A product rationalization project part of a portfolio optimization program

Developed by Christian Haim Raben

Product rationalization is the process of eliminating products that contribute negatively to the strategic organizational goals. Complexity develops from three interdependent dimensions and the associated costs grow exponentially. If an organization does not have the capabilities to manage complexity effectively from all its dimensions, the cost competitiveness will decrease. Product rationalization is a project that is initiated when the product portfolio has become too complex. Through intelligent product rationalization it is possible to minimize revenue loss but ensure significant cost reductions, hence reducing non-value adding complexity in the portfolio.[1]

Product rationalization is a central project in a portfolio optimization program used for reducing complexity costs. Many companies e.g. P&G[2], Henkel[2], and ROCKWOOL[3], have adopted complexity management approaches to reduce complexity costs, regain control of the product portfolio and become more competitive. The product rationalization project is carried out by a cross-functional team. The four step product rationalization process explains how to set up the project and the importance of involving key stakeholders. It explains how to identify, quantify and allocate complexity costs to product variants, how to eliminate product variants effectively and how to ensure that benefits are captured. The progress and success of the project are managed with KPIs.

The aim of this article is to examine thoroughly the use of portfolio optimization in regards to product rationalization as a method to reduce non-value adding complexity arising between products and processes, control the portfolio and release resources. As a result, from released resources and more capacity, new projects that both strengthen the portfolio and comply with the strategic organizational goals can be initiated while obeying budgetary restraints.

Contents |

Background

| Possible problems | Impact |

| No limit to projects taken on. | Resources spread too thinly. |

| Reluctance to stop or kill projects. | Resource starvation. |

| Lack of strategic focus in project mix. | High failure rates. |

| Weak selection criteria. | Projects chosen based on emotions, politics, or other factors,

which creates high downstream failure rates. |

| Weak decision criteria. | Low downstream impact in market due to

too many average projects selected. |

When the portfolio consists of too many products, it becomes critical to the cost competitiveness of an organization to effectively manage and control the products in the portfolio. Organizations proliferate their product variety to fulfil the market demand but also to establish barriers to entry.[5][6] This enables organizations to capture new revenue sources and limit the number of competitors, hence sustaining profitable growth through a competitive advantage.[7][8]

Product proliferation trends are apparent in many industries, but when more products are added the revenue per-unit can decrease.[9] On the other hand, if complexity is managed effectively, it can generate great profits.[10] Some organizations pursue the strategy of diversifying the product portfolio without fully understanding the extent to which implications can occur. Product proliferation and poor portfolio management in tandem often introduce complexity.

The problems in table 1 is a result from incoherent evaluations of new projects, which fail to both review economic and non-economic risk and rewards across a set of projects and to ensure the projects are balanced in the portfolio.[4]

What is complexity?

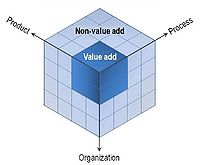

There exist two types of complexity i.e. value adding and non-value adding complexity. The complexity cube framework describes how complexity develops from the three interdependent dimensions; product, process and organization. The ability to understand and identify from where complexity develops in the specific organizations increases the ability to analyze and remove it. There are two key takeaways from the complexity cube, see figure 1.

- Complexity originates from the intersections between the dimensions.

- The costs associated with complexity is multiplicative between the dimensions.

Therefore, the effort to reduce complexity should be focused on multiple dimensions to create significant impact. The complexity costs grow exponentially with greater levels of complexity, hence organizations that can deliver value adding complexity and reduce or even eliminate non-value adding complexity will create a sustainable competitive advantage. They will create an advantage because they will be significantly more profitable and the skills to manage complexity are difficult to replicate.[1]

Product rationalization process

The process performance in an organization is affected by its product variety, and, conversely the product profitability is affected by the process performance. Therefore, complexity arises both when a product variant is added to the portfolio but also from the impact on the processes that delivers it. Below are some examples of symptoms of product portfolio complexity.

- A large portion of the products are unprofitable.

- Product shortage, as products compete for availability due to strained capacity

- Colossal inventory levels

- Long lead times, as product variety strain production

If some of these symptoms apply to an organization, it can be beneficial to reduce the number of products. Lars Hvam proposes a five step product rationalization model.[12] Step three and four have been consolidated into one step. These four steps are the most essential to realize a rationalization project.

