems are much bigger than this. For example, a portfolio manager may see that a project is behind schedule, but without additional context, it may not be clear why the project is behind schedule or what impact this will have on the portfolio.

Limited information

- KPIs might not give the whole picture of what is really going on in a project. For example, a portfolio manager may see that a project is on budget, but without additional information, it may not be clear whether the project is progressing according to plan or if other aspects of the project are causing problems. o All about tracking on the right KPIs and use them in a sensible manner.

Reflection

In conclusion, paying attention to KPIs is essential to achieve optimal performance and align with organizational strategies, goals, and objectives.

Annotated bibliography

1.1 Purpose of The Standard for Portfolio Management

KPIs for effective portfolio management

Referenfes

- ↑ [1.1 Purpose of the standard for Portfolio Management] https://content.knovel.com/content/pdf/13786/51975_01.pdf?ekey=f2AgMtPziM6rvTNh5JfrbVinHPOx3NMTm4v3_d5aDHGzHAowSUCkBwnfmZAGnYSOWa

- ↑ [KPIs for effective portfolio management] https://thinkingportfolio.com/en/7-key-kpis-for-effective-project-portfolio-management/

- ↑ [Peter Drucker management theory] https://www.businessnewsdaily.com/10634-peter-drucker-management-theory.html

- ↑ [Peter Drucker famous quote. From Corporate finance review ] https://static.store.tax.thomsonreuters.com/static/relatedresource/CMJ--15-01%20sample-article.pdf

- ↑ [Accounts recivable information ] https://www.investopedia.com/terms/a/accountsreceivable.asp