A product rationalization project part of a portfolio optimization program

* * * Work in Progress * * * Feedback for the title of the article wanted! :) # Portfolio optimization from a program management perspective # Product rationalization as part of a portfolio optimization program # Managing portfolio complexity # Product portfolio complexity management Need to write Implication Need to do references Need to do annotated bibliography Redo figures

When the portfolio consists of too many products, it becomes critical to the cost competitiveness of an organization to effectively manage and control the products in the portfolio. Product rationalization is the process of eliminating projects that contributes negatively to the strategic organizational goals. Through intelligent product rationalization it is possible to minimize revenue loss but ensure significant cost reductions, hence reducing complexity in the portfolio.[1] Additionally, prioritization and selection of products becomes essential to ensure alignment with the business strategy.

Product rationalization is a central project in a portfolio optimization program to reduce complexity costs. Many companies have adopted complexity management approaches to reduce complexity costs, regain control of the product portfolio and become more competitive. The aim of this article is to examine thoroughly the use of portfolio optimization in regards to product rationalization as a method to reduce complexity, control the portfolio and release resources. As a result, it is possible to maximize the strategic organizational goals by reinvesting in future projects to strengthen the portfolio while obeying budgetary restrictions.

Contents |

Background

| Poor portfolio management[2] | |

| Possible problems | Impact |

| No limit to projects taken on. | Resources spread too thinly. |

| Reluctance to stop or kill projects. | Resource starvation. |

| Lack of strategic focus in project mix. | High failure rates. |

| Weak selection criteria. | Projects chosen based on emotions, politics, or other factors,

which creates high downstream failure rates. |

| Weak decision criteria. | Low downstream impact in market due to

too many average projects selected. |

Organizations proliferate their product variety to fulfil the market demand but also to establish barriers to entry as it leaves little space for potential entrants.[3][4]

This enables organizations to prevent entry in mature markets as well as capturing new revenue sources and sustaining profitable growth through a competitive advantage.[5][6]

Some organizations pursue the strategy of diversifying the product portfolio without fully understanding the extent to which implications can occur. Product proliferation and poor portfolio management in tandem introduce complexity.

Expanding the product diversity without proper portfolio management several problems may occur. The problems in table XX is a result from incoherent evaluations of new projects which fail to both review economic and non-economic risk and rewards across a set of projects and to ensure the projects are balanced in the portfolio.[2]

The process performance is affected by the product variety, and, conversely product profitability is affected by the process performance. Therefore, complexity arises from both when a product variant is added to the portfolio but also the impact on the processes that delivers the product variant. Below are some examples of symptoms of complexity in the product portfolio.

- A large portion of the products are unprofitable.

- Product shortage, as products compete for availability due to strained capacity

- Incredibly high inventory levels

- Long lead times, as product variety strain production

What is complexity?

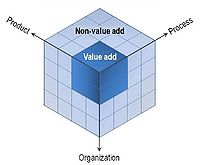

The complexity cube framework describes how complexity develops from three interdependent dimensions. The ability to understand and identify from where complexity develops in the specific organizations increases the ability to analyze and remove it. The key takeaway from the complexity cube, see figure 1, is that the issues of complexity originates from the intersections between the dimensions and the costs associated with complexity is multiplicative between the dimensions, hence the effort to reduce complexity should be focused on multiple dimensions to create impact. The complexity costs grow exponentially with greater levels of complexity, hence organizations that can deliver good complexity and reduce or even eliminate bad complexity will create a sustainable competitive advantage. They will create an advantage because they will be significantly more profitable and the skills to manage complexity are difficult to replicate.[1] This article focuses on the complexity that arise between products and processes.

Industry example of rationalization and benefit

Product rationalization process

The product rationalization process consists of 4 major steps. These steps describes the essential parts of the rationalization process.

Step 1 - Defining the scope

The first step in regaining control over the portfolio is to define the scope of the project. Defining the scope of the project starts by the program management appointing a project team to be responsible. The project team then conducts a stakeholder analysis. The project team determines the scope of the project in collaboration with the key stakeholders and takes into consideration the time and resources available. To delimit the project, there are three important aspects to consider.