Step 1 - Defining the scope

The program management assemble a cross-functional team to be responsible for the product rationalization project. The team´s first task is to conduct a stakeholder analysis. The project team determines the scope of the project in collaboration with the key stakeholders and takes into consideration the time and resources available. In this process SMART goals are created and KPIs are developed to evaluate these goals. To delimit the project, there are three important aspects to consider.[12][13]

- What product families and product variants to include as well as their level of detail i.e. finished good, module or component level.

- Where should the cost-saving effort be focused e.g. which lifecycle processes should be included.

- What are the given time period from which the different data will be collected.

Once the scope has been determined, the project team develops a project plan. It is critical to include key stakeholders in various workshops and in the decision-making process regarding the elimination of product variants and development of action plans for two reasons.

- The key stakeholders hold specific knowledge that increases the quality of the project.

- Ensure stakeholder alignment and satisfaction.

Step 2 - ABC analysis

The ABC analysis creates the baseline for the rationalization. The ABC analysis helps to determine which product variants that do not add value, hence can be removed. When the rationalization is carried out, more factors i.e. incremental revenue and a lifecycle perspective, are added to ensure maximum cost reductions and minimum revenue loss.

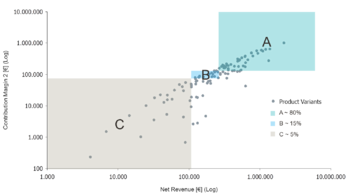

The ABC analysis divides the products into A, B and C categories. The product variants are categorized with a double Pareto analysis based on two parameters; revenue and complexity adjusted contribution margin.[15] The product variants accounting for 80% of the revenue and contribution margin are in category A. Product variants that contribute to the next 15% of the revenue and contribution margin are in category B. Category C products account the remaining 5% of the revenue and contribution margin. Product variants that lie outside of the categories are individually assessed and put into the category where they fit best.[12] The product variants are plotted in a diagram with logarithmic scale where the contribution margin are represented on the vertical axis and the revenue on the horizontal axis, see figure 2.[1] The figure illustrates a typical situation when complexity exists in the product portfolio. Category B and C show a long tail with approximately 80% of the product variants whereas category A has approximately 20% of product variants that contribute to 80% of the revenue.

Revenue

Revenue data per product variant is collected from a given time period and adjusted for deviations arising from customs, currencies, discounts, promotions, campaign etc.[12] Then the revenues are added together to calculate the correct revenue per product variant.

Complexity adjusted contribution margin

The complexity adjusted contribution margin is calculated by deducting both the variable costs for each product variant and the most significant complexity costs, i.e. a portion of the fixed costs that can be allocated to the specific product variants, based on the activity based costing principle.

Most effort should be allocated to identify, quantify and allocate the complexity costs to the specific product variants to provide a clear picture of the product variants´ true performance. It is important to focus the collective effort on the most significant complexity cost factors to execute the project efficiently. The Pareto principle describes why not all complexity cost factors are included in the quantification.[1]

It is key to the identification of the complexity cost factors to identify the cost areas with an uneven distribution of costs between the product variants.[1] The process of identifying the significant complexity cost factors can be started with a brainstorm. After the possible significant complexity costs have been identified, they are analyzed, quantified and allocated directly to the specific product variants. Quantification objects that allow approximations where it is possible can be used if the complexity costs are difficult to quantify. If data sets are incomplete, it can be necessary to creatively apply unconventional quantification methods to reliably complete the data sets.[12] When the different costs are calculated, comparable percentages can be calculated by dividing all costs by the net revenue for each product variant. If the analysis shows a clear uneven distribution of costs, then the significant complexity costs are deducted from the contribution margin.[12]

Step 3 - Product rationalization

The next step is to decide which product variants to remove from the portfolio. The goal is to create a portfolio, which offerings are focused on what customers want. To do so, the rationalization is split into four categories that is based on the product variants performance, but equally focuses on two important principles; incremental revenue and a lifecycle perspective.

