This Wiki-page is currently under construction, and therefore may important information be missing. In case of any conflicts, please contact, Andy M Filipovic, s153501@student.dtu.dk

Group members

| Andy Mattulat

|

Filipovic

|

s153501

|

| Casper Scheel

|

Nielsen

|

s193273

|

| Lucas

|

Gunnersen

|

s161812

|

| Magnus Thor

|

Gunnarsson

|

s193154

|

| Mohammad Sadeq Nateqi

|

Nateqi

|

s143376

|

| Morten Aarkrogh

|

Christensen

|

s193382

|

Introduction (Andy)

This Wiki page is a collection of tools and methods that we find relevant, in the development of a portfolio prioritization method/toolbox, in close collaboration with FL. Smidth.

Tools(Andy)

This chapter contains the different tool we intent to use during the portfolio prioritization process. The different tools will have short description of the tool and how it's intended use.

Tool 1: Scoring Method (Casper)

Definition

The scoring method/model as a basic and highly useful method used by organizations to develop a fast a intuitive overview of projects.

Further explanation of these methods can be found via: [1]

Practical guidelines /how to

The method is made up of a weighting process often comparing financial reward and strategic fit, whereas the projects are rated on simple metrics such as a 1-10 scale or low-to-high scale. The tool is, as mentioned, highly intuitive, whereas the criterias chosen can be customized to fit almost any scoring process.

Further explanation of these methods can be found via: [2]

Benefits and limitations

'

- Easy implementation

- Easily Understood

As mentioned, the tool is simple, whereby it can be deemed as easily understood as well. It doesn't require any additional training in terms of how to use it.

- Can provide great and powerful insight to certain aspects of projects

- Modular

- Intuitive

Further explanation of these methods can be found via: [3]

Tool 2: Bubble Diagram (Casper)

Definition

The bubble diagram is an illustrational tool used to support decision making in portfolio prioritization as well as other areas. The bubble diagram is a very simple, yet useful tool to map preferential values of a project. The values are mapped on an X-Y matrix, where each axis determine the desired value. The name bubble comes from the actual representation of the values in the matrix.

Further explanation of these methods can be found via: [4]

Practical guidelines /how to

The matrix as described is made up of either several dimensions of data, determined by the complexity of which is chosen. The mapping is often made on two variables, that is compared using the scoring method and mapped using bubbles in the matrix. Some of the variables often mapped against each other are:

Risk vs. Reward,

Strengths vs. Attractiveness,

Cost vs. Benefits,

Strategic vs. Benefit,

Further explanation of these methods can be found via: [5]

Benefits and limitations

Benefits of the tool include:

Benefits

- Easy implementation

The chart in itself is very simple and provided that the input data is suffieciently provided, the implementation stage can be seen as easy.

- Easily Understood

As mentioned, the tool is simple, whereby it can be deemed as easily understood as well. It doesn't require any additional training in terms of how to use it.

- Can provide great and powerful insight to certain aspects of projects

The variables mapped are often pressure points in portfolio management, and by creating an easily understood overview of them can be highly useful.

This said, the bubble chart should maybe not be the only source of data for decisions making.

- Modular

The tool is often done using various software, whereby it can be easily modified on the go, if any changes should occur.

Further explanation of these methods can be found via: [6]

Tool 3: Portfolio selection (Magnus)

Definition

Due to increasing competition and development of technology, more innovative products are being developed by companies. It is a risky path to take, due to uncertainty in its feasibility and future commercial success, which makes each selection and evaluation crucial. Each project selection thus has a high correlation with the survival of a company. The most common methods used to select projects or portfolios are quantitative, qualitative and hybrid methods.

Practical guidelines /how to

Quantitative methods:

These approaches focus on numerical information and ignore tacit knowledge and qualitative information. There are several dimensions of quantitative methods, the most common of them being mathematical programming.

Qualitative methods:

The focus of qualitative is to take into account factors that quantitative methods cannot. Some of the most used are bubble diagrams, sensitivity analysis and benchmarking.

Hybrid methods:

These are the most common methods for evaluating and selecting projects and portfolios today. In essence, these are a mix of quantitative and qualitative methods.