- What product families and product variants to include as well as their level of detail i.e. finished good, module or component level.

- Where should the cost-saving effort be focused e.g. which life cycle processes should be included.

- What are the given time period from which the different data will be collected.

SMART KPIs are set up to enable an evaluation of the successfulness of the project The KPIs should focus on e.g. financial data, lead time, the quality of the products etc. Once the scope has been determined, the project team develops a plan for the project. In planning the project, it is critical to identify stakeholders that can participate in various workshops and participate in the decision-making process regarding the elimination of product variants.

Include a graph here to visualize the major parts of defining the scope

Step 2 - ABC analysis

The ABC analysis helps to determine which product variants that do not add value, hence can be removed. When the rationalization is carried out, more factors i.e. incremental revenue, incremental costs and a life cycle perspective, are added to ensure maximum cost reductions and minimum revenue loss. The ABC analysis is a critical tool that creates the baseline for the rationalization.

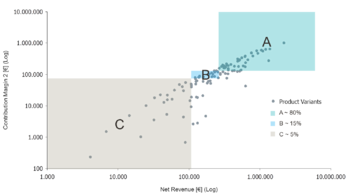

The ABC analysis divides the products into A, B and C categories respectively. To categorize the product variants, the Pareto distribution is used based on their revenue and contribution margin. The product variants accounting for 80% of the revenue and contribution margin are in category A. Product variants that contribute to the next 15% of the revenue and contribution margin are in category B. Category C products account the remaining 5% of the revenue and contribution margin. There will be product variants that lie outside of the categories when a double Pareto analysis is conducted. These product variants are then individually assessed and put into the category where it fit best. The product variants are plotted in a diagram with logarithmic scale where the contribution margin are represented on the vertical axis and the revenue on the horizontal axis.

Revenue

To calculate the revenue per product variant, sales information is collected for a given time period and adjusted for deviations arising from customs, currencies and discounts. Then the sales are added together to calculate the correct revenue per product variant.

Complexity adjusted contribution margin

The complexity adjusted contribution margin is calculated by deducting both the variable costs for each product variant and the most significant complexity costs, i.e. a portion of the fixed costs that can be allocated to the specific product variants, based on activity based costing principle.

The biggest exercise is then to identify, quantify and allocate the complexity costs to the specific product variants to provide a clear picture of the product variants´ true performance. It is important to focus the collective effort on the most significant complexity cost factors to execute the project efficiently. The reason why not all complexity cost factors are included is because of the 80/20 costing principle. By adjusting the contribution margin with approximately 20% of the most significant complexity cost factors, 80% of the answer is given. (Waging war on complexity).

It is key to the identification of the complexity cost factors to identify the cost areas with an uneven distribution of costs between the product variants. The process of identifying the significant complexity cost factors can be started with a brainstorm. After the possible significant complexity costs have been identified, they are analyzed, quantified and allocated directly to the specific product variants. If the complexity costs are difficult to quantify, you can find quantification objects that allow approximations where it is possible. It can be necessary to creatively apply unconventional quantification objects to reliable complete incomplete data sets.

When the different costs are calculated, comparable percentages can be calculated by dividing all costs by the net revenue for each product variant. If the analysis shows a clear uneven distribution of costs, then the significant complexity costs are deducted from the contribution margin. The adjusted contribution margin per product variant is used for the ABC analysis.

Step 3 - Product rationalization

The next step after constructing the ABC diagram is to decide which product variants to remove from the portfolio. The goal is to create a portfolio, which offerings are focused on what customers want. To do so, the rationalization is split into 4 categories that is based on the product variants performance but equally focuses on two important principles; incremental revenue and a life cycle perspective.