1. Incremental revenue

Incremental revenue is the revenue that will be lost if the product variant in question is eliminated. Identifying the incremental revenue is essential to product rationalization. Incremental revenue is expressed by:

| Incremental Revenue = Revenue x (1 – Revenue Substitutability) + Linked Revenue |

Revenue substitutability is the extent to which customers will transfer their purchase from one product variant to another if the product variant in question is eliminated. The revenue substitutability is expressed as a percentage. Product variants with a high substitutability are likely to be eliminated as the revenue loss will be minimum whereas the complexity associated with the eliminated product variant will be eliminated. Estimating the revenue substitutability can be difficult. However, an informed estimate can be sufficient. Adding rough estimates to the scenario is better than assuming zero substitutability.[1]

Linked revenue is the revenue from the sales of other product variants in the portfolio that would be lost if the questioned product variant is eliminated. The linked revenue may be higher than the revenue related to itself. The product variants with a high linked revenue are called door openers. The rule of thumb is to assume zero linked revenue. This is because organizations tend to believe that they have more door openers than the customers think. Adding linked revenue should serve to separate real door openers from the imposters.[1]

By adding incremental revenue to the scenario it is possible to remove product variants with reasonable revenue but low incremental revenue. It limits the revenue loss however it also adds revenue to the remaining products. It results in both reduced non-value adding complexity, as the complexity cost associated with the deleted product variant is eliminated and the existing complexity costs will get less expensive as it will be spread over more revenue due to the revenue substitutability from the eliminated product variant.[1]

2. A lifecycle perspective

The strategic incentives to start a cost reduction program is to ensure long term business growth. Therefore, lifecycle considerations are important for two reasons.

- To ensure that the portfolio optimization not only focuses on past financial and operational data but takes the future performance into considerations.

- Enable the establishment of an evaluation sequence of product variants. A categorization method could be the Boston Matrix.

It is therefore critical for the future growth of the business to develop precedence where the dependence between products and their relative future attractiveness are considered.[1]

Rationalization categories

Based on the rationalization principles the decisions regarding which product variants to eliminate and which product variants to keep in the portfolio are made. The categories, described in table 2, are used to divide the product variants into removal categories. The volume of product variants that should be eliminated depend on the previous described principles and analyses.

| Product removal categories | Types of products in scope | Portion that should be removed | Characteristics of products that should be removed | |

| Profitability | Typical revenue per product variant | |||

| "Cleaning the attic" | Product variants for which there is essentially no activity | All | All | |

| Removing the "small losers" | Very profitable | Small | Majority | All, except product variants that are in the beginning of their product lifecycle |

| Removing the "sacrificial sinners" | Unprofitable | Medium | Many | High revenue substitutability |

| Cannot become profitable by the removal of other product variants | ||||

| Removing the "silent killers" | Profitable | Large | Some | Very high revenue substitutability |

Cleaning the attic are product variants that have been left in the portfolio but effectively have no activity belong in this category. Removing the attic creates a better overview, creates space, it removes noise from the portfolio and can provide some quick gains. The pitfall is that organizations focus on the number of product variants eliminated rather than the impact made.[1]

Small losers are characterized by having small revenue and low volume per product variant. The small losers are all unprofitable and large in numbers. Removing the small losers will reduce the level of complexity in the portfolio, however it will not make the remaining complexity cheaper because their removal will not add significant revenue to the remaining product variants. The majority of the small losers should be removed except product variants that are early in their lifecycle and have a promising future.[1]

Sacrificial sinners are profitable product variants that are shown to be unprofitable when the contribution margins are adjusted with the significant complexity costs. Sacrificial sinners have medium revenue per product variant. Sacrificial sinners with high revenue substitutability that have the opportunity to turn other unprofitable product variant profitable should be removed. Additionally, product variants with low revenue substitutability that cannot become profitable and do not have any linked revenue should also be eliminated.[1]

Silent killers are profitable and have large revenue per product variant. The silent killers are characterized by having almost 100% revenue substitutability. The incremental revenue is very small or zero. The silent killers consume a large amount of resources, hence removing the silent killers have great impact as large costs can be removed while revenue are preserved. The number of silent killers that should be removed will significantly depend on the industry but typically be few in numbers.[1]

Step 4 - Evaluate

The last step is evaluating and implementing the findings from the step 1-3. The implementation is planned in regards to a short-term, mid-term and long-term perspective.[12] The effect of the product rationalization project is evaluated based on the KPIs. Be aware that some measures cannot be obtained immediately. In the evaluation step it important that the cross-functional team also sets up a complexity governance structure. In the governance structure five elements should be considered:[9]

- Create a cross-functional decision-making structure.