Further explanation of these methods can be found via: [7]

Tool 3: Stage-Gate Process (Magnus)

Definition

The Stage-Gate Process is a project management tool that divides the time horizon of a project into several stages. These stages are then separated by gates which represent certain decisions made for the project. The background of the process is derived from the limited resources companies have on their projects, and the need for the development of their project portfolio such that only the most beneficial projects are put through.

Regular Stage-Gate Processes consist of 4 to 8 stages, where at each gate, the evaluation criteria is discussed upfront with the project group and acted upon by the gatekeeper.

Practical guidelines /how to

Stages

There are multiple ways to design the stages in the process, but the following five stages are a typical example that is widely used.

- Preliminary assessment.

- Definition

- Development

- Validation

- Commercialization

Gates

Where stages typically represent a longer period of time, gates represent meeting which only typically lasts a number of hours. At each gate, the following element are kept in mind.

- Inputs/Deliverables

- Definition

- Outputs

In the output element, usually go/kill/recycle/hold outputs are generated.

Benefits and limitations

The benefits of the Stage-Gate process is that it allows for faster and more adaptive response to market change, high visibility of the project, forces more attention to quality of execution, among other things.

Some limitations to the method are for example that the effectiveness of the method highly depends on the behaviour of the people appointed as senior managers, and that it requires an extensive research to be made by organization when determining criteria at the gates, which can prove to be challenging.

Further explanation of these methods can be found via: [8]

Tool 4: The Analytic Hierarchy Process (AHP) (Morten)

Definition

The analytic hierarchy process is used to help decision making when working with projects, programs or portfolios, where multiple criteria needs to be considered. The process keeps the decision unbiased and objective by the use of eigenvectors. The functions that are considered in AHP are structuring complexity, measurements and synthesis.

Practical guidelines /how to

When AHP is used in decision making, one will need to go through the 6 steps that is:

1. Define scope

2. Hierarchy

3. Pair wise comparison

4. Scoring and consistency

5. Evaluation of the alternatives

6. Make the decision

Benefits and limitations

The benefit of AHP is its ability to handle more criteria than the human mind can, which will increase the amount of correct decisions made. Furthermore AHP decreases the amount of subjectivity used to make decisions as it leaves out biases. AHP is a time-consuming process the first time it is used, however after several uses it is more easily applied.

Further explanation of these methods can be found via: [9]

Tool 5: Innovation Portfolio Management (IPM) (Morten)

Definition

The concept behind innovation portfolio management (IPM) is to bring innovative products to the market that is in line with the strategic vision of the company. It does this by using four main goals, which are strategic alignment, maximizing portfolio value, balancing number of projects and balancing time frame of the projects.

Practical guidelines /how to

IPM is best utilized by splitting the work into a strategic and an operational part, each having two activities to be controlled.

Strategic innovation portfolio management (SIPM) covers balancing of the portfolio by different criteria. Secondly the projects of the portfolio is evaluated and prioritized in a cyclic manner.

Operational innovation portfolio management (OIPM) has the activities of tactical resource allocation and constant review and adjustment of products in the portfolio.

Benefits and limitations

A benefit of IPM is that it gives the company high flexibility as it is routinely reviewing and adjusting the portfolio to fit changes of the market. However IPM has not been used by many companies and is still a new method to be used in the industry. This creates some uncertainty as the method has not been tested thoroughly yet.

Further explanation of these methods can be found via: [10]

Tool 6: XXX (Andy)

Definition

Practical guidelines /how to

Benefits and limitations

Tool 7: XXX (Andy)

Definition

Practical guidelines /how to

Benefits and limitations

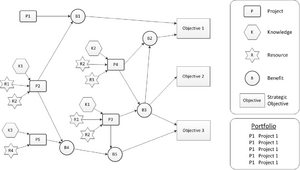

Tool 8: Interdependence Model (Lucas)

Definition

This model functions to visualize the dependencies interacting between projects, these dependencies is divided into three different fields. Resource, Strategic and Knowledge depedency, resource defines the link between resources such as employees or finances, strategic is the connection between a common collaboration of projects to achieve a strategic goal, knowledge is when projects requires the same knowledge.