Rationalization principles

Incremental revenue

Incremental revenue is the revenue that will be lost if the product variant in question was eliminated. Identifying the incremental revenue is essential to product rationalization. Incremental revenue is expressed by:

| Incremental Revenue = Revenue x (1 – Revenue Substitutability) + Linked Revenue |

By adding incremental revenue to the scenario it is possible to remove product variants with reasonable revenue but low incremental revenue, due to the high revenue substitutability. This limits the revenue loss however it also adds revenue to the remaining products. This result in both reduced complexity, as the complexity cost associated with the deleted product variant is eliminated and the existing complexity costs will get less expensive as it will be spread over more revenue due to the revenue substitutability from the eliminated product variant.

Revenue substitutability is the extent to which customers will transfer their purchase from one product variant to another if the product variant in question is eliminated. The revenue substitutability is expressed as a percentage. Product variants with a high substitutability are likely to be eliminated as the revenue loss will be minimum whereas the complexity associated with the eliminated product variant will be eliminated. Estimating the revenue substitutability can be difficult. However, an informed estimate can be sufficient. Adding rough estimates to the scenario is better than assuming zero substitutability.

Linked revenue means the revenue from the sales of other product variants in the portfolio that would be lost if the questioned product variant is eliminated. The linked revenue may be higher than the revenue related to itself. The product variants with a high linked revenue are called door openers. The rule of thumb is to assume zero linked revenue. This is because organizations tend to believe that they have more door openers than the customers think. Adding linked revenue should serve to separate real door openers from the imposters.

A life cycle perspective

If the rationalization is only based on the current performance of each product variant and the incremental revenue, the decisions for the portfolio rationalization is only based on the current performance. The strategic incentives to start a cost reduction program is to ensure long term growth. Therefore, life cycle considerations are important for two reasons.

- To ensure that the portfolio optimization not only focuses on past financial and operational data but takes the future performance into considerations.

- Enable the establishment of an evaluation sequence of product variants. A categorization method could be the Boston Matrix.

It is therefore critical for the future growth of the business to develop precedence where the dependence between products and their relative future attractiveness are considered.

Rationalization categories

The basic understanding of the underlying rationalization principles has been established. The next step in the process is to make decisions regarding which product variants to eliminate and which product variants to keep in the portfolio. The process of elimination is described in table XX - Categories of Product Rationalization. The categories are used to divide the product variants into removal categories. The volume of product variants that should be eliminated depend on the above described principles and analyses.

| Cleaning the attic | The product variants that have been left in the portfolio but effectively have no activity belong in this category. Removing the attic creates a better overview, creates space, it removes noise from the portfolio and can provide some quick gains. The pitfall is that organizations focus on the number of product variants eliminated rather than the impact made. |

| Small losers | The small losers are characterized by having small revenue and low volume per product variant. The small losers are all unprofitable and large in numbers. Removing the small losers will reduce the level of complexity in the portfolio however it will not make the remaining complexity cheaper because their removal will not add significant revenue to the remaining product variants. The majority of the small losers should be removed except product variants that are early in their life cycle and have a promising future. |

| Sacrificial sinners | Profitable product variants that are shown to be unprofitable when the contribution margins are adjusted with the significant complexity costs are called sacrificial sinners. Sacrificial sinners have medium revenue per product variant. Sacrificial sinners with high revenue substitutability that have the opportunity to turn other unprofitable product variant profitable should be removed. Additionally, product variants with low revenue substitutability that cannot become profitable and do not have any linked revenue should also be eliminated. |

| Silent killers | Silent killers are profitable and have large revenue per product variant. The silent killers are characterized by having almost 100% revenue substitutability. The incremental revenue is very small or zero. The silent killers consume a large amount of resources, hence removing the silent killers have great impact as large costs can be removed while revenue are preserved. The number of silent killers that should be removed will significantly depend on the industry but typically be few in numbers. |

| Categories of Product Rationalization | |||||

|---|---|---|---|---|---|

| Product removal categories | Types of products in scope | Portion that should be removed | Characteristics of products that should be removed | ||

| Profitability | Typical revenue per product variant | ||||

| "Cleaning the attic" | Product variants for which there is essentially no activity | All | All | ||

| Removing the "small losers" | Very profitable | Small | Majority | All, except product variants that are in the beginning of their product lifecycle | |

| Removing the "sacrificial sinners" | Unprofitable | Medium | Many | High revenue substitutability | |

| Cannot become profitable by the removal of other product variants | |||||

| Removing the "silent killers" | Profitable | Large | Some | Very high revenue substitutability | |