- Develop roles and responsibilities to ensure that the right personnel with the capabilities needed takes complexity related decisions.

- Make complexity and integrated ongoing process and create an incentive structure that focus on complexity drivers and the costs of the products.

- Develop KPIs to track complexity in the product assortment.

- Make complexity visible in all functions of the business both upstream and downstream.

CASE: Benefits from reducing complexity at ROCKWOOL International A/S

ROCKWOOL International A/S was founded in 1937. Today ROCKWOOL has an annual turnover of 15 billion DKK, 28 factories, 11,300 employees and they are located in 30 different countries with 95% of their sales outside Denmark. ROCKWOOL has more than 100,000 Stock Keeping Units and it increases every day.[3] It has resulted in shorter production runs, increased handling and an unclear product assortment for the customers. In a portfolio optimization program, in the initial steps of the product rationalization approach, ROCKWOOL discovered through an activity based costing approach that their profitable products covered over their unprofitable products. ROCKWOOL did an ABC classification of their products with the goal of improving the profitability of the assortment. A cross-functional team reviewed the product variants based on the discussed rationalization principles.[3]

- Revenue substitutability

- Linked revenue

- Product lifecycles

These aspects were included to ensure that the right product variants were eliminated. Moreover, the team created an action plan for the implementation of the decided initiatives. The progress of the program was documented through KPIs. ROCKWOOL has created greater profits through the portfolio optimization program. Clear benefits of the program included a 10% reduction of production runs below 60 minutes and reduced the costs related to longer production runs. ROCKWOOL has also developed a structured product portfolio management process. The improvements also created great value for the customers, as they have experienced a clear product assortment with a reliable delivery service.[3]

Implications

The rationalization process should be a central project in a portfolio optimization program. The portfolio optimization program should consist on concurrent actions. However, it is critical to get the rationalization right to ensure substantial impact of all concurrent actions.

Common pitfalls in the portfolio optimization process

- It is difficult to decide how to manage complexity in the specific companies if the project team lacks a proper understanding of complexity. This results in a waste of resources because the project team will do unproductive analyses due to their lack of focus.[1]

- Another source of failure is spending too much time on analysing. It is much more efficient to focus the analysis as described previously with the 20/80 Pareto principle.[1]

- Risk aversion from stakeholders can result in focusing on the number of products eliminated rather the cost savings obtained, hence the elimination of low-risk products will be preferred that may result in fewer benefits.[1]

- A fourth risk is the failure to capture the benefits. A portfolio optimization plan should be created in the beginning of the overall program to mitigate the risk. The plan should describe where benefits are expected to be found e.g. in overhead savings or reduced inventory levels. On way to capture this benefit is to plan concurrent actions as e.g. footprint consolidation.[1]

- It is important treat portfolio optimization as an ongoing process and not a as single event. Failure to understand this will make it difficult to sustain the benefit and keep complexity costs low. To prevent complexity from creeping is important to educate the employees and build complexity management capabilities. Also, guidelines should be established describing how variety can be introduced to the portfolio in a smart way e.g. through prioritization methods, selection and decision models, standardization and modularization or product reengineering.[9]

| Reflections | ||

|---|---|---|

| Reflections on the rationalization process | Reflections on a portfolio optimization program | |

| Advantages |

|

|

| Disadvantages |

|

|

Different approaches

Boston Consulting Group has another approach for how to select the different product variants based on other metrics. Boston Consulting Group also explains how they approach hidden complexity.

A.T. Kearney and Bain describe an alternative method to identify and manage complexity. Read how Zero Based Budgeting can help to identify costs that cannot be justified and does not add any specific value.

References

- ↑ 1.00 1.01 1.02 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.10 1.11 1.12 1.13 1.14 1.15 1.16 1.17 Wilson, A. S., & Perumal, A., 2010. Waging war on complexity costs. McGraw-Hill.

- ↑ 2.0 2.1 McKinsey, 2004. Making brand portfolios work. Available at: http://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/making-brand-portfolios-work.

- ↑ 3.0 3.1 3.2 3.3 Bayer, M., Moseley, A., 2016. Simplify to Grow - Reducing Complexity at ROCKWOOL. ROCKWOOL International A/S.

- ↑ 4.0 4.1 Tidd, J. and Bessant, J., 2013. Managing innovation: Integrating technological, market and organizational change. 5th edn. United States: Wiley, John & Sons. Page 338-339.