Interdependence model

[1] Practical guidelines /how to

The model is applied in a "Risk Opportunity Identification Framework" as a part of 6 steps:

1. Definition Step

2. Modelling Step – “Interdependence Model & System-Environment model”

3. Identification based on interdependences

4. Identifcation based on system-environment search

5. Iterations

6. Portfolio risk opportunity register output – Risk oppurtunity register model

Benefits and limitations

Its an essential step in gaining a common overview of the project interconnection in the organization, it is crucial that every member which is a part of the framework application has a common understanding of the dependencies inbetween projects.

Further explanation of these methods can be found via: [11]

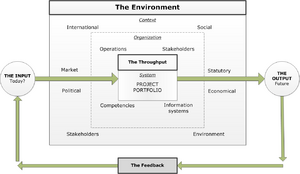

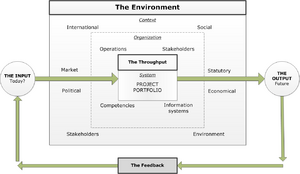

Tool 9: System-Environment Model(Lucas)

Definition

This model functions of five elements which is defined to gain an overview of the portfolio investigated, as seen on the figure it defines the environment surrounding the project portfolio which functions to give an understanding of the odds of succeding in terms of organizational goals. The model is defined by Input, Output, Throughput, Feedback and the environment.

System-environment model

[2] Practical guidelines /how to

The model is applied in a "Risk Opportunity Identification Framework" as a part of 6 steps:

1. Definition Step

2. Modelling Step – Interdependence Model & System-Environment model is applied

3. Identification based on interdependences

4. Identifcation based on system-environment search

5. Iterations

6. Portfolio risk opportunity register output – Risk opportunity register model is applied

Benefits and limitations

Defines an overview of the influencial factos which can oppose a risk to the portfolio success, as previously mentioned it is a step of a predefined framework which will allow the user to gain an overview and awareness of its issues.

Further explanation of these methods can be found via: [12]

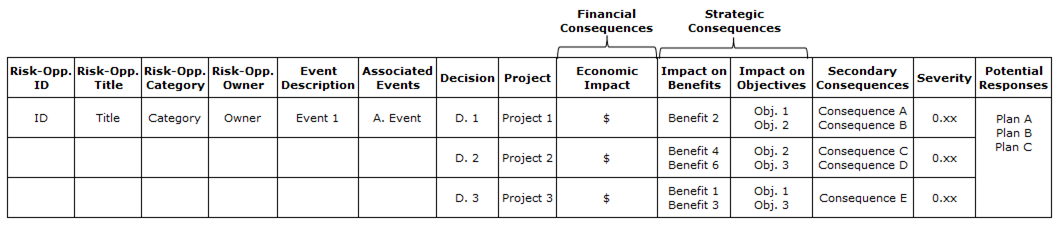

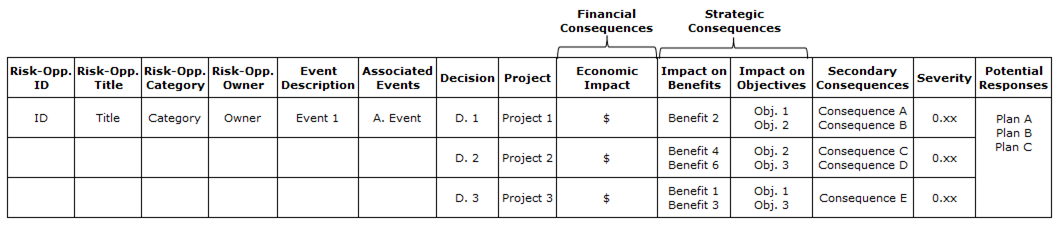

Tool 10: Risk Opportunity Register Model (Lucas)

Definition

This model is the final step of the risk opportunity framework which functions to display the financial and strategic consequences each project is evaluated to potentially could impact the organization, by the implementation of the before mentioned models it should give an idea of the severity of each project.

The risk-opportunity register

[3] Practical guidelines /how to

The model is applied in a "Risk Opportunity Identification Framework" as a part of 6 steps:

1. Definition Step

2. Modelling Step – “Interdependence Model & System-Environment model”

3. Identification based on interdependences

4. Identifcation based on system-environment search

5. Iterations

6. Portfolio risk opportunity register output – Risk opportunity register model

Benefits and limitations

This model is beneficial as a supporter to the final decision making as it displays the overall results of the framework and potentially should imply which projects to prioritize and invest their time and finances into.

Further explanation of these methods can be found via: [13]