Step 4 - Evaluate

The last step is about evaluating and implementing the findings from the above steps. The implementation is planned in regards to a short-term, mid-term and long-term perspective. Also, the analyses have revealed the most significant complexity cost factors. When you are aware of where the complexity arises, it is possible to try to reduce the impact of the complexity in the future. Lastly, the effect of the product rationalization project is evaluated based on the SMART KPIs. Be aware that some measures cannot be obtained immediately.

Implications

The rationalization process should be a central project in a portfolio optimization program. The portfolio optimization program should consist on concurrent actions. However, it is critical to get the rationalization right to ensure substantial impact of all concurrent actions.

Common pitfalls in the portfolio optimization process

- It is difficult to decide how to manage complexity in the specific companies if the project team lacks a proper understanding of complexity. This results in a waste of resources because the project team will do unproductive analyses due to their lack of focus.

- Another source of failure is spending too much time on analysing. It is much more efficient to focus the analysis as described previously with the 20/80 costing principle.

- Not cutting deep enough will result in fear deletion. Risk aversion from stakeholders can result in focusing on the number of products eliminated rather the cost savings obtained, hence the elimination of low-risk products will be preferred that may result in fewer benefits.

- A fourth risk is the failure to capture the benefits. A portfolio optimization plan should be created in the beginning of the overall program to mitigate the risk. The plan should describe where benefits are expected to be found e.g. in overhead savings or reduced inventory levels. On way to capture this benefit is to plan concurrent actions as e.g. footprint consolidation.

- It is important treat portfolio optimization as an ongoing process and not a as single event. Failure to understand this will make it difficult to sustain the benefit and keep complexity costs low. To prevent complexity from creeping is important to educate the employees and build complexity management capabilities. Also, guidelines should be established describing how variety can be introduced to the portfolio in a smart way e.g. through selection and decision models.

| Reflections | ||

|---|---|---|

| Reflections on the rationalization process | Reflections on a portfolio optimization program | |

| Advantages | * Reduces the complexity

|

* Create large impacts

|

| Disadvantges | * Is not a standalone project | * Long term benefits

|

Testing referencing.[8]

Relevant material

Project Prioritization in Portfolio Management using Quality Function Deployment

Project Evaluation and Selection for the Formation of the Optimal Portfolio

Stakeholder Expectations Management¨

Portfolio Management using the BCG-Matrix

Annotated bibliography

References

- ↑ 1.0 1.1 Wilson, A. S., & Perumal, A. (2010). Waging war on complexity costs. McGraw-Hill.

- ↑ 2.0 2.1 Tidd, J. and Bessant, J. (2013) Managing innovation: Integrating technological, market and organizational change. 5th edn. United States: Wiley, John & Sons. Page 338-339.

- ↑ Schmalensee, R. 1978. Entry deterrence in the ready-to-eat breakfast cereal industry. Bell Journal of Economics, 9: 305–327.

- ↑ Smiley, R. 1988. Empirical evidence on strategic deterrence. International Journal of Industrial Organization, 6: 167– 180.

- ↑ Mascarenhas, B., Kumaraswamy, A., Day, D., & Baveja, A. 2002. Five strategies for rapid firm growth and how to implement them. Managerial and Decision Economics, 23: 317–330.

- ↑ Pichler, H., Vienna, Dawe, P. and Edquist, L. (2014) Less can be more for product portfolios. Available at: https://www.bcgperspectives.com/content/articles/lean_manufacturing_consumers_products_less_can_be_more_product_portfolios/.

- ↑ Perumal, W. and Company (2013) How is complexity impacting your retail business? Available at: http://www.wilsonperumal.com/blog/how-is-complexity-impacting-your-retail-business/.

- ↑ Remember that all the texts will be included into the reference containing the name= attribute.