- ↑ Schmalensee, R. 1978. Entry deterrence in the ready-to-eat breakfast cereal industry. Bell Journal of Economics, 9: 305–327.

- ↑ Smiley, R. 1988. Empirical evidence on strategic deterrence. International Journal of Industrial Organization, 6: 167– 180.

- ↑ Mascarenhas, B., Kumaraswamy, A., Day, D., & Baveja, A. 2002. Five strategies for rapid firm growth and how to implement them. Managerial and Decision Economics, 23: 317–330.

- ↑ Pichler, H., Vienna, Dawe, P. and Edquist, L., 2014. Less can be more for product portfolios. Available at: https://www.bcgperspectives.com/content/articles/lean_manufacturing_consumers_products_less_can_be_more_product_portfolios/.

- ↑ 9.0 9.1 9.2 Bayer, J. S., Hilding, M., Kamps, A., Sahlén G., Sparrefors, R., 2016. When product complexity hurts true profitability | Accenture outlook. Available at: https://www.accenture.com/us-en/insight-outlook-when-product-complexity-hurts-true-profitability-supply-chain.

- ↑ Meeker, B., Parikh, D., Jhaveri, M., 2009. The complexity conundrum. Marketing Management 18 (1), 54-59.

- ↑ Perumal, W. and Company, 2013. How is complexity impacting your retail business? Available at: http://www.wilsonperumal.com/blog/how-is-complexity-impacting-y our-retail-business/.

- ↑ 12.0 12.1 12.2 12.3 12.4 12.5 12.6 Hvam, L., 2014. Complexity reduction based on the quantification of complexity costs. Technical University of Denmark.

- ↑ George, M.L., Wilson, S.A., 2004. Conquering Complexity in your Business. McGrawHill.

- ↑ Andersen, M. H., Porsgaard, C. B., Raben, C. H., Stamm, J., 2016. Complexity Management. Technical University of Denmark.

- ↑ Koch, R., 2008. The 80/20 Principle – The Secret to Achieving More with Less. Doubleday.

Annotated bibliography

- Ref 1: Wilson, A. S., & Perumal, A., 2010. Waging war on complexity costs. McGraw-Hill.

Annotation: Waging war on complexity costs provides deep insights about complexity and thorough explanations of how to address complexity. Waging war on complexity costs is split into four parts. The book establishes a fundamental understanding of all aspects of complexity. Part one describes what complexity is. The second part elaborates from where complexity arises and how complexity costs are multiplicative. Part three describes how to battle complexity effectively with concurrent actions. Lastly, defense strategies to prevent complexity creep are elaborated. It describes the importance of building organizational capabilities to manage complexity and provides methods and tools to battle the complexity costs.

- Ref 4: Tidd, J. and Bessant, J., 2013. Managing innovation: Integrating technological, market and organizational change. 5th edn. United States: Wiley, John & Sons.

Annotation: Managing Innovation thoroughly describes how innovation can be managed in organizations. In the context of this article, the book provides tools for evaluating and prioritizing new projects. It describes the importance of proper portfolio management to manage uncertainty by spreading the risk and how to build a portfolio. It gives a good understanding about portfolio theory and different approaches to manage development projects.

- Ref 8: Pichler, H., Vienna, Dawe, P. and Edquist, L., 2014. Less can be more for product portfolios. Available at: https://www.bcgperspectives.com/content/articles/lean_manufacturing_consumers_products_less_can_be_more_product_portfolios/.

Annotation: The article describes how the importance of managing product diversity effectively to maintain a competitive edge. It elaborates how organizations, through market and supply chain insights, can reduce non-value adding complexity and keep value. Additionally, the article provides an initial health check. An initial health check and insights will in tandem allow organizations to reduce where non-value adding complexity.

- Ref 9: Bayer, J. S., Hilding, M., Kamps, A., Sahlén G., Sparrefors, R., 2016. When product complexity hurts true profitability | Accenture outlook. Available at: https://www.accenture.com/us-en/insight-outlook-when-product-complexity-hurts-true-profitability-supply-chain.

Annotation: The article gives an insight into a process for improving profitability. The article gives an introductory to product profitability and how low profit contributors can be eliminated through the identification of incremental value. The article is specifically strong in describing specific techniques to improve the product profitability and how to set up a governing structure to prevent complexity creep.,.